Market analysis from BlackBull Markets

USD/INR surged from 86.30 to nearly 87.85 in just over a week, driven by U.S. President Donald Trump announcing plans to impose a 25% tariff on select Indian exports. The latest 4H candles show signs of exhaustion, with price stalling near the highs and forming small-bodied candles with upper wicks—suggesting weakening bullish momentum. A break below 87.45...

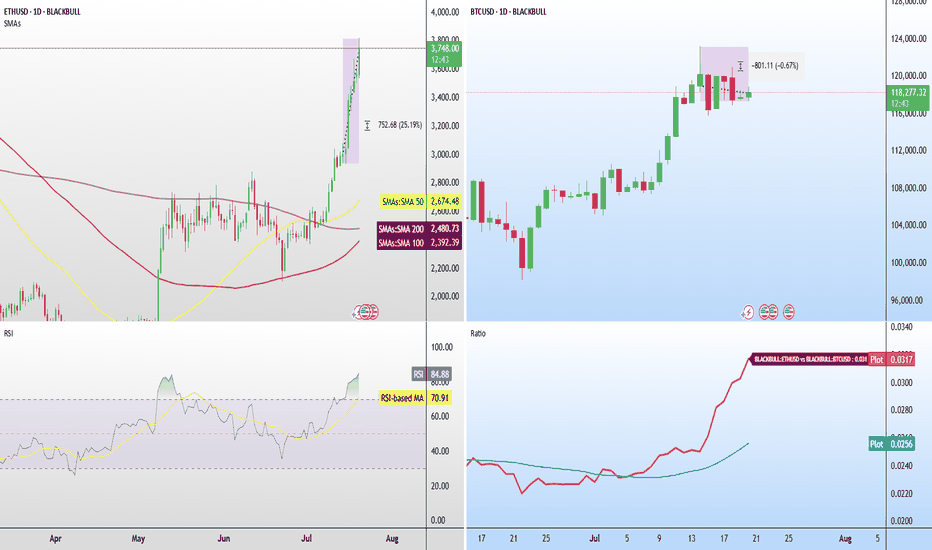

Bitcoin has dipped below $118,000, putting pressure on the bullish structure that’s held for the past two weeks. The attempted breakout above $121,000 has failed, and price is now breaking down through the middle of the consolidation range, threatening short-term higher lows. On the 4H chart, this move resembles a failed breakout with a potential double-top...

The Fed isn’t expected to cut rates this week, but this FOMC meeting should still be very interesting. Powell will need to address growing pressure from board members Waller and Bowman, who’ve both called for cuts, citing limited inflation impact from tariffs. Still, Powell is just one of 12 votes on the FOMC, and there’s little sign of broader support for a...

