deepanshu422

AEM HOLDINGS (AWX ) stock trading above all short-term moving averages and recently stock also trade above 100 Day simple MA. Stock breaksout with 3 months price range with volume addition on upside also suggest large players are building their position.

As per Weekly Chart Crude oil took support around $50 where from where it took breakout in the month of July. If crude oil sustain above this level can bounce back up to $55. As after sharp selloff momentum indicator like RSI also moved to over sold region.Closing below $50 can open new downside.

Looking At Daily Times Fram e Chart What I Predict For TVC:STI is: Breakout above Resistance 3120 Will Head It towards Its Next Big Hurdle 3180 Major Support Is 2955 (26 oct 2018 Low) and Psychological Support of 3000 For Next 2-3 Months Trading Range Can Be between 3200-2900

After Looking At " Daily Chart Time Frames" 1.On 10th October 2018 There Was Rectangle Pattern Breakout .This Breakout is same on Weekly Chart 1214 That 1214 Is Strong Support Point For Gold 2.Recently on 13th Nov it traded one month low at 1196 So It Another Strongest Support 3.Looking at Fibonacci Level .38 any daily close above 1244 will be...

Breakout after inverterd Head and shoulder at price 1.1460 Then It can go upside till 1.1730 with maintaining Stop Of 1.1320

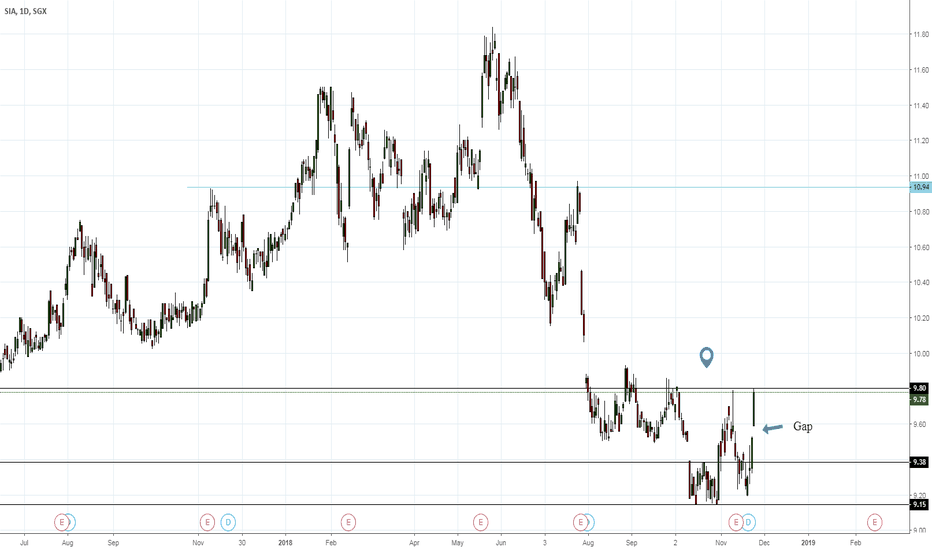

Singapore Airlines Is Looking Upside Till S$11 ->But there is gap today so I will move Till 9.60 -> Breakout above $10 will Move it for another 2 gaps filling till 11 ->10% upside is possible