EW 2 hit the golden pocket 0.65 nicely today at 0.145. I am expecting to bounce from here to start impulse wave 3. The falling wedge also points to a break above. Target for Wave 3 from here is 0.715. Remember to set your stop losses target. IF we do not bounce here, expect next support level at 0.105.

I am not confident of Vita's price movement lately. It has broke out of the falling channel but a double top has formed and prices are likely to reverse. Watch out for break and confirmation below $0.93. Target short @ $0.52. A price above $1.415 will invalidate this bearish view. Background: Vita diversification strategy involving a move into cosmetic...

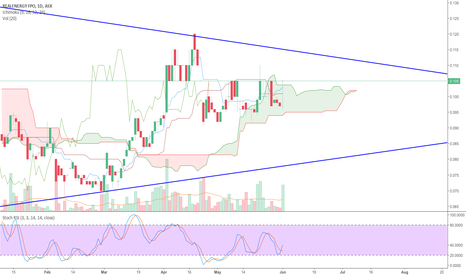

These are my two targets. We have to break out of the triangle before anything drastic will occur. Will reassess when we break out.

The volume on Pilbara is declining. That can mean 2 things. Investors are holding it and waiting for a good sell entry, or when volume comes in, weak hands will be shaken off. I am still hopeful for PLS to test the upper channel of the ascending triangle and hoping for a miracle to break upwards. But left side of the chart shows that an ascending triangle can...

Real Energy (ASX: RLE) has completed drilling at its Windorah gas project and is moving towards diagnostic fracture injection testing after striking gas pays at its three Tamarama wells. RLE should warm us up this winter. 1. TK crossed in the cloud signifies medium bullish signs 2. Chikun lagging span closed above price today - bullish sign 3. Price closed above...

ASX:QAN Qantas refused to close above $6.50 today and a shooting star has formed. A support at $6.10 if we drop further tomorrow.

Prices of PLS is now residing in the cloud. Last week 1D close has formed an ascending triangle. If prices do not fall under the cloud, we should see PLS testing the top of the ascending triangle at $0.95 and hopefully, a breakout to $1.00 this week.

SW1 Swift Network Group prices seem to be moving into the apex of the simultaneous triangle. I am expecting a breakout to the upside. The correction at EW2 hits the golden pocket nicely at 0.65. I believe we are going into EW3.

Traps traps traps. Traps everywhere. Are we seeing a double bottom with the RSI indicators? The bull trap was clear few weeks ago. Could this be just a bear trap?

Star Combo Pharma has just started trading last week. It has a good run up to above $2. I believe this is Wave 1 of Elliot. The price has dropped a bit at writing and if I am not wrong, corrective wave 2 will probably hit between 0.5 to 0.618 in the next few days. If i were to trade, i would look for entry below $1.30 between 0.5 to 0.618 fibonacci. At writing,...

$PLS Pilbara seems to be on the Elliot Wave 5 path now. Anyhow, in Ichimoku terms, 1. TK cross bullish 2. Chikun above price - Bullish 3. Break above clouds 4. Target: $1.00 5. SL @ $0.91

NAB is bearish on the 1W weekly outlook. 1. TK cross bearish under cloud 2. Chikun (Lagging span) under price - bearish 3. Price under cloud - bearish See chart for 2 intermediate support levels. If hell breaks loose, a stronger support is at $23.

$MPL Medibank is poised for a good run soon. It is currently trading at the bottom range of the overall uptrend channel. Target: $3.45 SL: $ 2.87

NIB $NHF $NHF is painting a bearish flag right now. We might see lower prices. I see correction to $5.25 or even $5.00 if $5.25 does not hold.

Qantas facing a lot of resistance at 6.45. This historical resistance was established in October 2007. If we managed to break 6.45, expect free run to 7.60. Otherwise fall back support level at $6.05 then we re-assess from there.

1D $BTC update painting a 'no man's land' outlook. Why? 1. TK bearish cross, but prices have held steady in the clouds. Prices are consolidating here and that's GOOD instead of falling below the cloud. 2. 1D Stoch. RSI shows promising outlook. 3. Until we break above the cloud, 9k-ish, and TK cross bullish, stay away. I would.

Bioxyne Ltd (ASX: $BXN) is painting a bull flag. If it breaks out of the resistance at $0.91 I expect target to be between $1 to 1.20. The $0.91 is a very strong resistance as we can see now that the bears have refused to let the bulls through. This Australian life sciences and health products company is targeting the Asia market with its health and wellness...