hungry_hippo

So I managed to dump my GLD holdings Tues premarket (left a comment on one of my posts Tuesday morning) because I realized that gold was doing a three drive pattern, got a pump at the end which started to sell off premarket. Not to mention, it had hit the target I posted with the big green arrow. Also, we have confirmation that my 3 hr indicator does work on GC,...

We have an open gap above and an open gap below. I assume the one above will fill first on this rate cut pump until POwell (and/or inflation numbers) squashes it then it fills the gap below. Everything is green right now, index futures, cryptos, and even gold but I assume that's because it's a commodity not because of speculative hedging. All otehr commodities...

I think the market is gonna go oversold on the daily again. It broke the wrong way out of the pennant-like structure, we still haven't heard about the electronics tariff, and we've got a slew of earnings coming up where every conf call will talk about tariffs and recession. Long on gold at least until we hit that bottom again, not shorting because of the open...

Not sure if this is a melt up or not, bit strange that RSI and MFI are moving in opposite directions. I have a long term position set up, but I'm not planning on doing big options plays unless MFI hits the red line or if I expect the stock market to drop. I might play a little tomorrow for TSLA earnings, lol. (TSLA has dropped so much it's only 2.6% of QQQ, it...

Sorry, I don't have time to post during work hours, I did comment on my last ES post though. As I mentioned, RSI hit oversold mid day on my 3hr chart with positive MFI divergence. So here's an updated plot. I can't watch the market continuously, so I didn't play the bounce. Thought about some calls EOD, but if you hold a long position overnight, you're...

Not many of my followers trade futures, but in case I don't have time to post an update before work tomorrow: 1) Another open gap down. I don't think it fills until RSI hits oversold and we get a bounce. 2) Dollar index broke support, but wouldn't surprise me if it did a backtest (maybe) 3) Gold trying to "break out" yet again, but a dollar backtest will look...

Here's a longer term view of teh dollar index. Yes, it can go down a lot further.

Dollar index hasn't broken support, and ECB meeting tomorrow. I went into gold today anyways because the pumping will counteract any rise in teh dollar, lol. If gold dips tomorrow after the meeting, I'm adding more.

Same as NQ, indicators did not go oversold yet, but looks like the EUros set up for an ECB rate cut bump tomorrow morning. MFI might hit oversold premarket tomorrow. Note that ES filled the NVDA gap but still has the original tariff gap above.

Looks like the EOD pump might be a setup for the ECB meeting tomorrow morning. Did not play it because my indicators did not hit oversold. Taking the patient approach and just waiting for a good play. I did get into sold gold though this morning. They way they're pumping gold, the dollar index won't matter as much, lol.

No idea what this market is doing, it wants the gap fill but can't figure out a way to get there, lol. It did fill the gap up from last night though. Indicators are neutral, Powell speaks Wed, ECB meeting premarket Thu so I dumped my gold premarket today. Basically a wash trade, I wish I had figured out what was going on sooner. If ECB cuts rates, you'll see...

Just wanted to point out that the dollar has already lost support in terms of the Euro, and regardless of indicators, I doubt it recovers until the next president. I see this hitting all time lows within 2 years, that's how bearish I am on the US dollar. Probably should have posted this Thursday when I posted teh gold plots.

3hr MFI is headed quickly to oversold, and the dollar index is bouncing back a little. FUtures are also green. I expect the market to bounce up when MFI gets oversold, so possibly a gap up which sells off then market goes back up? Gold trade is on hold until currency direction is determined. The dollar will eventually break though, so holding the small...

RSI hit overbought so we got a dip. We may get another dip when MFI gets overbought today, or just a bigger dip if it hits overbought premarket. Will we get a melt up instead? I dunno. Keep in mind that China still has tariffs, but also keep in mind he's going to do exemptions. So that rules out shorting AAPL or any sector like auto. We will get another huge...

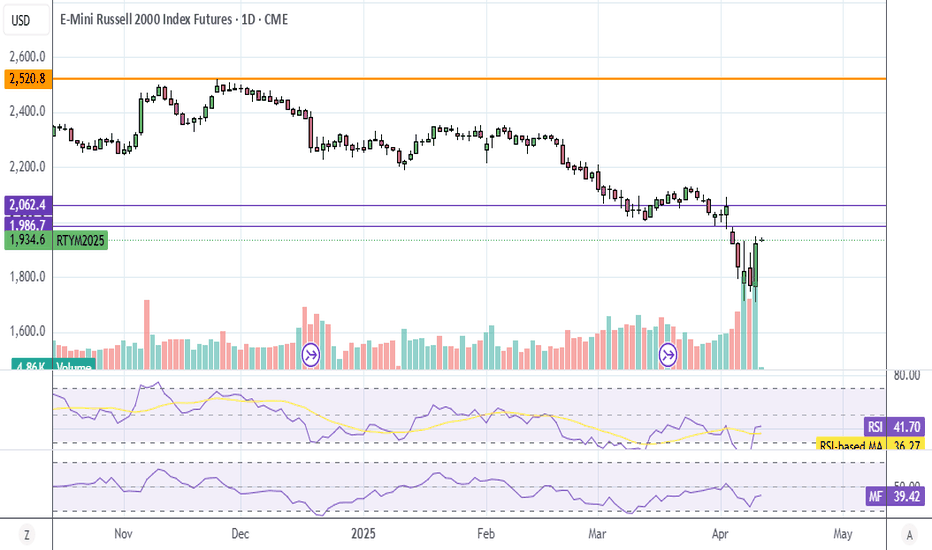

Small caps got hit hardest by the tariffs, fell the most, went up the least today, and has the furthest to go to fill the futures gap and also the all time high (ATH). I think RTY (IWM ETF) will outperform ES/NQ (SPY/QQQ) the next 90 days as Trump unwinds all of the tariffs including the 10%. He'll more than likely repeal the China tariffs in the next week or...

I've been watching this thing through the tank, PCAR has always filled open gaps before, and there's a bunch of them now. I don't expect earnings to be that great, so hopefully they all fill before then. ANyways, it's back to my favorite play. I've made so much money off this stock, I was willing to jump in a bit late and take the risk. I'm up, but not a lot...

Not sure if I will have time to post an update tomorrow morning, futures are red, RSI looks like it's headed to oversold, foreign investors are ditching US assets, nobody trusts Trump. Index futures, stocks, bonds, and the US dollar all selling off. With Trump gaming the market, it's easy to get whipsawed into a loss. Get caught holding puts when "news" comes...

If you look at gold in francs, it's not close to a breakout. Gold looks like it's breaking out because we trade in dollars. I'm only entering the gold trade if the dollar index loses 100 support.