Market analysis from ActivTrades

By Ion Jauregui –ActivTrades Analyst The EUR/USD is at a time of high expectation, with key European Central Bank (ECB) appearances and the release of quarterly U.S. Gross Domestic Product (GDP) promising to generate significant moves in the financial markets. Today, all eyes are on Christine Lagarde and Luis de Guindos, president and vice-president of the ECB,...

By Ion Jauregui - ActivTrades Analyst In a surprising turn of events for the stock market, so far in 2025 we see how retail investors have taken center stage, betting heavily on “ buy the dip” as large investors reduce their positions. According to data from VandaTrack, these small investors have injected nearly $70 billion into U.S. stocks and ETFs. This...

By Ion Jauregui - ActivTrades Analyst The copper market is going through a decisive phase, influenced by political and economic factors that could alter its behavior in the coming months. The return of Donald Trump to the U.S. presidency and his reactivation of tariff policies has generated expectations of a new record in the price of the red metal since the...

By Ion Jauregui - ActivTrades Analyst Santander, the second largest listed company on the IBEX 35, is on the verge of reaching a new milestone: regaining €100 billion in market capitalization. This figure, not seen since 2015, marks a turning point in the trajectory of the bank, which consolidates its position as the largest in the euro zone, surpassing BNP...

By Ion Jauregui - ActivTrades Analyst The IBEX 35 is at an interesting juncture. Despite the fact that the average of its stocks is trading at just 40% of its historical highs, the national index is 17% away from its 2007 high, having reached a resistance at 13,466 points (19.69% since 2007) on Tuesday, March 3. This data shows a significant gap between the...

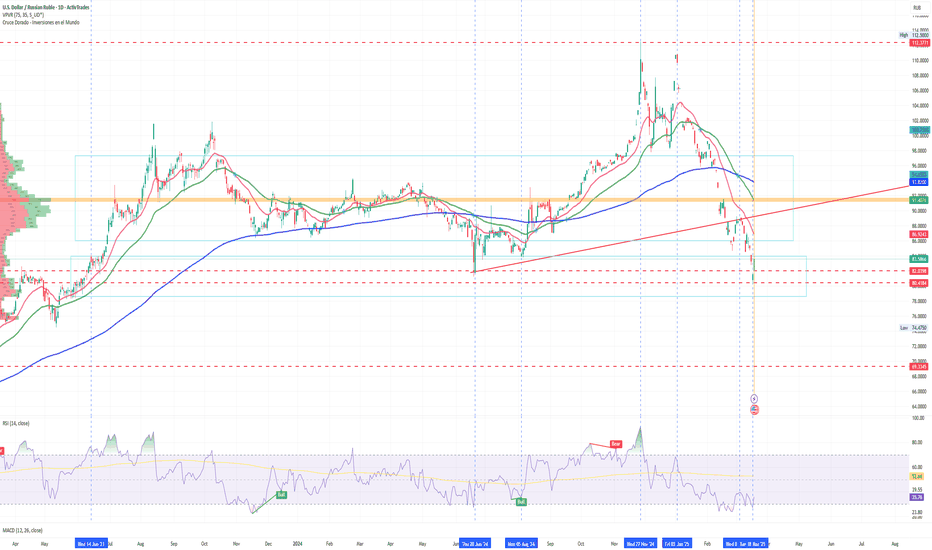

The outlook for the currency market has been radically transformed. After a period in which the ruble hit record lows, today marks the start of a bullish rebound. The dollar's loss of value has allowed the ruble to strengthen significantly, while attention is focused on the appearance of Christine Lagarde, president of the European Central Bank (ECB). Lagarde's...

By Ion Jauregui, ActivTrades Analyst The Russell 2000 small cap index has experienced a marked deterioration in positioning, with a significant increase in short positions over the past week. Investor confidence in small caps has weakened markedly, in contrast to the S&P 500, whose positioning has returned to neutral after the sharp pullback from January's bullish...

By Ion Jauregui –ActivTrades Analyst International Airlines Group (IAG), which includes airlines such as British Airways, Iberia and Vueling, has reiterated its interest in acquiring a majority stake in TAP Air Portugal. The move follows the abandonment of plans to acquire Air Europa due to regulatory obstacles, underlining the strategic importance of TAP to...

The Hang Seng Index, a key barometer of Hong Kong's economy, is currently hovering around 24,130 points. However, a number of fundamental, technical and policy factors suggest the possibility of a rebound towards 26,253 points. This analysis explores the main reasons for this possible recovery, integrating recent market information and the Chinese government's...

By Ion Jauregui - ActivTrades Analyst The “strategic review” announced by CEO Marc Murtra focuses on the Hispanic American market, a sector that has shown negative results for years. In 2024, business in countries such as Argentina, Colombia, Chile, Peru and Mexico generated 'red numbers' that reached 2,432 million euros, as gains in Ecuador, Venezuela and...

By Ion Jauregui - Analyst ActivTrades The U.S. economy faces growing signs of recession, driven by uncertainty surrounding the Donald Trump administration's economic policies and global challenges. With clear signs of an economic slowdown in the U.S., gold is emerging as the asset of choice for those seeking to safeguard their wealth. With the environment marked...

By Ion Jauregui, Analyst ActivTrades The S&P500 index has surprised everyone by rebounding after a historic day of declines. The volatility experienced last Monday, driven by uncertainty over new tariff measures, has begun to subside, giving a glimpse of a possible equilibrium in the US markets. Yesterday was a real hell for investors. Fears were triggered by the...

By Ion Jauregui - Analyst ActivTrades The EURUSD pair remains one of the key indicators in the currency markets, reflecting investors' perception of the relative strength of the euro against the dollar. The upcoming Ecofin and Eurogroup meeting will be closely watched. Any hints about the eurozone economic outlook that emerge at these meetings can generate...

The same man who set pharmaceuticals dancing is now turning his attention to the food industry. Robert F. Kennedy Jr, head of the U.S. Department of Health, will meet today with top executives from General Mills (Ticker AT:GIS.US) and PepsiCo (Ticker AT:PEP.US), according to Politico. Pushed by the White House, this meeting aims to discuss the elimination of...

By Ion Jauregui - ActivTrades Analyst The EUR/USD is at a point of high volatility this Friday, marked by the release of the US jobs report and the speech of Christine Lagarde, president of the European Central Bank (ECB). These key factors will influence investors' decisions and the direction of the currency market. U.S. Employment Data: Impact on the Dollar ...

By Ion Jauregui – ActivTrades Analyst The payments landscape in Europe could change dramatically if the project for a payments platform independent of Visa and Mastercard takes hold. The interconnection between Bizum and Wero, with the backing of the European Central Bank (ECB), paves the way for a sovereign alternative that could displace the US giants. But how...

The National People's Congress opens this week as one of the most eagerly awaited events, with the market on tenterhooks over the possibility of stimulus measures to boost economic recovery. During this meeting, Chinese leaders will discuss measures aimed at strengthening growth, controlling deflation and providing crucial support to the real estate sector. As...

By Ion Jauregui - ActivTrades Analyst Microsoft continues to consolidate its presence in Aragon with the investment of 2.9 billion euros in a new data center in Zaragoza, reinforcing its commitment to growth in the region. This center is in addition to other projects that Microsoft has previously announced, totaling nearly 10,000 million euros in investments in...