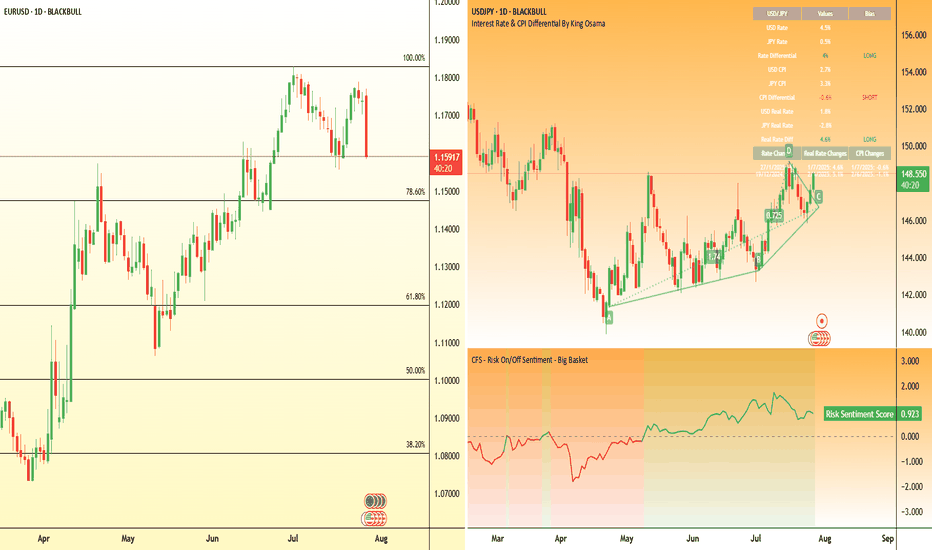

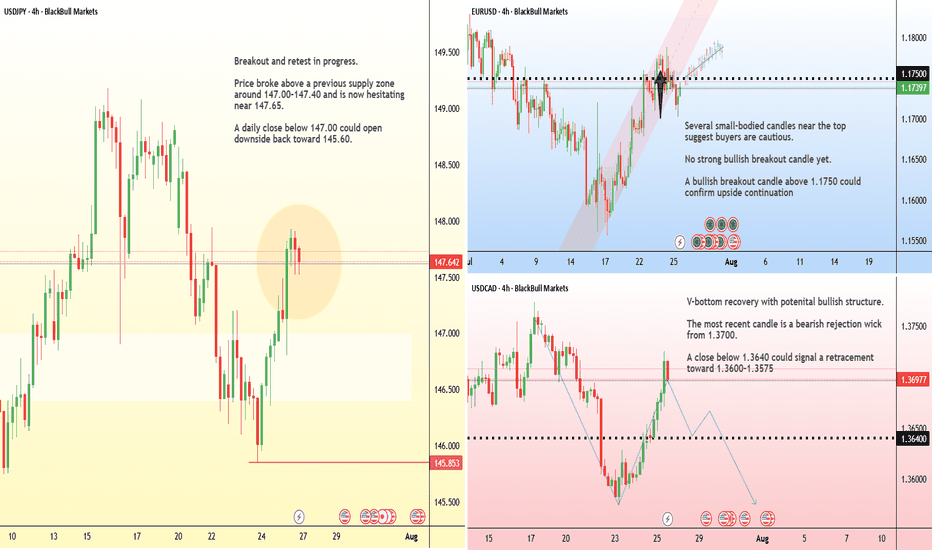

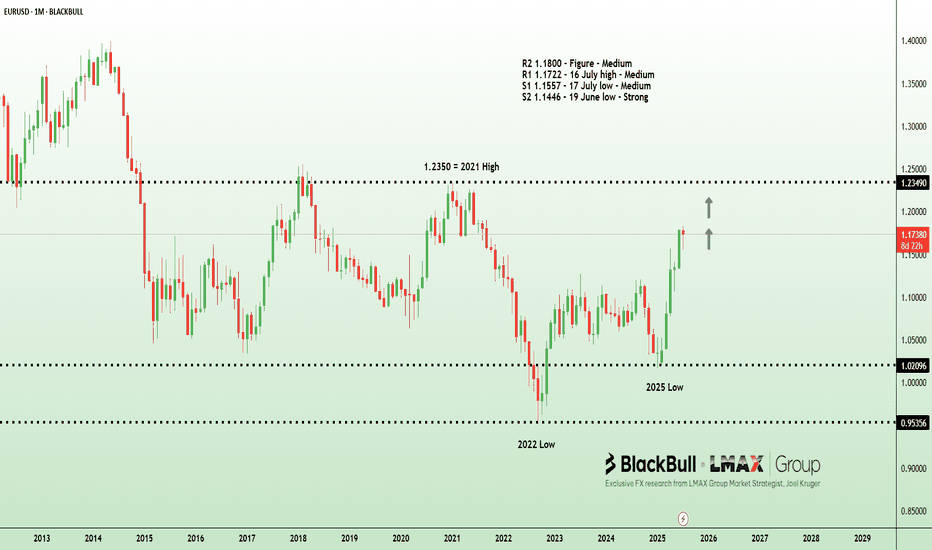

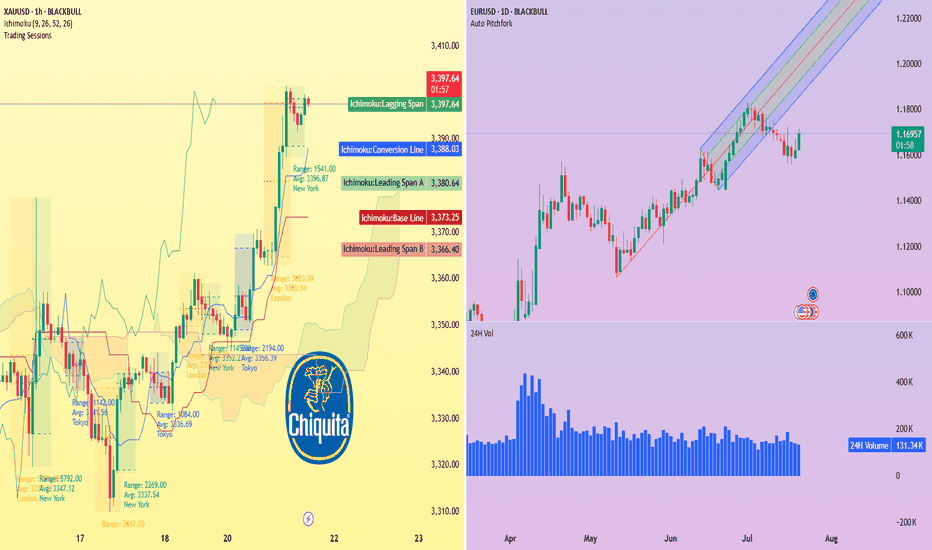

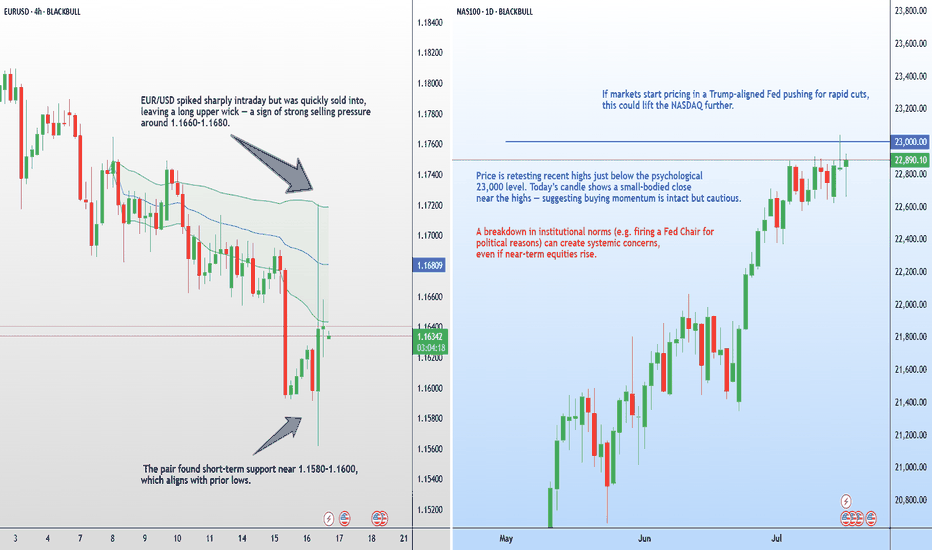

The euro surged in early Asian trade following the US–EU trade agreement announced over the weekend, but has since faced consistent selling pressure, eventually triggering stop-loss orders below 1.17, reflecting a classic buy-the-rumour, sell-the-fact market reaction. The deal imposes 15% tariffs on most EU exports to the US, down from 25% for automobiles, while...

Federal Reserve Chair Jerome Powell is under mounting pressure from President Donald Trump to begin cutting interest rates. Markets and analysts overwhelmingly expect the Fed to hold rates steady this Wednesday. But what if the political heat is becoming too much to bear, and Powell and the Fed board advocate for a cut this week? Some Fed governors, Chris...

The tariff truce between the U.S. and several major trading partners is set to expire on August 1 . A deal with Japan has already been reached, but talks with the EU, Canada, and Mexico remain active. In monetary policy, the Federal Reserve is widely expected to hold rates steady at 4.5% during its midweek meeting . Across the border, the Bank of...

The US dollar is trading mixed after President Trump made a rare appearance at the Federal Reserve’s renovation site, in an attempt to distract from you know what. While the visit had no formal policy announcements, Trump did try to further undermine Chair Jerome Powell by erroneously claiming the renovation cost had blown out to 3.1 billion by adding the cost...

