With a monthly close around these prices, we'll be breaking the pennant and potentially making a large upmove. What has me cautious is that most indicators are oversold, we could easily reject here and go back to consolidating / retesting the yellow trendline. The MACD has also crossed bearish and we can see the last time this happened we made a move down to...

This is the first time in history leverage has been so easily accessible. Every time the market agrees price is heading down, shorters become fuel for the next leg up. Every other time the RSI has been so oversold the market has dipped, this time you can see the RSI has stayed oversold and remained sideways as the price continues to fly higher. In my opinion, the...

We are currently at the mid-range after spiking up and rejecting back into range. We are likely to see a bounce at the mid-range but if we are to lose this level there is a demand zone that coincides with the 50 day MA that will almost certainly get tapped. The RSI is giving mixed signals here as there is a strong bearish divergence based on the highs but a weaker...

LINK is forming a solid pennant that it's been respecting since September of 2020. I believe the earlier pump was simply deviation, and that the real breakout is still coming. A buy at the current price ($20) is further supported by the Stoch RSI, where each time it's bottomed out has been a great opportunity to buy. Based on the fib retracement from the last pump...

Keeping it simple RSI going through a bullish cross, and making a move up from it's lows. Meanwhile in terms of price action we are about to pass the local high. Everything seems primed for a major move up. If we break and close above the local high we should see a very strong move up.

With multiple patents and permits being acquired recently by FLT there's clearly strong growth from a business standpoint. From a chart / technical standpoint, we seem to be bottoming out from the last drop. We've set a higher low, a positive sign for a bullish case, now the only question is whether a higher high will be printed. On a lower time frame, a break of...

With their security efforts being a long-term play BB will likely consolidate in the $1-$18 region for quite a while. Their partnerships with companies such as Amazon / AWS are quite impressive and show how resilient the company is. Ideally the best long would be at a clean break of $18, especially considering the consolidation range would let this bleed down...

We're currently at the 1.6 extension compared to the last high and low. With such a large point of resistance here will we see a 5 wave elliot pattern? If so we'd retrace to the $1.4-1.6 range.The ideal alternative is we break the $2.30 resistance level and head towards $3.5 with a parabolic move. This will rely heavily on how Bitcoin behaves and if it sets a new...

With Blackberry's shift from phones into other areas such as cloud communications there's a lot more potential for upside. The company has showed resilience but price is still in a dangerous spot, with hype driving up the market we still need to clear the $20-30 range to be sure this is a new bull trend. You can see that moves like this have rejected and gone back...

It's important to keep in mind that Bitcoin moves up so fast because it has an exponential growth rate. Which requires a log chart like the one used here in order to clearly see Bitcoin's growth. Using a log chart allows us to see that it had been forming a bullish pennant for the past few years that it finally broke recently. Based on the last uptrend up to it's...

If we take a fib retracement from the last high to the low during the crash we get these levels. You can see these levels have consistently been major for Bitcoin, or example the 0.5 line has had a lot of price action around it. Now that we broke out we're approaching the 1.6 level at 30k. I'm posting this to show how price isn't just up in thin air, we are right...

Based on ichimoku if price trades above the cloud we should see a strong bull run. In addition to this, the next cloud forming is green which is a positive sign. On the other hand, we are also at a strong fib level of resistance and at the top of the red cloud which are both strong forms of resistance so taking profit here is not a bad option. XRP is known to dump...

If we zoom out we can see that a bullish pennant has formed. Based on the uptrend the target is set at $18,000. This is supported by the bullish MACD cross which can be seen in my previous analysis. Note that this is a long-term price prediction so any short term trades should refer to a lower time frame. If you are a long term holder this year should be very promising.

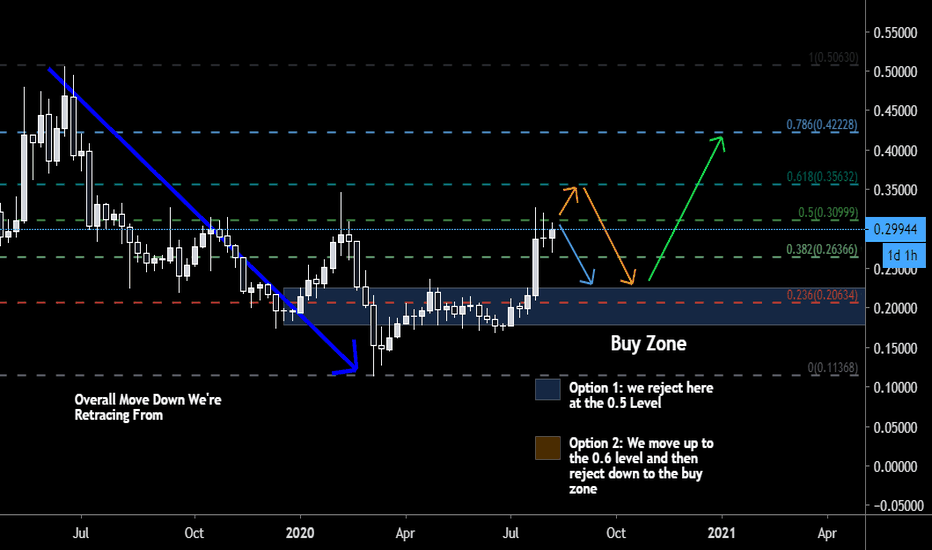

The general market sentiment at the moment is overly bullish which is always dangerous to buy into. XRP is currently at major resistance (0.5 level), due to how strong the bulls are we can smash through this as well but we'd likely reject at the 0.6 level. Both options I expect to retrace back down to the base of the W formation we've made on the weekly chart....

With the chart putting in lower lows and lower highs we can expect to see another lower low form based on the bearish market structure the dollar has been following so far. With the lockdown and economic tensions it looks like the dollar is very weak at the moment. I expect precious metals and crypto to really fly this cycle as the dollar weakens. I'll slowly be...

We haven't even broken the 0.23 retracement level from the ATH to the low. Once we break this level I can start to see a reason for bullish sentiment. Also keep in mind that the MS is still mixed as well, the last low was a lower low. Long term I am bullish for ETH but don't get caught up in the hype and zoom out.

For the past few months buying when price taps the 21 EMA has been consistently profitable (indicated by blue arrows). Ideally you would buy a 200 EMA tap (indicated by the green arrow). This is a simple way to not get caught in the Link fomo, as it is always dangerous to buy a parabolic move as we're seeing now. The red flag indicates when this trend ends as...

Based on a Fibonacci retracement from the ATH to the low, we can see that price has been moving in an uptrend from level to level. We've made a new high and we are now due for a pullback. This aligns with Bitcoin which looks to be due for a pullback as well, which leads me to believe we'll see price hit the 0.382 level. This is outlined by the orange arrows, the...