At the end of the day the recent rally is still a lower high and a lower low. If it was any different I would hop on the rocket.

This stock continues to make higher highs and higher lows. I am always looking for entry in this continued bull run for gold from a macro POV. Good buy and sell points.

I like this Streamer because its discount to FNV or RGLD. Its actually a decent company for portfolio. See my portfolio holdings based on price.

Higher highs and higher lows. The CAD is showing some steam and the BoC is being hawkish. Posted positions in relation total holdings.

This index is an obvious sign of a looming world recession. It continues to show lower highs and a steep decline.

A significant trend of lower lows and lower highs and lower volume. I would hold off on buying and if you still have some green on your BTC acct..... Take it before it turns red.

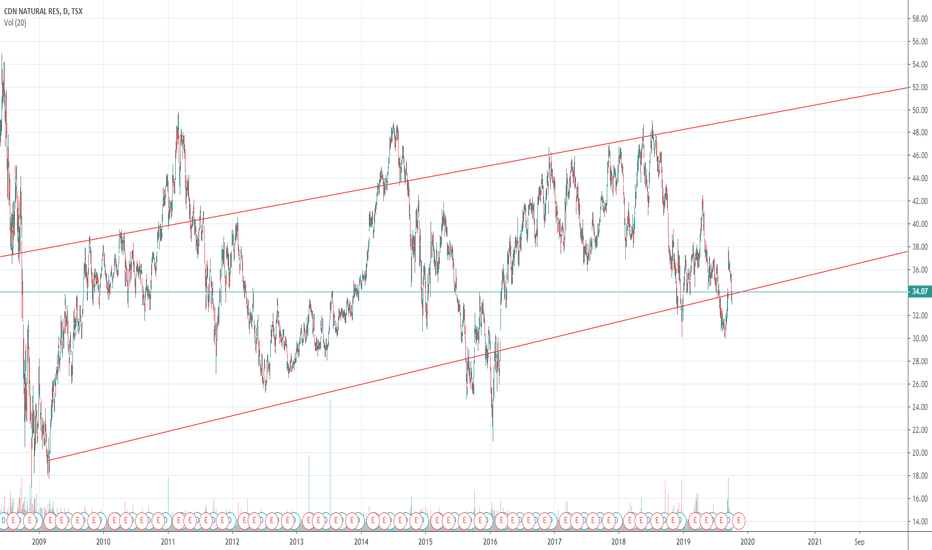

The chart looks like it is staying within its trend. With a weakening dollar this chart could see a huge upside if the oil price creeps up.

So this chart is ugly. Lower highs and lower lows, but we are near the 10 year bottom in its price. I think with the peak dollar gearing up for weakening from Fed rate cuts we could see a higher oil price and alternatively a higher IMO stock. Gearing up to open a position of 1.5% to 3% on oversold days.

The 12 month chart looks bullish for CAD. Couple that with a hawkish BoC and a dovish Fed. We could see it in the next 12 months if the chart holds the pattern.

The 1 year is still semi bullish, but the 3 month shows a turn over. If we see a new lower low get posted in the next few weeks. Then I think it is over. Either way, buy the dips and sell the rips, just hold less of a core position.

Lots of Beta (Elliott) wave specialists stating gold will drop below 1000$ to as low as 700-800/oz. If you look at the historical growth of gold based on low interest rates coming out of late 90s. Gold had a natural incline. The early 2000s crash was followed by a record gold shorts in gold history. If you were to subtract that speculation even and the 2011...

This would be the sexiest stock at the bear right now if it could wear a thong. Nice upside. Higher highs on track with gold and higher lows based on the uptick in gold volume. I would load up on the low end of the range and unload near the top. Rinse and repeat.

The charting is difficult for the fledglings, but all of the same. The volume has dropped off a cliff at a new high. Generally not a good sign. I like the service, but it makes no money.

Love this stock. It trades a 10$ spread regularly. It trades on both gold and oil , but mostly gold . Pays a dividend. More higher lows, we will see if there is higher highs. The volume is consistent. Love the stock. I start selling above 80 and start buying below 70.

I remember when I got a 16mb Voodoo graphics card when I was 10-12. Best card I ever had. Played Diablo 1 and Warcraft 3 for days. Nvidia is a good company, but really their recent growth worth mentioning is crypto. Now that Btc price is picking up, it is no guarantee for Nvidia. Lots of Alt coins were mined last year and a boat load of cards are sitting around...

People keep talking about some gold/silver ratio like its a matter of fact. Silver is an industrial metal. Industrials are growth slowing. Silver is price dropping. if you want an inflation hedge buy oil, if you want a currency hedge buy gold, and if you want dead money buy silver.

I like WPM, but it trades better on an inflationary run more than anything. Silver is the bulk of its streams which should not perform in an industrial slowing environment. This stock is on its high end and I think it is a fish out of water. Buy it later when it pulls back.

What can I say? I hate cryptos, but this one will not go into obscurity. Its on a bull run and will continue to be for a while. my target is 1150-1200. After that, I don't think the same amount of new money will enter it like in 2017-2018. The new car smell is gone, lots of people have been burned, and many from 2017 are sitting at 10-18k hoping to break even and...