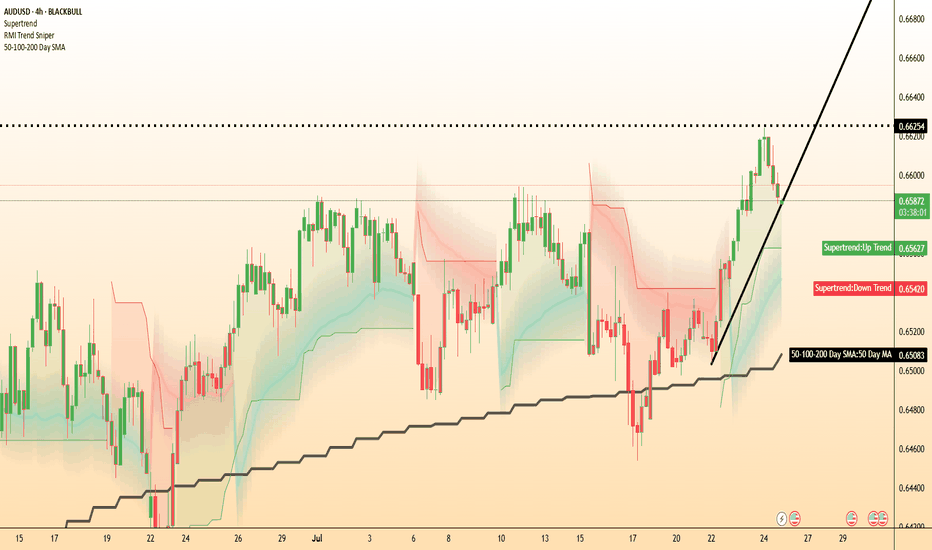

The New Zealand dollar strengthened to around 0.6045, its highest level in over a week, supported by improved global risk sentiment following a breakthrough U.S.–Japan trade agreement. The agreement, which lowers tariffs and boosts bilateral investment, triggered a surge in Japanese markets. Japan’s Nikkei 225 index jumped more than 3%, hitting a one-year high....

The dollar extended its slide on Tuesday, weighed down by soft US regional data and renewed political pressure on the Fed, reinforcing the market's dovish bias. The Richmond Fed manufacturing index plunged to -20, far below expectations, while business conditions and the Philly Fed survey showed slight improvements but remained in contractionary...

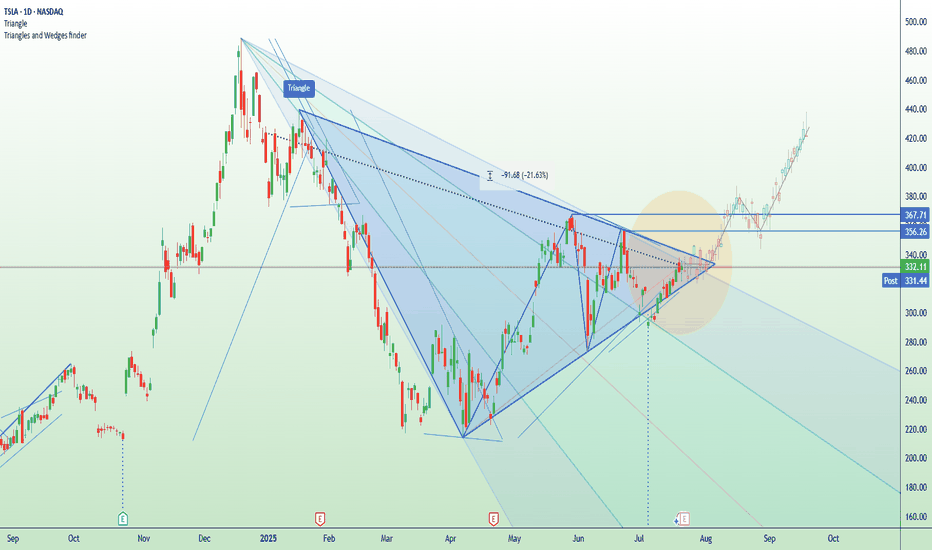

Tesla is set to report Q2 earnings after the closing bell on Wednesday, covering the quarter ending June 2025. The stock has been highly volatile this year, amid concerns about tariffs, Elon Musk’s politics (and nazi salutes), and his public clashes with President Donald Trump. Tesla bulls Wedbush think, “We are at a 'positive crossroads' in the Tesla...

