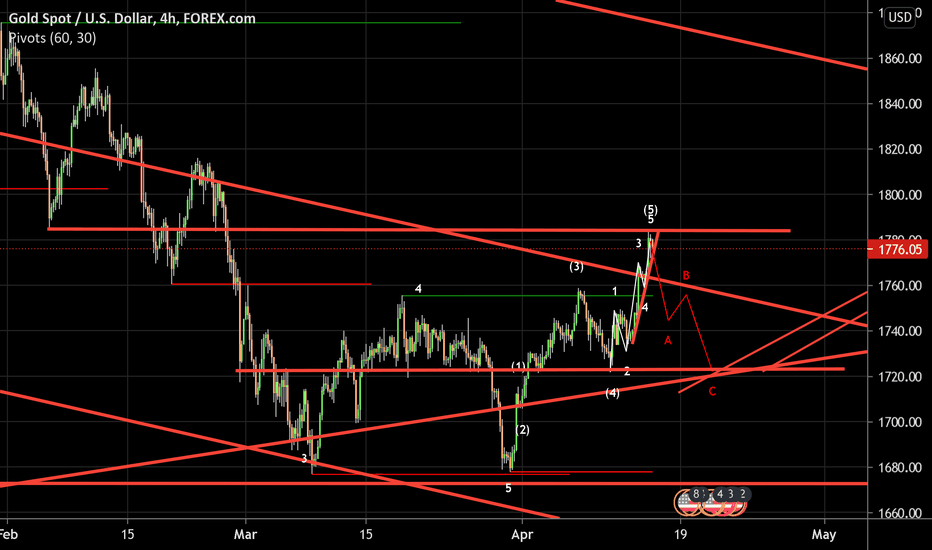

as it looks now we may test 85 before raking sl to 47 all bullish scenarios

As suspected gold making leading wave 1 1760 is pivotal and maybe tested one more time yet target above 1872

Bear scenarios are exhausted invalidations are almost done I am looking for a dip around 1720 which is now a well tested pivotal level

Update on the longer-term plan so far I see a correction 61.8% bear volume came in and although I am very bullish a flat scenario still remains short term. Above 1620 bull is safe and all dips are been bought.

update of same idea short term looking to add again 1720-10 levels buy and hold dips bullish scenario and bearish scenario short term gold will remain above 1620 with a good chance bottom is in

smaller trade longer-term remains same 4hr showing clear divergences impressive bull held through a good NFP for the dollar. 1760 short-term target now strong resistance.

pretty much same idea buy and hold with 1618 maximum validation can touch lower to 1670 area if it so wished lol. Holding longs for longer term targets is what i am looking to do

similar same idea as published during week range suggests a test of 1875 ready to look for shorts

Printing another 3 waves up 1920 been 50% area tp 1880 area

the wider view will retest that broken channel in the short term it can go lower to 1765 even a small new low but buys there is no brainer with tp safe at 1860-70. Which point will look for shorts with a target of 1670 area and of correction finally

small update on idea published most recently can see we are still at resistance and seeing 65 area is still likely before testing 1860-70 area again