trader9224

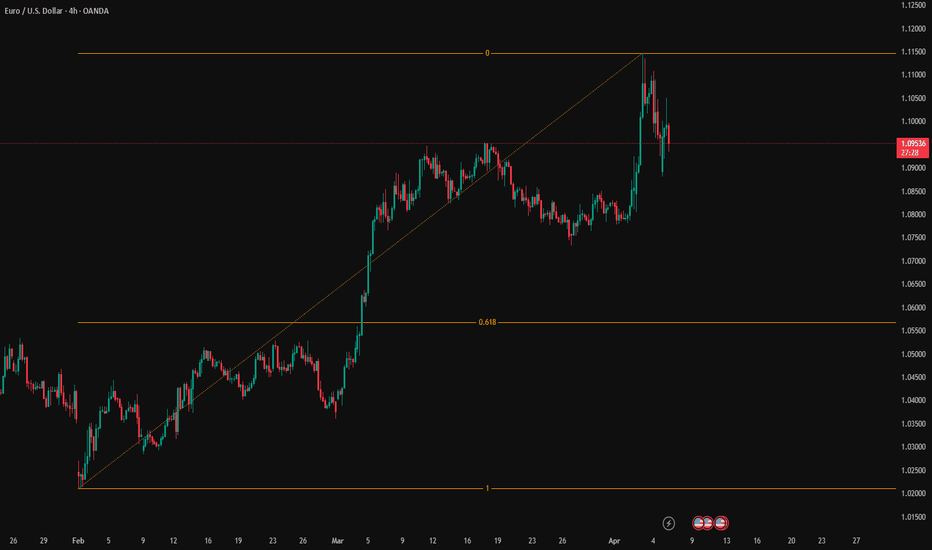

EssentialAs we analyze the EUR/USD pair, the overall market structure appears to be shifting toward a bearish outlook. The recent price action suggests a potential continuation of downward momentum, with various technical signals aligning to support this view. With increasing pressure on the upside, it seems that sellers may start to dominate in the near term. Key factors...

Potential bearish setup forming on 6B. Price showing signs of weakness, with key resistance levels in play. Watching for further confirmation and potential downside movement. Keep an eye on momentum and structure for entry triggers. Risk management is crucial.

looking for USDJPY to retest the daily open / intraday highs from this solid - low time frame - support level

The USDCAD pair is currently exhibiting bearish pressure, with the price hold key resistance levels, signaling a potential move lower

looking for USDCAD to fall away from intraday resistance

Long position from earlier in the day got hit for a stop loss. Risking the other way for a possible reversal in this market

Third time's the charm on USDCHF. Looking to take one final entry this week in USDCHF and ride it to my "target 2"

Bullish USDJPY in the gap down. Looking at a retest and/or breakout of recent swing highs as targets

The USDCHF is still showing strong bullish momentum. Price action has been respecting HTF support levels and we've seen a recent breakout above resistance, signaling a potential continuation.

The USDCHF is currently showing strong bullish momentum on the 1-hour chart. Price action has been respecting the key support level, and we've seen a recent breakout above the resistance zone, signaling a potential continuation to the upside.

The AUDUSD pair is showing strong signs of bullish momentum as we anticipate further upside potential. With an overall positive outlook on the Australian Dollar and supportive technical indicators, this pair is poised for a potential rally. Watch for favorable market conditions that could drive the price higher in the coming sessions.

As the DXY faces resistance and shows signs of weakening, EURUSD may find support and start to push higher. Watch for a breakout above recent highs for confirmation and keep an eye on momentum and price action for the next key moves

"The current price action suggests a bearish scenario for usdjpy. After a period of consolidation price seems to be setting up for a downward move with key indicators indicating a possible trend reversal."

Following up on the previous trade idea , where we anticipated DXY breaking to new lows. We can now observe that the uptrend line has been broken, and a potential downtrend line is starting to form.

The AUDUSD pair is showing strong signs of bullish momentum as we anticipate further upside potential. With an overall positive outlook on the Australian Dollar and supportive technical indicators, this pair is poised for a potential rally. Watch for favorable market conditions that could drive the price higher in the coming sessions.

The AUDUSD pair is showing strong signs of bullish momentum as we anticipate further upside potential. With an overall positive outlook on the Australian Dollar and supportive technical indicators, this pair is poised for a potential rally. Watch for favorable market conditions that could drive the price higher in the coming sessions.

"The current price action suggests a bearish scenario for usdjpy. After a period of consolidation price seems to be setting up for a downward move with key indicators indicating a possible trend reversal."

Over the weekend, the market closed following a 1H bullish trendline break. However, it appears the market is holding resistance on the intraday timeframes. If bearish momentum persists, the daily ATR suggests a potential test of the hourly swing lows around 103.3, assuming the bearish bias continues.