EURCHF being held down by trend line and some volume at a recent area of support and resistance , see chart . Expect a pullback ahead of US data . Stop 9545 Entry 9520 Exit 9490 E.

Fairly quiet morning ahead of US data this afternoon so would expect a retrace in GBPCAD given the levels of historic support and resistance shown on chart . Risk reward > 1:1 Stop 18495 Entry 18455 Target 18408 E.

Crypto markets remain solid at the moment as evidenced in BTCUSD idea earlier today . Much the same scenario appearing in SOLUSD with price retracement to area of solid price action and underlying bull still intact . Looking for a short term buy at current levels in a quick trade . Stop 135.40 Entry 139.40 Exit 144.40 E.

Bitcoin has retraced to an area where volume has been decent and resistance recently turned to support but its overall bullish tone remains intact in short term time frames . It seems to have held the area indicated in the chart and begun to turn upwards on short term time frames I'd expect more of a bounce if equity markets remain calm but nothing too big so...

GER40 retraced this morning in an otherwise quiet market after european markets snapped a three day losing streak yesterday on news that Trump may soften his tariff stance . Market is quiet until US opens , recent economic data still pointing to upside potential , charts indicating a good point to rebound from . Stop 22725 Buy 22980 Take Profit 23308 E.

GBPJPY reversed after UK inflation data earlier , however it has retraced to significant 200 EMA level and areas of previous good volume / reversal points ( see chart ) Given also that : 200 Hourly EMA providing technical resistance Running into a cluster of previous volume areas Overall recent trend is still bullish Despite the data this morning giving GBP a...

Shorting EURGBP at 0.8368 after this morning's data 200 Hourly EMA providing technical resistance Running into a cluster of previous volume areas Overall recent trend is still bearish . Despite the data this morning giving GBP a push lower , this move appears way too aggressive for the data and likely more position covering than fundamental given that...

I'm cautious as market awaits FOMC tonight , but it's early in Europe and we have time for some retracement beforehand . Long at 3440 Stop 3408 Target 3475 Price has retraced to an area of good liquidity in terms of previous activity and a Fibonacci retrace of most recent move , all in a generally upbeat market . Covering of shorts worried before tonights...

Caution as FOMC meeting later tonight but price has been pushed higher this morning on lower liquidity and overall crypto sentiment is not great . High probability reversal from recent areas of strong activity and a Fibonacci area of the most recent move . Sell 84100 Stop 85250 Target 82500 E

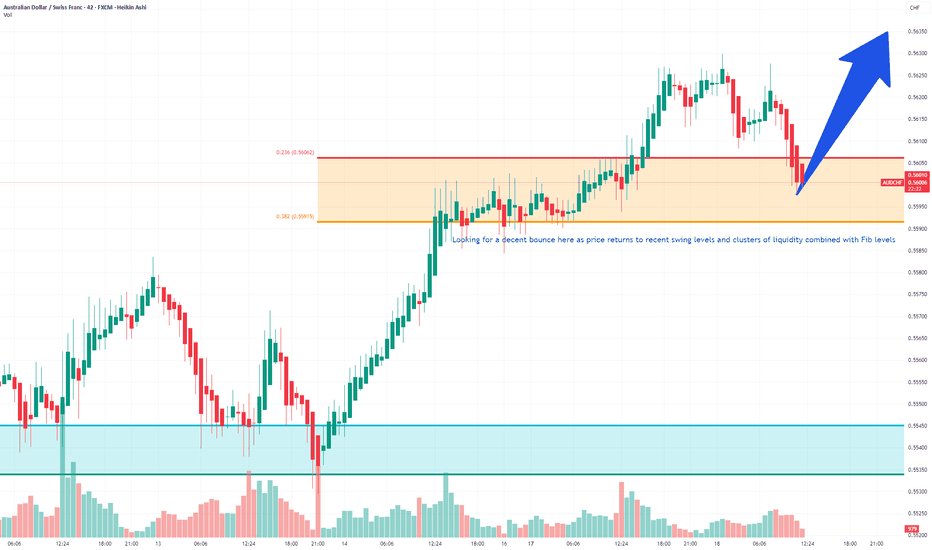

Similar pattern and risk to the recent EURAUD trade so be aware for risk purposes . Looking for reversal and push up as we move towards US Market open and beyond Turning around clusters of liquidity at the " big figure " Previous historic resistance levels Return to Fibonacci zones from recent rise Entry 5599 Stop 5580 Target 5628 A reasonable risk...

Looking at a retracement from this mornings rally as US participants begin to arrive . A retracement from Fibonacci levels Short Entry at 17156 Target 17087 Stop at 17215 Targets and stops approx 1:1 risk reward at Previous Swing Levels .

Just testing out the platform configuration with a few ideas for short term trades . Not financial advice . Thankyou .

Looking for some profit taking on this retrace in ETH .Selling at 1945 Stop at 1980 Target 1910 Testing format , any ideas for style greatly appreciated . Thanks