1Hr TF overview ✅ Trade Breakdown – Buy-Side (GBP/USD) 📅 Date: Wednesday, April 9, 2025 ⏰ Time: 4:00 AM (NY Time) – Tokyo to London Session Overlap 🕒 Entry Timeframe: 2-Minute (Microstructure Entry) 📈 Pair: GBP/USD 📈 Trade Direction: Long (Buy) Trade Parameters: Entry: 1.28700 Take Profit (TP): 1.30051 (+1.05%) Stop Loss (SL): 1.28384 (–0.25%) Risk-Reward...

📉 Trade Breakdown – Sell-Side (CG1! Futures) 📅 Date: Thursday, April 10, 2025 ⏰ Time: 11:45 AM (New York Time) 🕒 Session: London to NY Overlap – Late NY AM 📉 Pair/Instrument: CG1! 📈 Trade Direction: Short (Sell) Trade Parameters: Entry: 3179.7 Take Profit (TP): 3149.7 (–0.94%) Stop Loss (SL): 3186.0 (+0.20%) Risk-Reward Ratio (RR): 4.76 Reason: Observing...

30min TF overview Trade Breakdown – Buy-Side (EUR/GBP) 📅 Date: Wednesday, April 9, 2025 ⏰ Time: 4:00 AM (Tokyo to London Session Overlap) 📈 Pair: EUR/GBP 📈 Trade Direction: Long (Buy) Trade Parameters: Entry Price: 0.85672 Take Profit (TP): 0.86354 (+0.80%) Stop Loss (SL): 0.85503 (-0.20%) Risk-Reward Ratio (RR): 4.04 Buy-Side Opportunity During Tokyo-London...

1Hr TF overview ✅ Trade Breakdown – Buy-Side (EUR/USD) 📅 Date: Thursday, April 10, 2025 ⏰ Time: 4.00 AM (New York Time) – Tokyo to LND Session AM 📈 Pair: EUR/USD 📈 Trade Direction: Buy (Long) Trade Parameters: Entry: 1.10245 Take Profit (TP): 1.11064 (+0.74%) Stop Loss (SL): 1.10027 (–0.20%) Risk-Reward Ratio (RR): 3.76 Price tapping into a discounted...

Trade Breakdown – Sell-Side (GBP/JPY) 📅 Date: Thursday, April 10, 2025 ⏰ Time: 5:45 AM (London Session AM) 📉 Pair: GBP/JPY 📉 Trade Direction: Short (Sell) Trade Parameters: Entry Price: 188.632 Take Profit (TP): 187.731 (-0.48%) Stop Loss (SL): 188.883 (+0.13%) Risk-Reward Ratio (RR): 3.59 Strategy PD Array, Supply Zone Rejection 🎯 Target Detail: 0.328 (PD...

Trade Breakdown – Sell-Side (EUR/USD) 📅 Date: Wednesday, April 9, 2025 ⏰ Time: 10:30 AM (New York Time) – NY Session AM 📉 Pair: EUR/USD 📉 Trade Direction: Short (Sell) Trade Parameters: Entry Price: 1.10429 Take Profit (TP): 1.09064 (-1.24%) Stop Loss (SL): 1.10815 (+0.35%) Risk-Reward Ratio (RR): 3.54 Intraday Sell Setup During NY Session: Reason: Based...

1Hr TF 0verview Trade Breakdown – Buy-Side (EUR/USD) 📅 Date: Tuesday, April 6, 2025 ⏰ Time: 4:00 PM NY Time (NY Session PM) 📈 Pair: EUR/USD 📈 Trade Direction: Long (Buy) Trade Parameters: Entry: 1.09541 Take Profit (TP): 1.10886 (+1.23%) Stop Loss (SL): 1.09428 (-0.10%) Risk-Reward Ratio (RR): 11.9 🔥 Reason: The buyside trade idea was taken after a pullback...

Trade Breakdown – Buy-Side (BTC/USD – Intraday Setup) 📅 Date: Monday, April 7, 2025 ⏰ Time: 1:15 PM NY Time (NY Session PM) 📈 Pair: BTC/USD 📈 Trade Direction: Long (Buy) Trade Parameters: Entry Price: 78,281.5 Take Profit (TP): 79,619.0 (+1.71%) Stop Loss (SL): 77,890.0 (-0.50%) Risk-Reward Ratio (RR): 3.42 🚀 Reason: The Buyside trade idea is based on the...

Trade Breakdown – Sell-Side (Crypto Weekend Setup) 📅 Date: Saturday, April 5, 2025 ⏰ Time: 3:00 PM NY Time (NY Session PM) 📉 Pair: DOGE/USD 📉 Trade Direction: Short (Sell) Trade Parameters: Entry Price: 0.16821 Take Profit (TP): 0.16173 (+3.85%) Stop Loss (SL): 0.17009 (-1.12%) Risk-Reward Ratio (RR): 3.45 Reasoning: Demand Turned to Resistance" — this...

