Market analysis from BlackBull Markets

A round of discouraging survey data out of the US on Tuesday has fueled more selling of the US dollar as the market prices in increased odds for recession. Philly Fed services and consumer confidence polls plunged to post-pandemic lows, while consumer expectations faltered on worry over personal finances. US equities, on the other hand, remained in demand—perhaps...

President Trump will announce new tariffs on auto imports during a press conference in the Oval Office at 4 p.m. ET, according to White House press secretary Karoline Leavitt. The headlines have weighed heavily on EUR/USD, pushing the pair to multi-week lows (now below 1.0750). However, it is hard to find sources that indicate that the tariffs announced today...

Israel is sending a delegation to Washington for strategic talks on Iran, while Trump has reportedly given Tehran a two-month deadline for a nuclear deal—so far, Iran isn’t engaging. So, the question is: Are we headed towards military conflict or a significant wave of sanctions? Meanwhile, protests erupted after Erdoğan’s main rival was arrested, triggering...

As expected, Powell reiterated that the Fed is in no rush to adjust rates, and the labour market is stable. He also reaffirmed the Fed’s reliance on hard data over sentiment and the approach of slowing balance sheet reduction. What’s different this time: Inflation & tariffs: Powell acknowledged that recent inflation upticks may be tariff-driven, delaying...

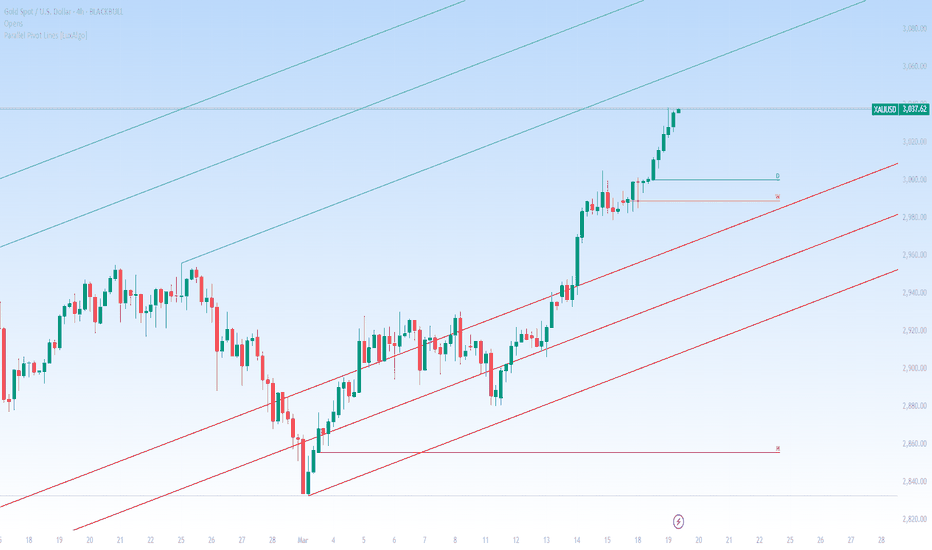

Gold is now up 15.57% in 2025 after gaining 27.2% in 2024. If the current momentum continues, traders may target the upper parallel trendline near $3,060 and rising. Safe-haven demand is a key driver of this rally, but what could disrupt it? For one, U.S. President Donald Trump and Russian President Vladimir Putin spoke for 90 minutes today, agreeing on...

Gold remains in high demand as a safe-haven asset, currently trading at $2,998.7 per ounce. Why the need for a haven? Here’s an update: A ceasefire in Ukraine hinges on some unpalatable conditions. Donald Trump has announced plans to speak with Vladimir Putin on Tuesday, saying that land and power plants are part of the negotiations. Reports suggest his...

We've seen an extension of US dollar weakness in recent sessions, partially on the back of deteriorating consumer sentiment in the US and perhaps partially due to the risk-on reaction to the US avoiding a government shutdown. Elsewhere, it finally looks like the Greens have backed up Germany's massive fiscal plans, which has been helping to keep the Euro...

The USD/MXN has fallen over 2.5% in the past five trading sessions, dropping below 19.9 per USD for the first time since November 2024. Two key factors could be driving this move: 1. Investor distrust in the U.S. dollar – Market confidence is weakening due to Trump’s inconsistent tariff threats and other unpopular policies. In contrast, the Sheinbaum...

This analysis is provided by Eden Bradfeld at BlackBull Research. I’ve written a lot about WarnerBrothersDiscovery, and I’ve talked about it a lot in this newsletter. Long story short — giant monolith formed by the merger of Discovery and the spun-out Warner assets of AT&T³. The big issue was debt. They’ve managed to pay off a lot of debt — the company’s...

Gold is sprinting to new all-time highs and approaching the $3000 level. The price has just reached $2983 at the time of writing, just $17 away from the key $3000 level. Alex Ebkarian from Allegiance Gold forecasts “prices to trade between $3,000 and $3,200 this year,”. Momentum is currently being driven by uncertainty around Trump tariffs and stalled...

Financial markets can't get away from all things trade tariffs, and it's clear the unpredictability has been rattling sentiment. The unpredictability has also been behind a lot of the US dollar selling we've been seeing, particularly against the major currencies now viewed as alternative safe havens amidst the deterioration in confidence in the buck. Meanwhile,...

You may be sick of hearing about tariffs, but they are currently the catalyst for a huge amount of volatility in the market and a huge amount of trading opportunities. And now Trump’s trade war has crossed the Atlantic Today, the European Union announced retaliatory tariffs on approximately €26 billion worth of U.S. goods in response to President Donald...

This analysis is provided by Eden Bradfeld at BlackBull Research. We’ve seen the S&P, NASDAQ and every other American index get slammed in the last couple of days. Some people are panicking. A lot of people are panicking. If you go on Twitter (sorry — X dot com) you will find a lot of people who listened to a recommendation from a guy on YouTube about a trash...

So, Trump was all like, “Let’s slap an extra 25% tariff on Canadian steel and aluminum,” which meant total duties shot up to 50%. Why? Because Ontario put a 25% tax on electricity exports to the U.S. And Doug Ford? He was not having it—saying he’d “respond appropriately” and “not back down.” But —he totally backed down and scrapped the tax on electricity exports...

Risk off - dollar off isn't exactly a familiar trend in markets, yet this is how things have been playing out in recent sessions. Ultimately, the market is deeply distressed about the outlook for the U.S. economy given the unpredictability of administration policies, forcing investors into risk reduction mode, where alternatives to the U.S. dollar have become the...

With markets in turmoil, it's easy to overlook the growing risk of a U.S. government shutdown. A three-week market sell-off intensified today as investors worry that unpredictable policies from the Trump administration are pushing the economy into recession. The S&P 500 is down 9.1% from its February high, the Nasdaq 14%, and the Russell 2000 18%. A 10%...

Bitcoin surged on March 3 after Donald Trump announced a strategic crypto reserve, only to erase gains following erratic tariff announcements the following days. Friday’s White House crypto summit, expected to be a turning point, fell flat. Trump met with top crypto executives, promising to ease Biden-era regulations, but offered only vague commitments. Instead...

Treasury Secretary Scott Bessent, speaking at the Economic Club of New York, said the U.S. is enforcing sanctions on Iran for “immediate maximum impact,” warning that Iranians should move their money out of the rial. The goal is to cut Iran’s oil exports from 1.5 million barrels per day to near zero. His comments came as oil prices fell to multiyear lows on...