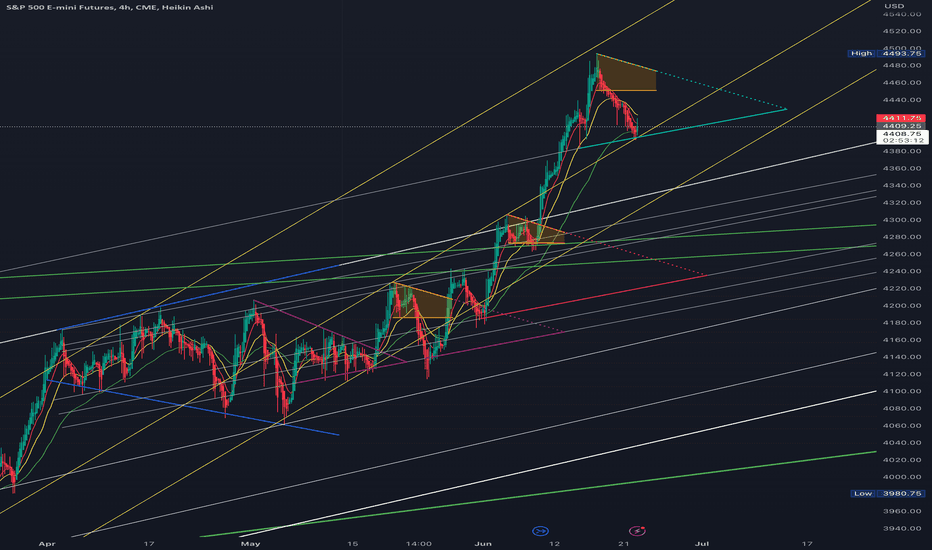

Recap This week saw the continuation of our Technical Analysis 101 principles, with the ES rallying 330 points from its May 24th low and experiencing its first 6-day pullback last week. The pullback stopped at exactly the 4372 level, which had been identified over a week ago. This level was the breakout point of a 6-month rising channel on June 12th. We also saw...

Recap After a five-week rally, the ES saw its first pullback phase last week, with five out of six days in the red. However, the pullback ended at 4372, a multi-month support level. This led to a 30-point rally, highlighting the power of simple channels. Yesterday’s rally was also set up by a clean failed breakdown late yesterday. The Markets Overnight 🌏 Asia:...

Recap Yesterday was another complex session, with the price largely ping-ponging between 4404 resistance and the 4370-80 support zone. The tight range will resolve with a good move, but the direction remains uncertain. The Markets Overnight 🌏 Asia: Mostly up 🌍 Europe: Down slightly 🌎 US Index Futures: Up a bit 🛢 Crude Oil: Down 💵 Dollar: Down 🧐 Yields: Up a...

Recap Last week, ES experienced a red week for the first time in five weeks, beginning a corrective leg. The dip was slow and labored, indicating a possible bull flag pattern. The market remains choppy and complex, with a focus on reacting to real-time trade plans rather than predicting trends. The Markets Overnight 🌏 Asia: Down 🌍 Europe: Near unchanged 🌎 US...

Recap The market continued to follow the pattern of Mon-Wed weakness, Wednesday tight chop, and Thursday/Friday strength. This week, ES had a 30 point rally off the lows of the day, continuing the trend. However, there is still reason for caution as ES had a rare 3 red days in a row. In this newsletter, we will discuss the setup that produced yesterday's rally...

Recap Yesterday was a high complexity session with hours of total chop around the key 4413 level, which acted as a magnet. ES has now put in 3 red days in a row for the first time since May 4th, and we are yet to see if the Thursday rally will bail out ES. The Markets Overnight 🌏 Asia: Down but China closed for holiday 🌍 Europe: Down a lot 🌎 US Index Futures:...

Recap Last week's rally saw a timely exit of my remaining runner long from 4405, concluding a 90+ point long. This week began with highly complex, tactical action, and we got a rare short trigger on the fail of 4450, which played out nicely for a good 30+ points. The Markets Overnight 🌏 Asia: Down 🌍 Europe: Down 🌎 US Index Futures: Down a bit 🛢 Crude Oil: Up...

Recap The past week saw an impressive rally, with a 100-point squeeze on Thursday leading to a 190-point rally throughout the week. This marks the fourth week where the Thursday or Friday rally tendency has been tracked. As expected, Friday was OPEX day, leading to a messy, rangebound chop. The Markets Overnight 🌏 Asia: Down 🌍 Europe: Mixed 🌎 US Index Futures:...

Recap In the past few weeks, traders have witnessed the power of simple technical analysis in cutting through the noise and negativity, leading to account-changing growth. The market has been on a strong rally, with every intraday dip being bought. Yesterday saw another melt-up, and while a pullback is expected soon, the focus remains on reacting level to level...

Recap Yesterday's FOMC session contained the typical trap, but ultimately the dip was bought, continuing the impressive uptrend we've seen in recent weeks. The rally demonstrates the power of simple technical analysis and the importance of holding runners. We have had a massive rally, and it would not be surprising to see ES get some complex rangebound trading,...

Recap Yesterday's CPI report led to a 40-point upside squeeze after an initial flush. The first move was a trap, followed by a flush down to 4380 support, recovery, and then a squeeze up. Since June 1st, ES has been in a "buy all dips phase" with a 140-point increase. However, FOMC day is today, which may bring more complexity and difficulty for traders. The...

Recap The SPX has continued its routine Thursday/Friday rally, with the market rallying 80+ points on Thursday. This trend has been observed for the past 4 weeks, and it is expected that this week may be the last time we see it due to the upcoming CPI and FOMC events. Yesterday was another straightforward trend day, with a classic trend day in play. Today is CPI...

Recap As mentioned in previous newsletters, we have observed a solid day-of-week tendency in ES, with weakness from Monday to Wednesday, followed by Thursday and Friday squeezes. This pattern has held up for 8 of the last 10 weeks, including last Friday. However, last week we expected this to happen, and with both CPI and FOMC, we anticipate one of the most...

Recap Yesterday, we were closely watching the rally in the S&P 500 futures with a target of 4304 from the 4268 support level. The market held strong at 4268 and managed to reach 4303, just shy of our target. Throughout the night, the market has been basing around this level, indicating a potential major breakout point. The Markets Overnight 🌏 Asia: Up 🌍 Europe:...

Recap In the past few days, we have seen a pattern of weakness from Monday to Wednesday and massive strength on Thursday and Friday. This cycle has played out for 7 of the last 9 weeks. If this pattern persists for another week, this week will be the last as next week is both CPI and FOMC, which should be one of the most volatile, complex weeks of 2023 and will...

Recap In yesterday’s trading session, we saw the ES continue its choppy mode after hitting the 4280 target last week. The market has followed a pattern of Thursday/Friday rallies followed by Monday/Tuesday chop for the past three weeks. We had a 20-point rally off the 4267 buy zone and spent much of the day chopping under 4290. With another significant late-week...

Recap In the past few days, we've seen an extraordinary 110-point long and one of the more significant trades of the year. We are now up 120+ points in two days, and the pullback risk is high. Yesterday's action was highly trappy and complex, fitting the description of a post-trend period. We are now in a strong uptrend, which will remain the case for the...

Recap In this week's newsletter, we go over the recent market parabolic squeeze and how a classic failed breakdown setup caused it. With a move of 100 points, this produced one of the best trades of 2023. We also stress the significance of runners in catching these explosive moves and how they lessen FOMO and the need to chase/over-trade. The purple triangle,...