15min TF overview Trade Breakdown – Sell-Side (Intraday Crypto Setup) 📅 Date: Saturday, April 5, 2025 ⏰ Time: 9:00 AM NY Time (NY Session AM) 📉 Pair: BNB/USD 📉 Trade Direction: Short (Sell) Trade Parameters: Entry Price: 592.98 Take Profit (TP): 586.78 (+1.05%) Stop Loss (SL): 594.97 (-0.34%) Risk-Reward Ratio (RR): 3.12 Reason: Based on the narrative of...

Pair GC1! Buyside trade NY Session PM Thu 3rd April 25 7.00 pm approx. Entry 3175.7 Profit level 3196.6 (0.66%) Stop level 3173.6 (0.07%) RR 9.95 Reason: Observing price action on the 1min TF seemed indicative of a buyside trade based on the narrative of of demand and demand for directional bias. Entry 1min TF 1min TF overview

Day TF overview Sellside trade Mon 31st March 25 5.00 pm (NY Time) NY Session AM Structure Day Entry 4Hr Entry 0.62668 Profit level 0.61308 (2.17%) Stop level 0.63038 (0.59%) RR 3.68 Reason: WMA (100) and EMA (50) Observed for sellside directional bias along with the price failing to make a higher high. Target 0.382 (PD Array) 4Hr TF overview

Day TF overview Sellside trade Fri 28th March 25 9.00 am (NY Time) NY Session AM Structure Day Entry 4Hr Entry 194.679 Profit level 192.079 (1.34%) Stop level 195.101 (0.22%) RR 6.16 Reason: Trade Rationale: PD Array for Bias & Price Range: Using the Premium/Discount (PD) Array, suggesting entry from a premium zone for a short trade. The bias aligns...

1Hr TF overview Pair EURUSD Sellside trade Tokyo to LND Session AM Mon, 24th March 25 4.00 am (NY Time) Entry 1.08514 Profit level 1.06839 (1.54%) Stop level 1.08601(0.08%) RR 19.25 Reason: Based on the supply-and-demand narrative, the 1Hr TF price had reached a pivotal supply level indicative of a sell-side trade idea.

Day TF overview Sellside trade Pair NZDUSD Sun 30th March 25 5.00 pm (NY Time) NY Session AM Structure Day Entry 4Hr Entry 0.56969 Profit level 0.56389 (1.02%) Stop level 0.57247 (0.49%) RR 3.68 Reason: Price action seems indicative of a Sellside momentum since Sunday 30th March 25. Target Wed 5th March - liquidity low

Day Tf overview Pair GBPUSD Buyside trade Mon 31st March 25 9.00 am (NY Time) NY Session AM Structure Day Entry 4Hr Entry 1.29046 Profit level 1.29691 (0.50%) Stop level 1.28968 (0.06%) RR 8.27 Reason: The buyside trade idea is based on the supply and demand narrative... Observed Sun 29th March 25. Entry reached Mon 31st 9.00 am (NY time) 4Hr...

Pair USDCAD Buyside trade Mon 31st March 25 5.00 pm (NY Time) NY Session PM Structure - (Day) Entry 4Ht TF Entry 1.43382 Profit level 1.47241 (2.69%) Stop level 1.42525 (0.60%) RR 4.5 Buyside trade idea: Reason: Break of channel to the upside Indicators: WMA (100) EMA (50) observed as additional bias

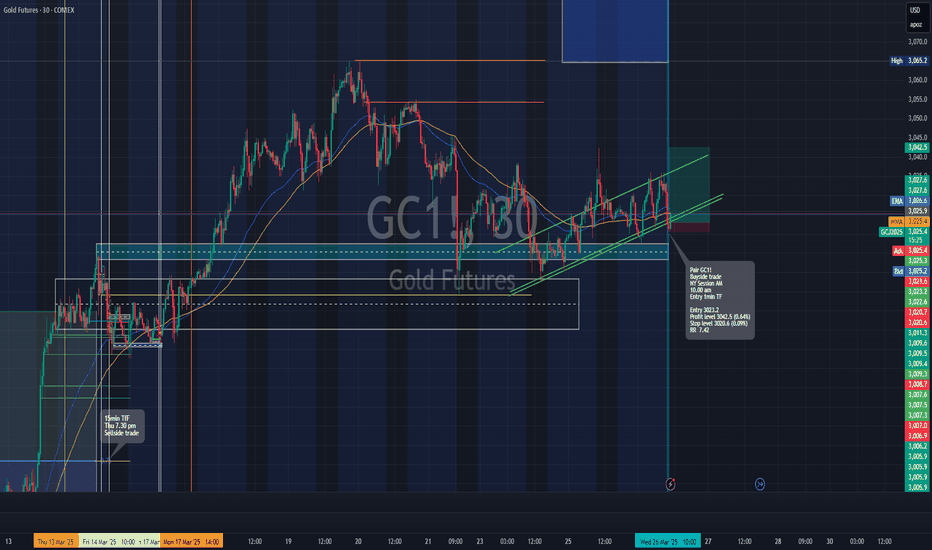

30min TF overview 1min TF Entry Pair GC1! Buyside trade NY Session AM 10.00 am Entry 3023.2 Profit level 3042.5 (0.64%) Stop level 3020.6 (0.09%) RR 7.42 Reason: Looking left at previous price action and respected levels along with the Periodic Volume Profile (PVP) indicator and ascending channel seemed to suggest we were at a prime demand level...