Market analysis from Alice Blue

Bank Nifty ended the week at 56,528.90, registering a marginal gain of +0.44%. 🔹 Key Levels for the Upcoming Week 📌 Price Action Pivot Zone: The critical zone to monitor for potential trend reversals or continuation lies between 56,411 and 56,648. 🔻 Support Levels: Support 1 (S1): 56,055 Support 2 (S2): 55,582 Support 3 (S3): 55,086 🔺 Resistance Levels:...

The Nifty 50 ended the week at 24,837.00, registering a decline of -0.53%. 🔹 Key Levels for the Upcoming Week 📌 Price Action Pivot Zone: 24,759 to 24,916 – This range is crucial for identifying potential trend continuation or reversal. A move outside this zone could set the directional tone for the coming sessions. 🔻 Support Levels: Support 1 (S1):...

Bank Nifty ended the week at 56,283.00, registering a marginal decline of -0.83%. 🔹 Key Levels for the Upcoming Week 📌 Price Action Pivot Zone: The critical zone to monitor for potential trend reversals or continuation lies between 56,165 and 56,402. 🔻 Support Levels: Support 1 (S1): 55,811 Support 2 (S2): 55,338 Support 3 (S3): 54,859 🔺 Resistance Levels:...

The Nifty 50 ended the week at 25,149.85, posting a loss of -1.22%. 🔹 Key Levels for the Upcoming Week 📌 Price Action Pivot Zone: 24,889 to 25,048 – This is a crucial range to monitor for potential trend reversals or continuation. A breakout or breakdown from this zone can set the tone for the week. 🔻 Support Levels: S1: 24,654 S2: 24,340 S3: 24,040 🔺...

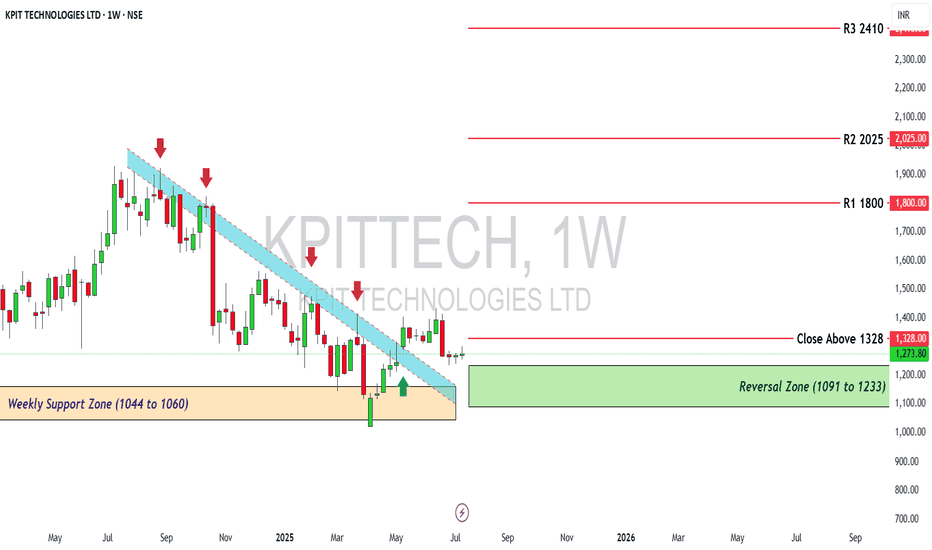

📊 Technical Chart Insights The stock was in a strong downtrend but has now broken above the descending trendline, which is a positive signal. It has shown a strong reversal from the weekly support zone between ₹1,044 and ₹1,060. A clear reversal zone is visible between ₹1,091 and ₹1,233 — this is a good accumulation or buy zone for long-term investors. The stock...

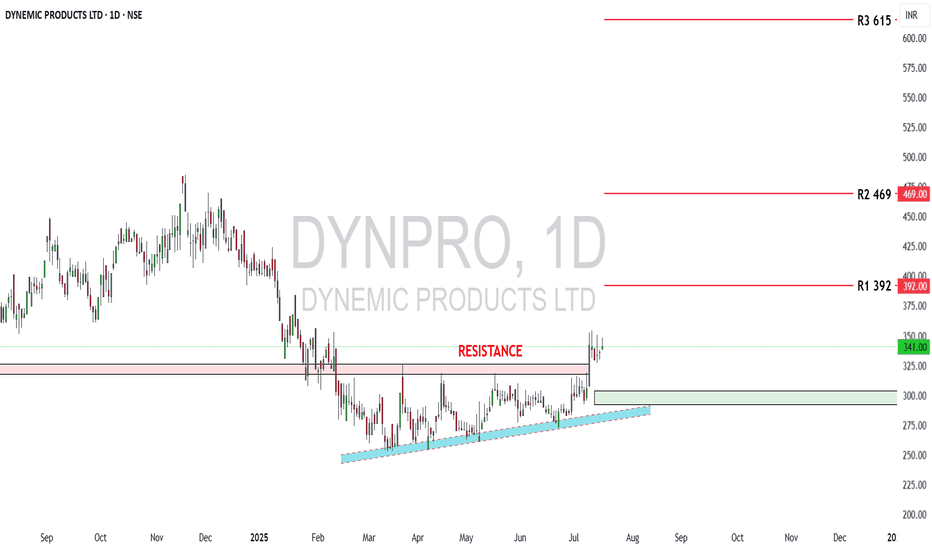

Dynemic Products Ltd (NSE: DYNPRO) is a well-established exporter and manufacturer of synthetic food-grade dyes, lake colors, and D&C colors, catering to global markets. As of July 16, 2025, the stock trades at ₹341 and has recently broken out of a prolonged consolidation zone, indicating renewed investor interest. From a fundamental perspective, the company’s...

