BNF possibly forming an upward channel. Price approaching 27800-28000 (27940) quite possible in a months time to reach at the top of the channel and cam pivot R4.

SMSLIFE CMP 490 STOP 400 LONG SUGGESTED ABOVE 530 TARGET OPEN LOGIC: WEEKLY CHART - Stock has formed a sort of reverse H&S pattern. Fundamentally EPS has been witnessing triple digit annual growth for the last couple of quarters Date EPS %Chg Sales(Cr) %Chg Sep-18 14.59 +334% 89.2 +75% Jun-18 10.16 +196% 59.9 ...

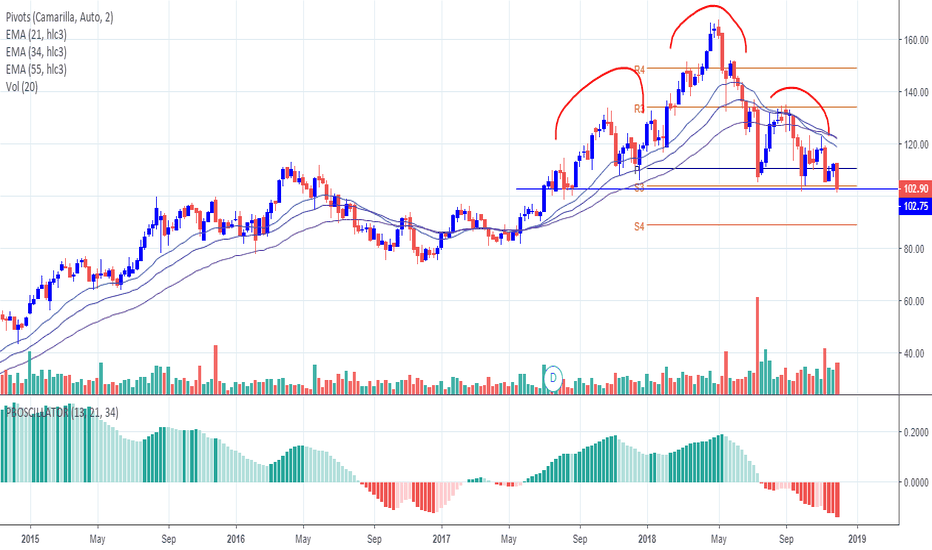

#ASHOKLEYLAND CMP 102.9 Bias - Bearish SUBJECT TO BREAKDOWN OF 100 LEVELS. Weekly chart shows a perfect H & S pattern. Price at the neckline region with higher probability of breakdown. Breakdown of 100 possibly could be disaster for the stock. Pivot based ema oscillator is at a new 2 year low. Next major support seen in the region of 80-82. Camarilla S4 at...

Cmp 2759 Long suggested above 2820 Stop 2570 Target Open Rationale: Weekly : 1) Passes Mark Minnvervini's trend template 2) Price closes above quarterly pivot zone. 3) Pivot based EMA Oscillator (PEMA OSC) color change indicates a possiblity of next leg of upmove. Daily: 1) Next period (monthly pivot) Pivot zone for daily charts is very narrow, suggesting a...

CMP 1969 Long suggested above 2000 Stop at 1900 Target 2200 plus Logic: W pattern formation fuelled by price / pivot oscillator divergence.

Daily charts cmp 169.80 Long advised above 172. High probability of Short term pull back towards mean. (195-200 ) Logic - Strong divergence seen in price Vs pivot based oscillators. Price forming lower lows + pivot based oscillators forming higher lows with volume supporting. DOES NOT SIGNIFY A PERMANENT REVERSAL. ONLY A SHORT TERM TRADING OPPORTUNITY. Stop for...

CMP 484 Long suggested above 495. Stop 420 Target Open Logic: Weekly chart 1) Passes MM trend template. 2) Price currently bounced from value zone and trading just above R4 cam pivots with good volumes. 3) Price has pierced the trend line resistance and has bounced back after making the first test with good volumes. 3) Fundamentally has been clocking triple digit...

BSE listed: Name : Valiant Organics Ltd. Code: 540145 Trading idea: Long suggested above 1185 Stop at 935 Lots 40 (for a capital of Rs 1 lac and a risk appetite of 10%). Technical rationale: Stock has corrected 22% from 52wks high with low volumes and has been in a consolidation phase for the last few days, effectively scaling up by 10%. Stock possibly finding...

BNF CMP 25119 Appears BNF approaching towards the key S3 C-pivot support which is coincidently the previous support zone. Coming weeks could possibly see the zone of 23300-23600 which could act as a strong support.

CMP 57. Long suggested at 64. Stop 54 Head and shoulders pattern. Exponential triple digit growth in YoY quarterly profits last 4 quarters. 650%, 200%,99%,338% FF 633 crores / MCap 1624, RoE 33%. Only concern D/E > 1.

Started trading at 1 around Apr 2013 and went all the way to 1175 in Nov 2013 (1175x) and dropped all the way to around 100 and broke out at around 330 in Oct 2015 and never looked back. Pattern involved in this setup was RdB (Rounding bottom). A similar characteristics is observed now. From around 330 in Oct 2015 to 19900 in dec 2017 (60x) dropped all the way to...

CMP 616 Long suggested around 610-620. Stop 575 Logic: Weekly chart Cup pattern breakout with good volumes. Fundamentals - Exponential growth in EPS and sales observed in the last 4 quarters / D-E 0.3 / Promoter holding 51% / Mkt cap 1970 cr and FF 980 cr.

CMP 287 Long suggested at CMP Stop 270 Target Open Technical logic: 1) Monthly Chart has a #VCP pattern breakout (Current month not complete. Breakout happened on the first day of the month, ie, today). Today's volumes are greater than the entire previous month's volume suggesting that smart money has flown into the stock. 2) Weekly chart has a Cup and Cheat...

CMP 621 Long suggested ONLY ABOVE 650. Stop 590 Target Open Technical logic: 1) Stock has been in a strong uptrend with stock above key MAs. 2) Stock has been consolidating from 52 week highs and during consolidation process has dropped 28% in the first swing, 22% in the second swing and 11% in the third swing indicating a VCP in progress along with volume...

CMP 3232 Long suggested at CMP 3200-3250 Stop 3050 Target Open Logic Weekly chart W pattern breakout with volumes supporting.

CMP 430 Long suggested above 460 ONLY Stop 408 Target Open Logic Weekly chart Cup and Cheat pattern

CMP 4240 Stop 4025 Long suggested above 4320 Target Open Logic Daily chart Volatility Contraction Pattern along with volume contraction seen.

CNX SMALLCAP 7666 Volatility contraction pattern seen. Looking for a move towards 7780. A move above 7800 could be very positive as it would be crossing 200 day MA. Time to go long on small cap scrips that pass the trend template and that exhibit patterns (VCP, Cup & Handle, W, Pole and flag, etc).