This ETF went inside down on the week and at major resistance. It's a bonafide short although I rarely short the ETF itself and look for the weakest names held by the ETF instead. Just like the home-builders sector there is a major disconnect from the real economic reality and price here. The FED can pump the larger market ad infinitum but there will be huge...

This is just an obvious buy to be on this big breakout this week. I have been holding $NEM and $GOLD for a few weeks and they have already gone up 25% in price, while GDX has just really broken out on the whole. As the FED pumps the stock market the fundamentals of these mining companies are hard to beat.

whether or not "everything opens" anytime soon I doubt the crowds are headed back to Orlando at all this year. Also high debt, not a lot of cash.

Looks like it could bomb from here. Permits looked ok last week but permits do not mean the thing will be built and considering 20% unemployed in the near future I think you might reconsider moving forward with building new in an already overbuilt environment. I don't think the market it pricing this in at all.

Think we reverse here. I bought after the opening 5 min bar today.

reversal from oversold conditions near support after massive post earnings selloff.

entered long on possible longterm breakout reversal

breakout price and momentum target $290s then $310

GDP and employment up, interest rates down.... welcome to boom town.

I know it's only Tuesday but....inside and down on the weekly near ATH with negative RSI div looks juicy. Currently testing support around 2940-2960.

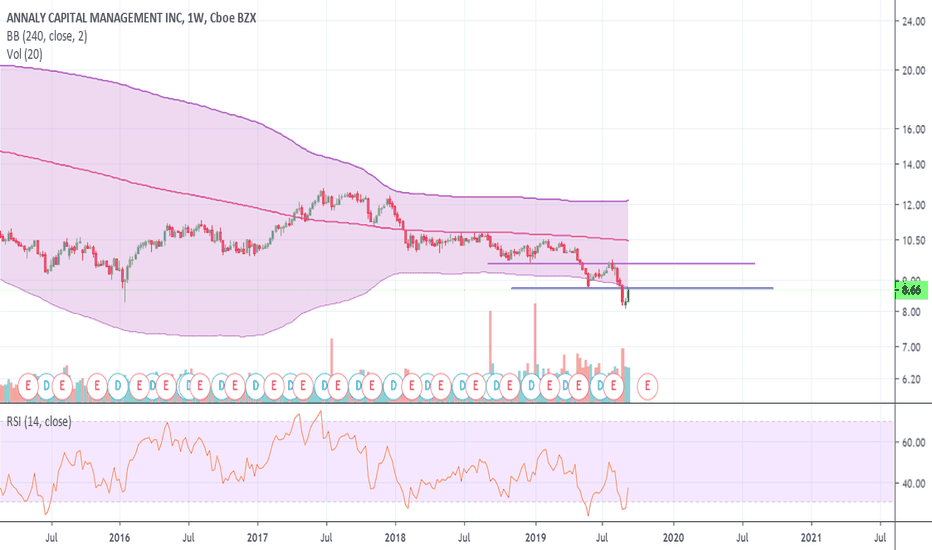

3 candle reversal bullish price action in oversold territory and near support.. First target $9.50.