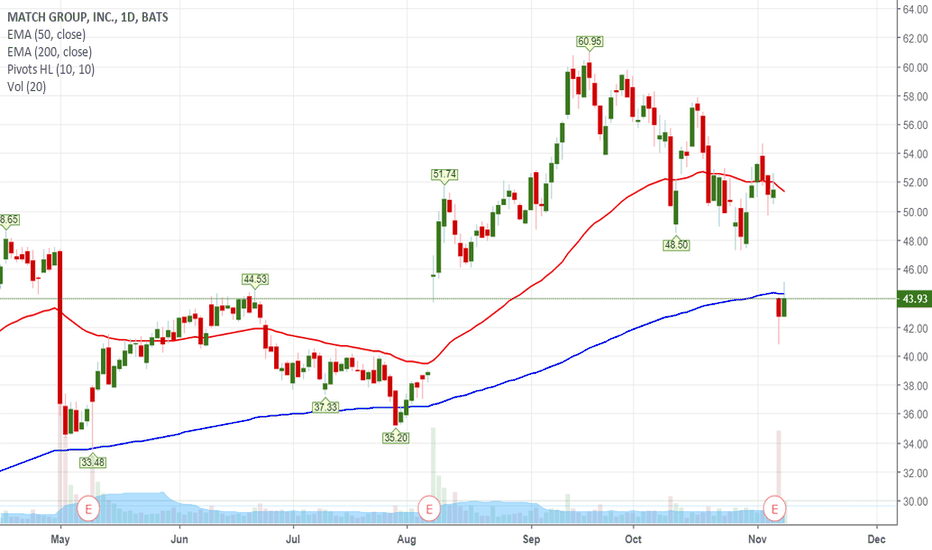

An apology, I was trying out this fibs with recent lows, but look like this longer term fibs have a more validation. Currently bouncing on the 61.8% fib. We might be looking more to a double bottom now. Still lots of resistance in front since we are under the 200 DEMA. 20 DEMA(not in chart) might be a useful guide with the 50% fib.

this should be fun, and im not talking baout the app

AAPL today's move might be an indication of a near term rebound, but also movement depending on general mkts.

So no more position opening for now, at least we break either side of this box, currently holding 78 fib. Currents positions will close themselves if stop. Shorts still open.

It seems like today the bottom of the channel got tested to finish the day above. Tested also 200 DEMA and rebound, so this can be a possible pivot point for IWM. Well see next week.

back into this once a again, seems to be working already, break out. Same thing happening to DIS

had to longed it from this last base, since i got stoped out a base before. right I a good entry point also, dont have any more cash to add to current position left tho haha. hold this. enjoy :cocktail: Past base idea:

Even if this is coming from a big dip, this at least from MA resistances, has a long good way to go. possible strong resistance at around 55. Ride the trend.

rebounding from bottom nice entry point now

I just want to advice vigilant of the current general market levels, since we dont seem to break out past 2 resistance levels, and even if we break we stil facing resistance near this levels. Stil this is a good set up, might do something near term, also got me some.

this possible top pattern in the spx maybe a double top. Not saying it is doing this or that just a possible sign for caution.

might be already an entry, and ready to break out.

not much to say, trend up, rebounding from base, and set to get to that past selling ressitance of 68.36, good volume my get on way to break out, still this candle W candle not to be wasted.