The US dollar got off to a soft start to the week, though thinner summer trading conditions have restrained activity across G10 and emerging markets. The Japanese yen stole the spotlight in G10 after the Ishiba coalition lost its upper house majority, fueling speculation about potential Bank of Japan policy normalization and political instability, which likely...

Traders now price in a 60% chance of a Fed rate cut in September, as political pressure on the central bank intensifies. Republican Rep. Anna Paulina Luna has officially accused Fed Chair Powell of perjury, while Treasury Secretary Scott Bessent has called for a full inquiry into the institution. Earlier this month, former Fed Chair Janet Yellen told The New...

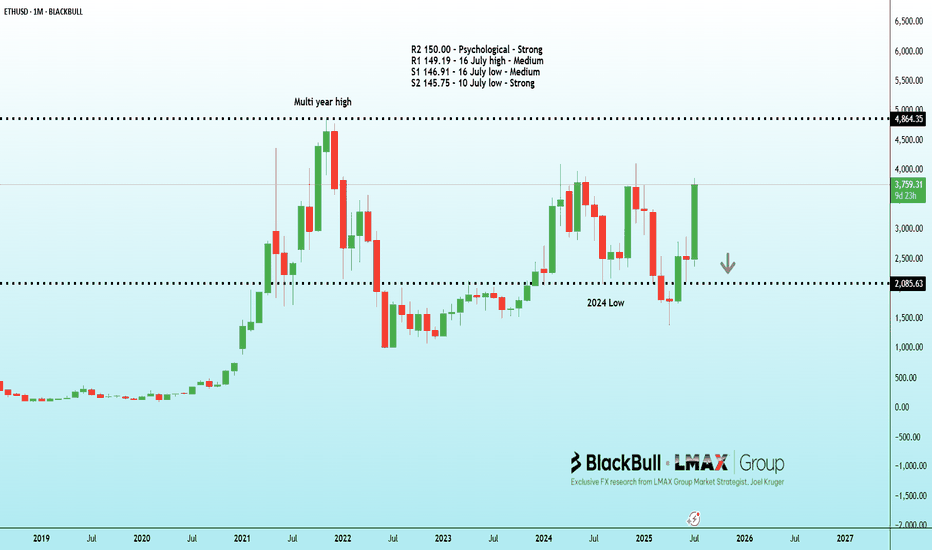

Ethereum is firmly in breakout mode. The ETH/BTC ratio , a closely watched measure of altcoin strength, has surged close to a year-to-date high. ETH has now gained over 25% in the past week, fueled by institutional flows into ETH ETFs and tech investor Peter Thiel reportedly taking a major stake in BitMine. RSI is at 84.82 , showing extremely strong...

JPMorgan and Goldman Sachs have both raised their concern about political interference at the Federal Reserve, amid reports that President Trump considered firing Fed Chair Jerome Powell earlier this week. In a note titled “How Safe is Powell’s Job?”, JPMorgan analysts warned that even the perception of a politically motivated dismissal could undermine the Fed’s...

In the U.S., inflation accelerated for a second straight month, with headline CPI reaching 2.7% year-on-year in June as President Trump’s tariffs begin to push up the cost of a range of goods. Increasing inflation could likely heighten the Federal Reserve’s reluctance to cut its interest rate, in defiance of Trump’s public demand. This could provide upward...

A sudden exit by Fed Chair Jerome Powell would create both a political and monetary shock. While the Chair is technically protected from arbitrary removal. Recent reports confirm that President Trump and his allies are scrutinising the Fed’s $2.5 billion renovation project—potentially laying the groundwork for a “for cause” dismissal. A surprise departure...

The Japanese yen remains vulnerable ahead of Japan’s Upper House election on July 20. Polls suggest the ruling LDP-Komeito coalition may lose its Upper House majority. Such an outcome would further weaken Prime Minister Shigeru Ishiba’s position, with his government already operating as a minority in the Lower House. Adding to the pressure, the U.S. is set to...

The Brazilian real weakened sharply against the U.S. dollar after US President Trump announced 50% tariffs on Brazilian exports, effective 1 August. In response, Brazilian President Luiz Inacio Lula da Silva announced Brazil would retaliate with the same rate on U.S. imports. Trump has already pledged to retaliate if Brazil retaliates. USD/BRL rallied from...