Silver and the search for evidence of the end of the largest decline in the time range. We expected not to break the support point 18.120, and the reversal will rise and the correction in wave 2 will end

wheat The completion of wave (C) of the irregular flat wave, and we expected this to depend on trading remaining above the support point 742.50, and we expected a rise to prices higher than 820.25 to achieve the condition of the irregular wave.

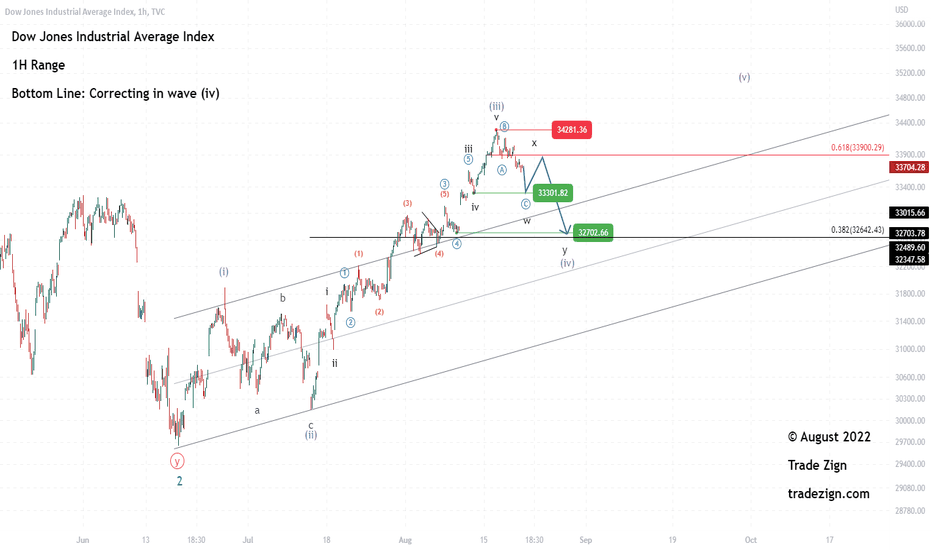

Dow Jones Industrial Average The index we expected to decline in the near term, targeting 38% of the length of the third wave. The drop we expected, as prices are trading at the lowest point of resistance of prices 34281.36, and we expected it to target prices 33301.82 and prices 32702.66 before rising again.

Cardano / dollar The completion of the triangle (X) wave and the last leg will end at the level of 61%, which is the price of 0.5125, and then decline again to achieve a lower bottom, the resistance point is expected not too broken at 0.5918 we expect the support point to broken at 0.4019 it may continue to fall to Prices 1.618% Prices 0.1970

Australian dollar / Japanese yen Completion of the triangle B wave and currently the correction in the last leg of a contracting triangle. is expected that prices will fall and the resistance point 95.148 is expected not to be broken and the continuation of the decline to the level of 93.064 and also to the level of 92.285, but until the triangle scenario is...

Copper futures. The rise of the metal depends on the 3.1315 support point to achieve the bullish movement, and we expect the metal to rise in the near term and also in the long term, it may rise from the current prices and the second wave has ended or the decline continues to the 61% level at prices of 3.3440 and the second wave ends there

SPDR Select Sector Fund 1H Range Further rise is expected in the XLE Energy Sector Index, targeting the third wave. Since prices are above the support point of 70.59, we expect a rise in the near term and also in the long term, and the main support point is at prices of 65.48

The rise of the bitcoin currency depends at the moment on the support point of 22676.61 the event that the support point is breached, we will turn to the second support point at the price of 20709.26, and this is the critical point in the event of breaking it, the rise will end and change to landing

Platinum; We expect a rise in wave (3) over The time term. The Rise depends on the first support point 565.43 The correction may have ended in wave (2) at the second support point 835.50 Therefore, the Rise depends on trading above the support point of 835.50

XLE ENERGY ETFS Look for evidence of wave termination ((2). Therefore, the current correction of the energy sector index may continue a little before it resumes and rises again, as support point 70.59 supports the rise in the near term will in the Long Term. Therefore, if trading remains above the support point of 65.48, we may see more rise.

expecting a correction near 0.915 to complete wave e of (X), key levels to note (1.00643 - 0.87579).

expecting a sharply reversal in wave (iii) of ((iii)), critical level at 15266

downside focus remains, expecting one more low to complete wave C of (Y) of ((C)) of IV.

expecting this bounce to be wave (B) of ((Y)) of b, critical level at 26.215.

expecting more upside near 1850 to complete wave (5) of ((3)), key level at 1576.6

upside focus remains, expecting more upside to 125.83 to complete wave 3.

upside focus remains in wave ((iii)), critical support at 941.50

expecting more upside near 9.40 to complete wave 5 of (5) of ((1)).