phaneth2014

Gold market uptrend, I recommend to buy with the below two setup price 1st BUY SETUP EP: $3215 - $3220 SL: $3208 TP1: $3260 TP2: $3280 TP3: $3300 2nd BUY SETUP (if hit SL 1st setup) EP: $3185 - $3190 SL: $3180 TP1: $3240 TP2: $3260 TP3: $3300 The gold market uptrend target ($3300)

Gold will dump to $2000 - below $2000, the root cause of the tariffs news, I recommend selling better than buying

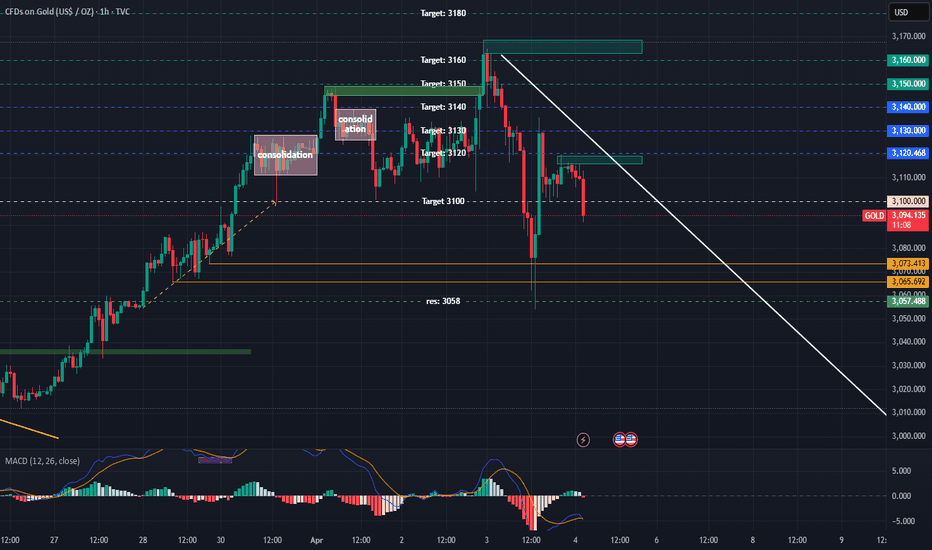

Gold on Friday last week trying to breakout the resistance and target $3100 plus, I have two setup signals for you FIRST BUY SETUP: One we can setup buy entry price below EP: between $3074 - $3073 SL: $3072 TP1: $3085 (resistance highest at $3086) TP2: $3100 (if breakout resistance price) SECOND BUY SETUP: we can setup buy entry price below (if hit SL setup...

Cross check MACD histogram reversed up, will break resistance 3040 target 🎯 $3060 - $3100

Cross check on MACD histogram looks reversed up, recommend to buy with below setup #️⃣GOLD/USD 📈BUY SETUP EP: $2,980 - $2,986 💙 SL: $2,978 💔 TP1:$3,000 💚 (resistance rejected) TP2:$3,020 💚 (break out resistance) TP3:$3,040 💚 (extend target) Target: $3,020 - $3,040 🎯 Opportunity to buy MACD histogram reversed up signed #️⃣GOLD/USD (rejected resistance $3000 -...

#️⃣GOLD/USD 📈BUY SETUP EP: 2986-2992 💙 SL: 2984-2980 💔(base on your entry price and balance) TP1:3020 💚 TP2:3040 💚 Target: $3020 - $3040 🎯 Opportunity to buy MACD looks reversed up tonight bullish sign

ETH Timeframe 1H failled to break Key support $2,000 - $2,100, it is sign a bullish

BTC/USDT Trade Strategy (1H Timeframe) 📌 Trade Bias: Bullish (As long as uptrend holds) BTC is in an uptrend, bouncing from key support levels, and MACD shows potential bullish momentum. The trade strategy will focus on buying from support and targeting resistance. 🎯 Long Trade Setup (Buying the Dip) ✅ Entry: Zone: $87,000 - $88,000 (First support...

XAU/USD (Gold) 1H Chart Analysis – March 7, 2025 1. Price Action & Market Structure Current Price: $2,904.42 Range Bound Movement: The price is oscillating between $2,890 and $2,920, indicating consolidation. Key Levels: Resistance: $2,920 - $2,930 Support: $2,900, then $2,880 2. Moving Averages (MAs) The 50, 100, and 200-period MAs are tightly packed, showing...

XAU/USD (Gold) Trade Recommendation – 1H Chart Analysis Current Market Overview: Gold is trading around $2,918 and is consolidating after a strong bullish move. Resistance is seen at $2,920 - $2,930, while support lies at $2,900 - $2,880. Moving averages suggest bullish momentum, but MACD shows indecision. 📉 Sell Setup (Preferred Based on Your Strategy) 🔹 Sell...

✅ TRADE SETUP: BUY XAU/USD Limit Entry: at $2,903 - $2,899 Stop Loss (SL): $2,897 - $2,895 TP1: $2,917 (minor resistance). TP2: $2,925 (next key level). TP3: $2,950 - $2,960 (extended bearish target). Why Buy? ✅ Rejection at key support ($2,9033 - $2,899). ✅ Price above EMA (20,50,100,200) 🚨 Risk Warning: If the price breaks below $2,895, close the trade as...

Long-Term Trading Strategy for Gold (XAU/USD) Since you prefer long-term trading, we will focus on higher timeframe trends and key levels rather than short-term fluctuations. 📉 Long-Term Bearish Outlook (Until Major Support) The chart suggests that gold could continue declining towards the 2,600 - 2,560 zone over the next few weeks. The descending trendline and...

Gold price languishes near a two-week low below $2,900 as traders await the release of the US PCE Price Index for cues about the Fed's rate-cut path. The crucial inflation data will influence the USD and provide a fresh directional impetus to the non-yielding yellow metal.

USD/JPY declines further to near 152.60 as the US Dollar underperforms its peers amid upbeat market mood. US Trump didn’t reveal its detailed reciprocal tariff plan on Thursday.

Gold NYSE:TVC : GOLD trying to break the resistance price failed two days on Thuday and Friday last week, closed day the lower then the resistance, I recommended to SELL, please check annalysis.

The current short-term bearish trend is expected to quickly reset the neutral or bearish trend. To avoid contradicting the short term, it would be possible to favour short positions (for sale) for RIPPLE - XRP/USDT as long as the price remains well below . The next bearish objective for sellers is set at . A bearish break of this support would revive the bearish...

The bearish trend is currently very strong for ETHEREUM - ETH/USD. As long as the price remains below the resistance at , you could try to take advantage of the bearish rally. The first bearish objective is located at . The bearish momentum would be revived by a break in this support. Sellers would then use the next support located at as an objective. Crossing it...

Economies.com provides the latest technical analysis of the GBP/JPY (British Pound Sterling/Yen). You may find the analysis on a daily basis with forecasts for the global daily trend. You may also find live updates around the clock if any major changes occur in the currency pair.