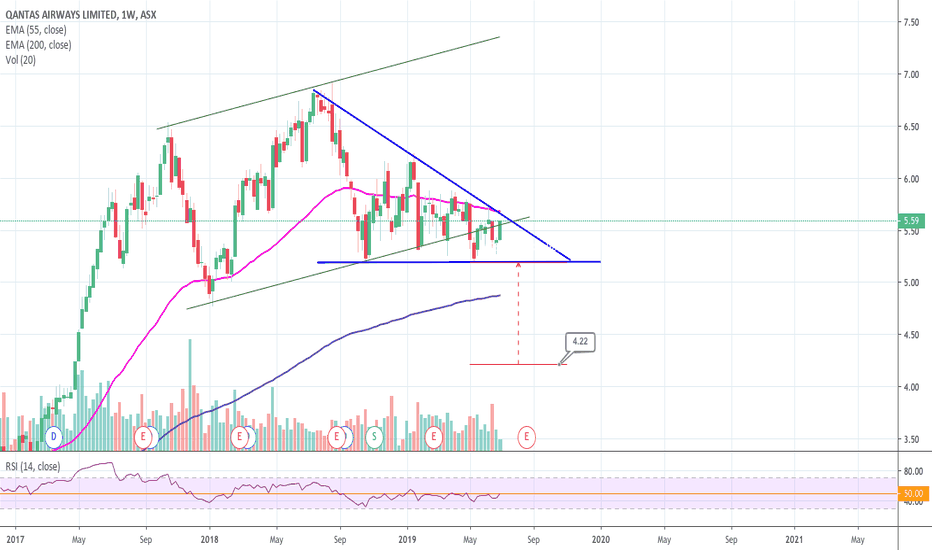

Qantas ASX:QAN is running out of room in what seems like a descending triangle. If there's no break to the upside, expect more downward pressure to $4.22 in the coming months - long term outlook. Due to the uncertainty of the market - trade wars and oil prices - a breakout in the coming weeks should also be taken with a pinch of salt as it might be a bull trap...

Pilbara ASX:PLS has corrected nearly 85% from all time highs since Dec/Jan18. Now it is sitting at the Fib 0.854 @ $0.485. How much more will it continue to be shorted? PLS is one of the most heavily shorted stock on the ASX by the way. The previous bull flag took 69 weeks to complete. Although there might be no correlation but price-action is printing a...

NASDAQ:AAL sitting comfortable inside the falling wedge. I am expecting/hoping for an upside break. Conservatively, I am targeting $40 if AAL breaks out of the wedge. Otherwise a correction to $29 invalidates this outlook.

NASDAQ:AAL might have bottomed. And if it falls further, it means trouble for the airline and everyone as well. The chart looks good by the way. Indicators are turning up and if you are looking to hold for long term, catching the falling knives at these levels might be a good bet. I am targeting $40 if the falling wedge breaks upwards. Otherwise a fall below $27...

Too early to tell but i am jumping the gun here. We need a close above 0.73 and a confirmation as well to be (more) sure. I do really like the forming of the bull flag in the weekly. In addition, there's a mini ascending triangle forming in the bull flag. Let's go!!! Target : 0.89 Close below 0.65 invalidates this outlook.

ASX:RHL I am adopting a wait and see first strategy for this stock. The bear pennant doesn't seem to excite me although 1. price action closed just slightly above the cloud for about 4 weeks already 2. declining volume probably explains why it has been rather flat 3. RSI showing positive signs both daily and weekly but i will still wait out for confirmation...

A2 Milk ASX:A2M is still bullish. Just be be cautious, daily chart is oversold. Target: $14. A break-down below $10.85 will invalidate this outlook.

I am confident of Qantas. The bullish trend is confirmed. Price is above the cloud. Conservatively, i have a price target of $6.74. A break below $5.80 invalidates this view.

Just be wary that ASX:PLS might fall to the bottom of the channel. Thick bearish clouds ahead and RSI has more lows to go.

I am bearish on ASX:VAH . Target 1: 0.180 Target 2: 0.110 Stop-loss: 0.25 A break above 0.25 will invalidate this bearish view.

ASX:MGG ascending triangle break out Target $1.9750. Stop loss: $1.650 A break below $1.60 will invalidate this bullish view.

NASDAQ:AAL the 28 day ascending triangle is not a very strong trend that i will usually trade. There's a strong resistance at $40.47, if we manage to turn this resistance into support, I target at $44.13. Stop-loss: $37.78 For safer entry, a break with confirmation above $40.47 will give a better risk reward. A break below SL will nullify this bullish take.

ASX:MGG had a pull back today and now resting on the first support at $1.555. I believe we should have a little bit more downside to go as the selling pressure (CMF) is still largely negative. I am targeting buys along the 0.618 Fib. at $1.505 to 1.520. Stop-loss set at $1.47 depending on your risk appetite.

ASX:QAN The 189 day ascending triangle is nothing short of exciting for me. When such a long trend happens, it happens for a reason and usually the break out will be 'intense'. Watch out for it. Earnings announcement coming on the 23 Feb. Keep a lookout for it. Conservative target at $8.28. A break below $6.19 will invalidate this bullish outlook.

ASX:MPL closed above the 55MA for 2 consecutive days. CMF has been neutral for the past week - hints of accumulation - prices were moving sideways. Volume is rising and this is positive. We have a few hurdles to clear from between $3 up to $3.17. As TK has crossed below the cloud, this signifies a weak bullish sentiment, but it is a first step we need to take...

I am very tempted to buy ASX:SRV now because I think the chances of it breaking out of the small symmetrical triangle is high. CMF is strong and positive and RSI is about to cross the midpoint. If you intend to take the risk and enter now, I would set my stop-loss at $3.91. For a safer entry, wait for a confirmation above $4.46. A fall below $3.91 would...

ASX:AQZ is now testing the bottom of the trendline. If broken, look for support at $1.685. Alliance Aviation looks like a good buy now, however, the risk of it falling out of the channel is still present because the RSI has yet to curl up and the 10 and 21 ema(s) are starting to curl downwards. I wouldn't catch the falling knife although some people love...

Hanging man closed on the daily today. I am bearish and targeting a 0.618 retracement. That will put the price at $2.68. A break-above $2.90 will abolish this bearish view.