Silver (XAG/USD) – Long Setup Idea Silver is currently trading around $31.30, while gold has surpassed the $3,000 mark, pushing the Gold/Silver Ratio (GSR) above 99 – a level that historically signals strong upside potential for silver. Industrial demand is surging, especially from solar energy, EVs, and electronics, with silver consumption expected to exceed 700...

GoPro (GPRO) Long Idea – Target: $1 GoPro CEO Nicholas Woodman has waived his salary for the remainder of 2025, reinforcing the company’s aggressive cost-cutting plan aimed at reducing operating expenses by 30% and returning to profitability by 2026. This symbolic gesture highlights leadership accountability and strengthens investor confidence in the turnaround...

Nike (NKE) has entered a key growth phase following its earnings report on March 20, 2025. The company exceeded market expectations in both revenue and EPS, reinforcing investor confidence in its long-term strategy. 🚀 Key Growth Drivers: Strong Earnings Performance: Nike reported an EPS of $0.72 (+5.8% YoY), surpassing market forecasts. Digital Expansion: Online...

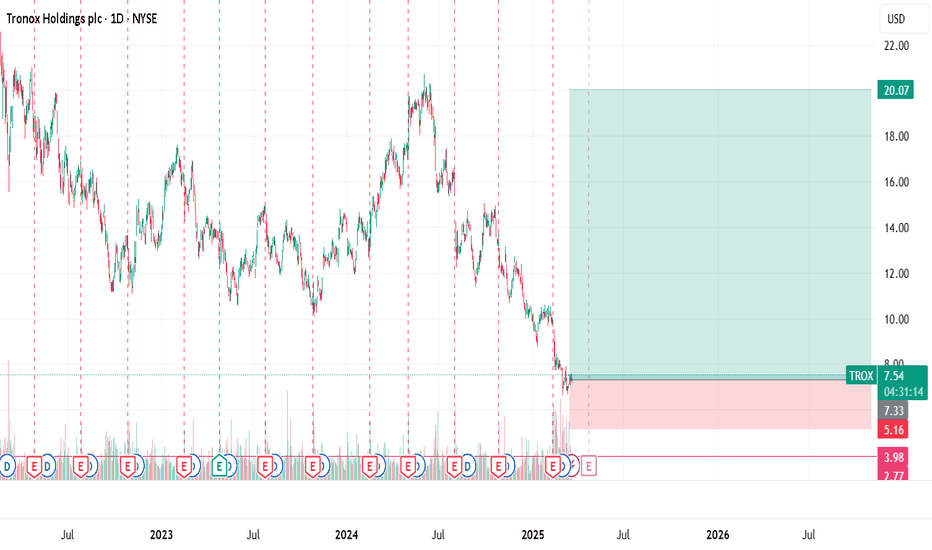

Investment Rationale: Tronox Holdings plc (NYSE: TROX) is a global leader in titanium dioxide (TiO₂) production, essential for paints, coatings, plastics, and other industrial applications. The company also mines and processes titanium-bearing minerals and zircon, making it a vertically integrated player with strong cost control advantages. Despite short-term...

Ethereum (ETH) presents a potential long opportunity with a target of $2,135, supported by several fundamental and technical factors. Fundamental Drivers for Upside: 1. Institutional Interest & Spot ETF Potential – Growing speculation around an Ethereum spot ETF approval in the U.S. could drive increased institutional adoption, similar to Bitcoin’s rally after...

BDCA/USDT Analysis – Long Setup with Target Above 1 USDT by End of April Entry: Current market price Target: Above 1 USDT (by the end of April) Stop Loss: Below key support levels Analysis: BDCA/USDT presents a strong long opportunity with bullish momentum building up. Recent price action indicates accumulation, and the asset is showing signs of a potential...

BioNTech SE presents a compelling long opportunity following its latest earnings report. The company continues to expand beyond COVID-19 vaccines, with a strong pipeline in personalized mRNA cancer therapies, infectious disease vaccines (HIV, tuberculosis, malaria), and autoimmunity treatments. With €17 billion in cash reserves, minimal debt, and high gross...

Long Thesis on First Majestic Silver Corp. (AG) – Target: $6.50 Why Long? Silver Market Strength: Expected Fed rate cuts and a weaker USD could drive silver prices higher. Industrial Demand: Growth in green energy (solar, EVs) supports long-term silver demand. Operational Recovery: Improved production efficiency and cost-cutting at key mines enhance...

Earnings Scenarios Optimistic Scenario Probability: 65% Assumption: The company will exceed EPS expectations (0.25 USD) due to increasing demand for gold as a safe-haven asset amid geopolitical uncertainties and inflation. Market Reaction: The stock price will rise to 18.5 USD (+10%).

An analysis a potential upward movement with a target price of $2.45 and a stop-loss set at $1.70. This indicates a bullish outlook, anticipating a significant price increase. The stop-loss at $1.70 is a risk management measure to limit potential losses if the price declines, while the target at $2.45 reflects the anticipated profit level. Please note that...

Nike has the potential to achieve significant stock growth based on better results and a positive outlook. Key factors will include the performance of the digital segment, demand stabilization in developed markets, and the implementation of strategic changes under new leadership. The target price for the growth scenario is set at $90.50.

After identifying the Judas swing in accordance with the RSMLT concept, the following analysis leads to a short trade scenario with a target of 100 pips. This setup exemplifies the RSMLT strategy in action, adhering to the predefined rules and utilizing its unique Fibonacci zones and manipulation-based approach.

I expect AUD/NZD buy 1.0909 SL - 1.088 TP - 1.09, because NZD is oversold a make lower low. Remember this pair have a low volatility, you can hold this trade over weekend. RSMLT !

I expect long from lower OB, with positive RRR 1/5. TP 0.849.

I expect short again before NY close with positive RRR and with use RSMLT FIBO analysis.

Possibly short after JUDAS SWING in pre-market, RRR - 1/3 !

I expect long EU from 1.0732 level, SL - 1.0705, TP - 1.0775

I expect long after massive short NFP. Entry about 1.0813, RRR - 1/2-1/3. We will see.