The Nifty 50 ended the week at 25,112.40 with a gain of 1.59% If Nifty sustains below 25,033, selling pressure may increase. However, a move above 25,192 could restore bullish momentum. Key Levels for the Upcoming Week 🔹 Price Action Pivot Zone: The crucial range to watch for potential trend reversals or continuation is 25,033 -25,192. 🔹 Support & Resistance...

Bank Nifty ended the week at 56,252.85 with a gain of 1.31% Key Levels for the Upcoming Week 🔹 Price Action Pivot Zone: The critical range to monitor for potential trend reversals or continuation is 56,135 to 56,372 🔹 Support & Resistance Levels: Support Levels: S1: 55,781 S2: 55,308 S3: 54,726 Resistance Levels: R1: 56,729 R2: 57,206 R3: 57,786 Market...

Indus Towers Ltd is India’s largest telecom tower infrastructure company, operating over 220,000 towers and enabling more than 340,000 colocations across all 22 telecom circles. Backed by Bharti Airtel (holding ~50%), the company offers long-term revenue visibility, steady cash flows, and a crucial position in India’s telecom value chain—especially as the country...

Bank Nifty ended the week at 55,527.35 with a loss of -1.86% Key Levels for the Upcoming Week 🔹 Price Action Pivot Zone: The critical range to monitor for potential trend reversals or continuation is 55,410 to 55,645 🔹 Support & Resistance Levels: Support Levels: S1: 55,058 S2: 54,588 S3: 54,119 Resistance Levels: R1: 56,000 R2: 56,474 R3: 56,947 Market...

The Nifty 50 ended the week at 24,718.60 with a rejection of (-1.14%) If Nifty sustains below 24,641, selling pressure may increase. However, a move above 24,798 could restore bullish momentum. Key Levels for the Upcoming Week 🔹 Price Action Pivot Zone: The crucial range to watch for potential trend reversals or continuation is 24,641 -24,798. 🔹 Support &...

Royal Orchid Hotels Ltd (ROHLTD) has caught the market’s attention recently with a powerful breakout move on the charts, supported by strong fundamentals. The company operates a growing chain of hotels across India under the Royal Orchid and Regenta brands. With domestic tourism booming and business travel recovering steadily, the company is well-positioned to...

Bank Nifty ended the week at 56,578.40 with a gain of 1.49% Key Levels for the Upcoming Week 🔹 Price Action Pivot Zone: The critical range to monitor for potential trend reversals or continuation is 56,706 to 56,469 🔹 Support & Resistance Levels: Support Levels: S1: 56,113 S2: 55,639 S3: 55,053 Resistance Levels: R1: 57,065 R2: 57,543 R3:...

The Nifty 50 ended the week at 25,003.30 with a gain of (1.02%) If Nifty sustains below 24,924, selling pressure may increase. However, a move above 25,283 could restore bullish momentum. Key Levels for the Upcoming Week 🔹 Price Action Pivot Zone: The crucial range to watch for potential trend reversals or continuation is 24,924 -25,083. 🔹 Support & Resistance...

Market Cap: ₹7,794 Cr Sector: Metals & Mining – Manganese & Iron Ore Sandur Manganese & Iron Ores Ltd (SMIORE) is a vertically integrated mining company engaged in manganese and iron ore production. With operations rooted in Karnataka and a legacy since 1954, the company continues to benefit from commodity demand and disciplined capital management. 🔍...

Cummins India Limited, a subsidiary of Cummins Inc. (USA), is a dominant player in the Indian power solutions market. It operates across three core segments: Power Systems (generators, alternators), Industrial Engines (used in construction, mining, and marine applications), and Distribution (aftermarket services). The company benefits directly from India's...

Weekly Recap: Bank Nifty opened last week with a gap-down at 49,336.10, plunging 2,166.6 points or -4.21%. However, it recovered over the course of the week and eventually settled at 51,002.35, registering a modest weekly decline of -0.97%. Key Weekly Levels for Next Week Price Action Pivot Zone: The crucial range to watch for potential reversals or trend...

Weekly Recap: Last week, Nifty opened with a gap-down at 21,758.40, dropping 1,146.05 points or 5%. However, it witnessed a recovery during the week and eventually closed at 22,828.55, marking a marginal decline of 0.33% from the previous week's close. Key Weekly Levels for Next Week Price Action Pivot Zone: The crucial zone to watch for any potential...