After Trump announced an additional 20% in tariffs, EURUSD made a relatively surprising move and surged sharply. This marks the second leg of the upward trend that began in early March. However, the sharp rise has now brought EURUSD to the doorstep of a very long-term resistance level. Since testing 1.60 in 2008, EURUSD has been moving lower within a wide...

The Dollar Index is currently testing a major demand zone between 99.50 and 101. This area has marked the end of downward moves and the beginning of dollar rallies five times since early 2023. The recent downward pressure is largely driven by rising expectations of an economic slowdown and a strengthening euro. At this point, several possible scenarios could...

Cameco has bounced from the key demand zone at 32.50–35.50 for the sixth time, further confirming this area as a significant support level. The 200-day moving average also played a major role in the bounce, acting as a magnet. In the last three instances, when the price moved nearly 20% below the 200-day SMA, an upward reaction followed, this time marks the fourth...

USDCHF is testing the critical 0.8350 support level amid rising safe haven demand. Yesterday’s chaos in the bond market highlighted how few places investors have to park their money. One of the most widely accepted safe haven assets is the Swiss franc, and current demand for CHF is clearly strong. But is it strong enough? There hasn't been a weekly close below...

USDJPY is currently testing its weekly trendline, but recent data from Japan may challenge the possibility of a downward break. Market turmoil has increased demand for long-term U.S. bonds, and the resulting drop in the TVC:US10Y has kept the TVC:DXY under pressure, conditions that have supported Yen bulls. However, the latest wage data out of Japan may...

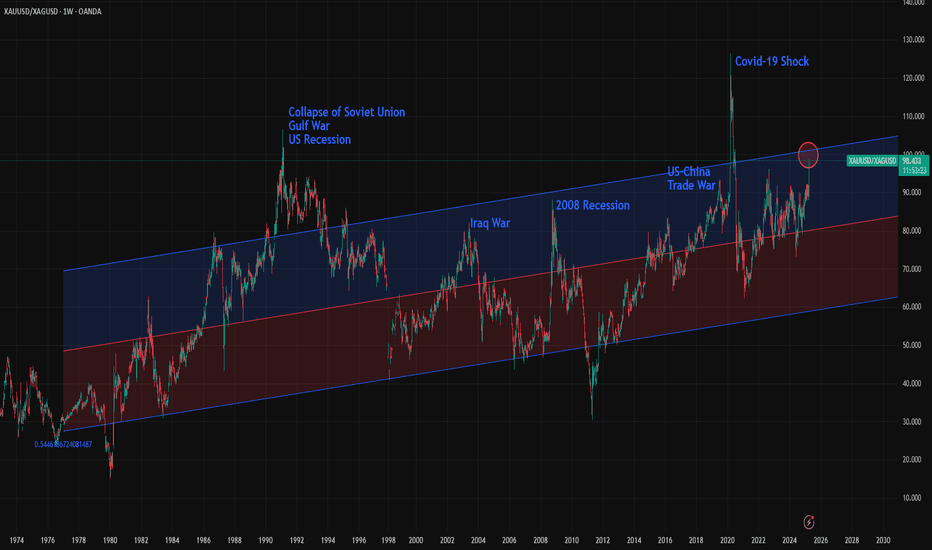

The Gold/Silver ratio is on the verge of reaching 100, an extremely rare level seen only at key historical turning points. The chart includes a 2,500-week linear regression channel, which shows that over the very long term, the ratio has been steadily rising, though at a slow pace. Occasionally, the ratio touches the 1.5 standard deviation line, and in rare,...

After a strong rally from around 1.03 to the 1.10s, EURUSD traders now appear undecided. The white line shown is the 17-year-long trendline, which is currently acting as major resistance. However, this is not a typical short-term resistance level, it's more appropriate to focus on weekly and monthly closes around this area. Still, its presence alone is enough to...

The trade war between China and the U.S. is escalating, and the Chinese yuan is starting to feel the pressure. After the U.S. raised tariffs to a total of 54%, China responded with a 34% increase of its own. Now, Trump has threatened an additional 50% tariff hike if China doesn’t withdraw its retaliation. It appears unlikely that either side will back down at...

The DAX is feeling the effects of a "Black Monday" scenario early on. The blue trendline that began in August was broken on Friday, and now the longer-term trend that started in October 2023 is being tested. This trendline, along with the major support zone just below it, could act as a potential turning point before a deeper selloff. If the 18,800–18,920 zone...

In our last BTC post, we mentioned that decision time had arrived—and the market has made its move. The downtrend is resuming with max-pain. Today, Bitcoin tested a major support zone at 72,000–74,000. This area, once a key resistance, now serves as critical support. Now, another decision point is approaching. Will the market recover and Bitcoin follow,...

Gold has triggered a sell signal based on a MACD system that has historically shown a 75% success rate since the major 2011 top. Out of eight total signals, six have worked, capturing an average downward move of 21.15%. While recent signals during the bull market have delivered more modest results, they have still successfully flagged key corrections. The latest...

The S&P 500 has formed a downtrend channel following the break below the 5700 support level. Trump's new aggressive tariff policy raised the minimum tariff on China to 54%, while China responded with equally aggressive 34% tariffs. The trade war has now officially begun. This escalation is clearly negative for the stock market. Recession risks have risen...

Snowflake has been trading within a wide range between 108 and 240 over the past three years. During this period, revenue growth has remained steady, but operating and R&D expenses have consistently increased. This is a company that prioritizes growth and invests heavily in research, expanding its product offerings and business relationships. However, the recent...

Ahead of today’s tariff announcement, EURUSD has formed a bearish triangle pattern. Among major instruments, EURUSD has been one of the least affected by tariff expectations in recent days. However, there is a short-term risk of a downside break. If the support near 1.0780 fails, EURUSD could retreat below 1.0750 before the announcement. In any case, traders...

Bitcoin is near a decision point. The market's reaction to the new tariffs came at a bad time. The daily timeframe downtrend line is being tested, and the short-term uptrend that carried the price to the trend line seems to be about to break. In that case, Bitcoin bulls are about to face pain, again. The SP:SPX is still the main catalyst for the crypto...

Last week, USDJPY got rejected from the cup&handle's 150 resistance, then break the 149 support, fell sharply. The recovery is in process but the broken trendline is a major hinderance in front of USDJPY bulls. Now the trendline and 150 resistance converged and USDJPY is trying another attempt towards this key resistance. As long as it holds, there is a good...

Gold’s horizontal move ended on Friday with the breakdown of the short-term support at 3025. Since then, the critical 3000 level has been tested twice but is still holding for now. The short-term trend has turned bearish, leaving gold prices stuck between the downward pressure from above and key supports at 3000 and the 200-hour moving average. Trump's recent...

The S&P 500 has formed an uptrend channel after breaking out of the "tariff panic" downtrend, which had dragged the index down more than 10%. But is this new short-term uptrend merely a correction, or has the real direction changed? That’s the key question, one that will likely be answered in early April when the new tariffs take effect. February consumer...