The GBPCAD pair is showing a clear bearish trend on the 4-hour chart following a confirmed break below a significant intraday support level. This suggests a possible continuation of the downtrend towards the 1.8420 level. Prepare for more downward movement.

Gold is currently experiencing a strong upward trend in trading. Following a recent all-time high, the market started a correctional movement. The price respected the strong support level at the 3000 psychological level, leading to a bullish wave that broke above a neckline of a cup and handle pattern acting as a local horizontal resistance. This is expected to...

Another pair that appears attractive for buying at a key support level is 📈CHFJPY. Following a test of an important intraday structure, the price has formed a cup & handle pattern. A bullish breakout above its neckline serves as a solid bullish confirmation. It is likely that the pair will continue to climb and reach the 170.24 level in the near future.

Bitcoin has formed an ascending triangle pattern on a 4-hour chart. The neckline has been broken, followed by a positive bullish reaction after a deep retest of the pattern. This indicates a strong signal for a bullish reversal, with a potential move towards 90,000.

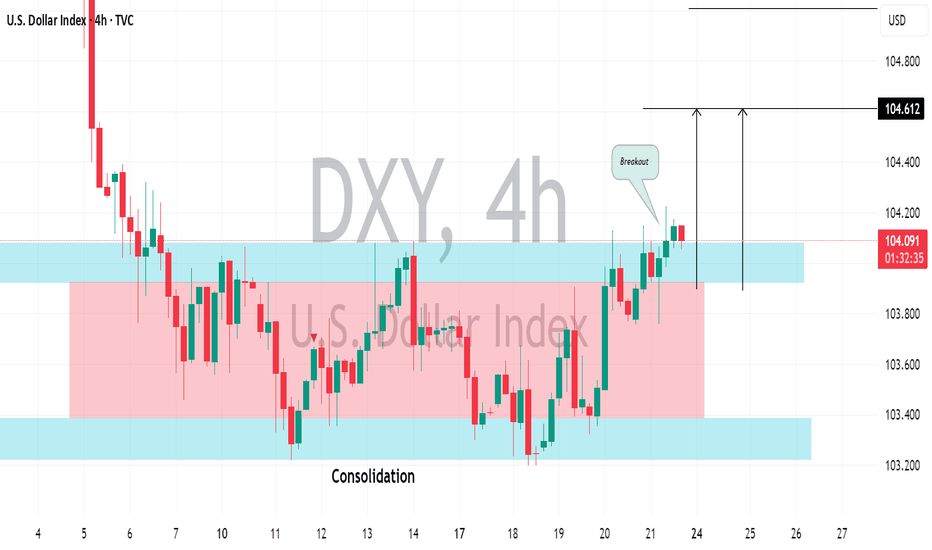

The Dollar Index appears to be showing bullish signs following a period of consolidation lasting two weeks. A breakout above a resistance level in a sideways trading range is a strong signal of confirmation. It is likely that we will see a move upwards, potentially reaching the 104.10 level.

The GBPAUD pair appears to be showing a bearish trend on the 4-hour time frame after testing a significant intraday resistance. An inverted cup & handle pattern was formed on the hourly chart, along with strong bearish momentum this morning, indicating a potential downward movement. I believe that the market may retrace back to the 2.0500 support level at the...

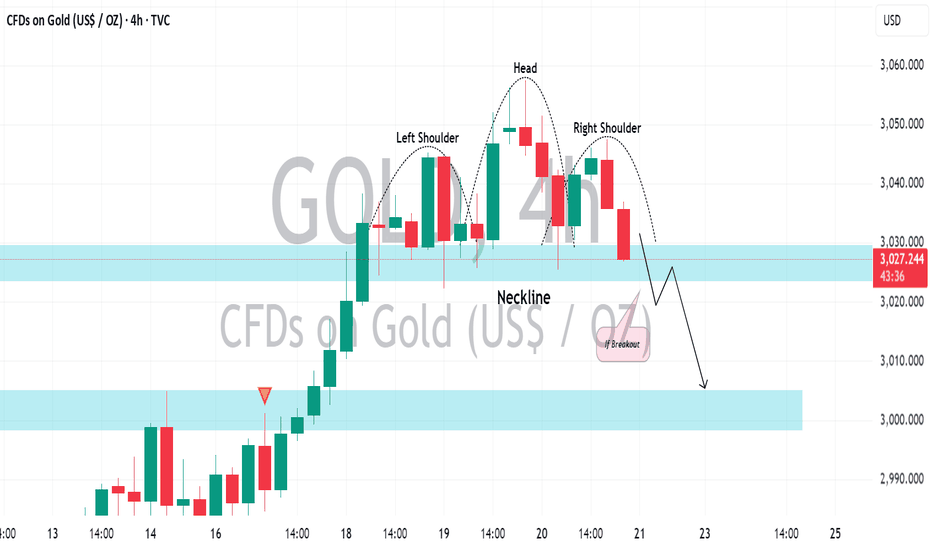

After experiencing a strong uptrend, ⚠️Gold appears to be overbought. By analyzing the 4H chart, we can see a complete head and shoulders pattern. A bearish trend will be confirmed if the price breaks below the horizontal neckline. If a 4-hour candle closes below 3022, we can anticipate a significant pullback to around 3000.

