Peaks met, supply levels expecting some push up before shorts. inter time frames showing h/s awaiting market opening

With oil fiasco all around, heating oil has a very strong correlation with crude oil. technically price at 61.8% supply levels. currently awaiting a drop from current levels to demand levels of 21.00 handle

.Looks like we may have a right shoulder about to form soon. currently short to 8.7200

low consumer sentiments sanctions, mid range between 75 and 64. next price level for this is demand levels around 64-65 lining up with 38% levels. oil stocks gradually climbing up globally. patience will pay off.

Same analysis for the GBPAUD. my theses behind every short position on GBP pairs is 85% driven fundamentally but as always with take the road with good risk management

MONITORING UNTIL CONFLUENCES LINE UP. I am currently watching the pair at the moment. considering the CAD index is also heavily influenced by the price of oil I see the CAD index picking up some momentum but the question is when. but on the other side of the table I am watching the GBP as well with extensions granted for the uk PARLIAMENT surrounding the Brexit...

With price bullish and India to cut the inflow of cotton to equilibrating the flow of price.... we are seeing an increase in demand. however this cut is just for a limited period with major clothing companies on the IND50 index forecasting some slow in sales on cotton products. this will restrict the flow or goods. tariffs can also be catalysts as well as high...

My 2 cents on this pair. I took a long position on this pair a couple of months ago where my first take profit was achieved. my second entry was however closed at break even and then price rallied targets lol... anyways... with ZXY index currently over bought I will be looking to take a sell on this pair with targets shown as below. once we it first take profit...

Expecting some more ranging and shorter short volatility in the stock markets which will affect the JPX pairs. as posted in my previous USDJPY posts which played out. this pair although works on a good technical perspective has a lot of fundamental use case behind it to driver price a lot be it long or short.. lets see how patience will pay of on this position...

Taking a long position on bitcoin a lot of people might say it's sort... but this wedge look like a break out . If it does I will be taking a long position on a close above the resistance. lol I shall await the etc short sellers to come lol

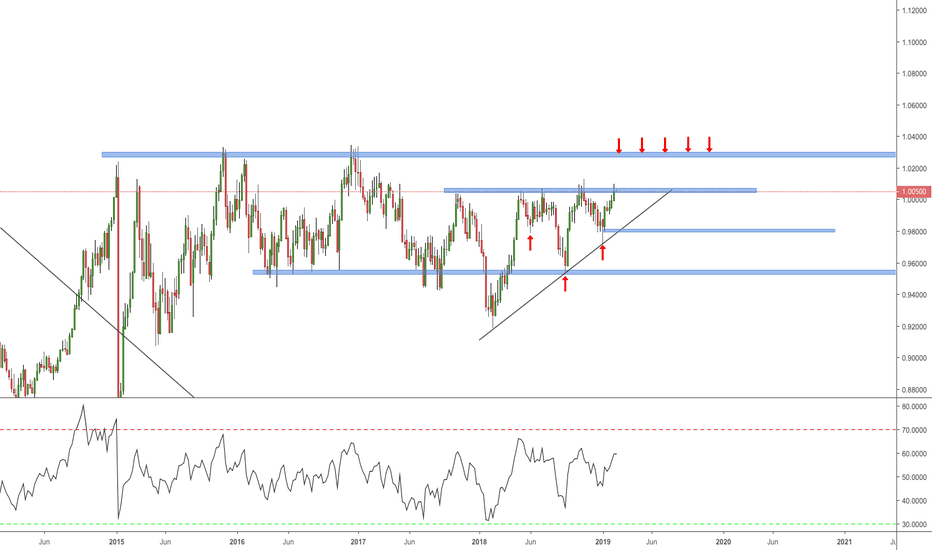

I am currently watching this pair over the next few weeks. this is a trade short Idea which hopefully should happen soon. I currently see price has formed an inverse head and shoulder patters but the current neck line is proving difficult to break on the supply zones of 1.00700 region. but with current trade talks and the ZXY index looking weak think we should...

currently looking at the NZDJPY daily for short nets. looking to see if price will bring the right shoulder to the down side.. looking to bag 345 pips on this one. lets see how the next few days/weeks react. we have some heavy fundamentals that are building some positive momentum for the JXY

Looking for short entries on this pair... lets see how the coming week will be considering there's a lot of chaos at Westminster. prime minister loosing grip of the entire Brexit situation. UK GDP deficits below targets, manufacturing index as well as output on exports not meeting optimum levels. looks to me this is a good opportunity to go short. will be...

A short positing for EURAUD with hyper corrective structure to 15830 demand levels confluence with CD leg completion. lets see how this plays out

With the prime minister heading to the Brussels for a negotiation for the Irish border back stop anything can happen. however if we look at the bright side of things although there is a high level of uncertainty in the market the technicals have presented some long ideas. we are currently 0.5% exposed to this trade due to this fundamental Brexit issue . now if...

Monitoring this pair at the moment on my watchlist. we have had price retrace from the 50% region. however price looks to be retracing back up.. I will ONLY take a short position when price breaks this inner trend line for valid confirmation where we might have a small right shoulder and drop further to the -127% levels around the 184000. HOWEVER if we do not...