Silver formed a classic head and shoulders pattern on the 4-hour chart. Following the release of US fundamentals today, the price quickly dropped significant and broke below the pattern's neckline. The price currently retesting the broken neckline, suggesting a potential continuation of the bearish reversal. The next support levels to watch for are at 33.05.

Ripple's price saw a positive shift following the SEC officially dropping the lawsuit against XRP. The price broke through a key daily resistance level, indicating a bullish trend reversal. A cup and handle pattern was formed with a broken horizontal neckline, suggesting a confirmed bullish reversal. I anticipate further growth in the market, with potential...

Take a look at the price movement of ⚠️BITCOIN, the market is consolidating around a significant daily support level. Analyzing a 4-hour chart, I spotted a descending trend line and a potential inverted head and shoulders pattern. The left shoulder and head have already formed, and the right shoulder is currently in progress. The neckline for this pattern is...

The 📈GBPCAD pair retested a horizontal structure that was previously broken on the 4-hour chart. Following this retest, the price formed an inverse head and shoulders pattern and broke above a resistance line of a bullish flag pattern. This suggests potential upward movement in the near future. The next resistance level to watch is at 1.8692.

GBPAUD has formed an attractive inverted head and shoulders pattern on the 4-hour chart. A bullish breakout above the neckline indicates a strong reversal signal, suggesting further upward movement and a potential test of the 2.0560 level in the near future.

There are clear confirmations of bullish momentum on the 📈EURAUD: This is evident from the breakout above a resistance line in a bullish flag pattern and the formation of a confirmed change of character CHoCH on the 4-hour chart. I believe that the market is likely to sustain its upward movement, with the next resistance level seen at 1.7300.

I have seen another bullish pattern on the EURUSD pair, specifically an ascending triangle formation. The price has broken above the neckline of the pattern, indicating a strong bullish trend. There is a high likelihood that the price will continue to rise, with the next resistance level at 1.1016.

I spotted a great example of a bullish reversal on 📈US100. The index formed a double bottom pattern on a 4-hour chart and broke and closed above a resistance line of a descending channel. There is a positive response on retesting the key support level based on a broken neckline. It is expected that the index will continue to rise towards the 20,000 / 20180 levels.

I believe the 📉GBPCAD pair is showing signs of being overbought. On the 4-hour chart, there is a descending triangle pattern with the neckline being broken and a 4H candle closing below it. This could indicate a correctional movement coming soon. Targets for this correctional movement are at 1.8506 and 1.8446.

After reaching a new high of $3000, a psychological level, the Gold price started to consolidate within a horizontal channel on the 4-hour chart. To buy Gold this week, it is advisable to wait for a breakout above the channel's resistance, which could lead to a movement towards at least 3020. On the other hand, a bearish breakout below the channel's support...

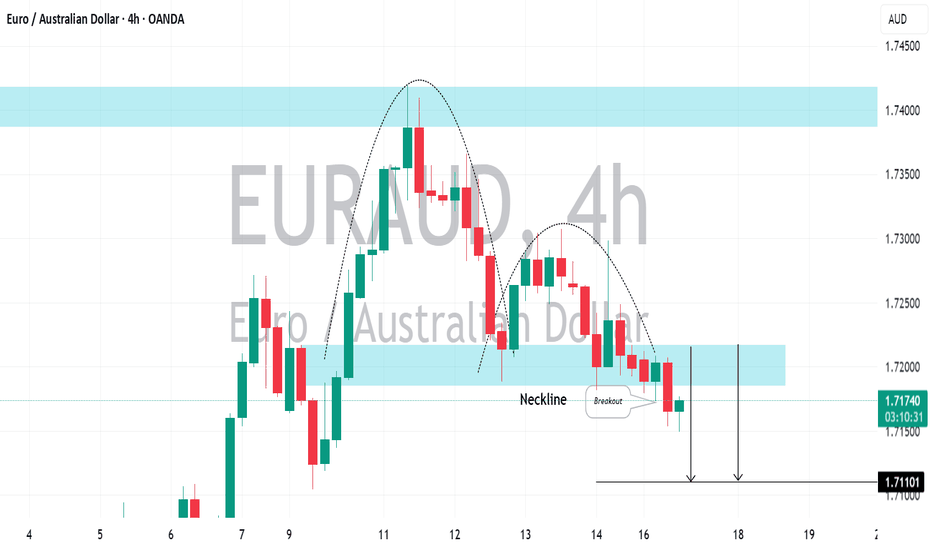

📉EURAUD has broken through and closed below an important horizontal support level during the day. The highlighted blue section also serves as the neckline for an inverted cup & handle pattern. This violation suggests that there may be further decreases in price. The next support level to watch for is at 1.7110.