Market analysis from CFI

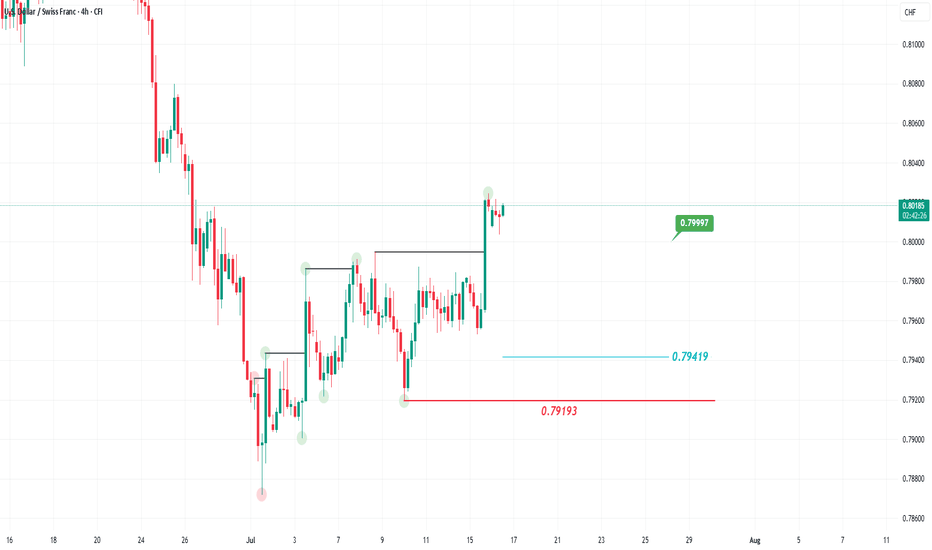

The recent rebound of the US dollar has led to a decline in the Swiss franc against it, similar to other major currencies. The US dollar is also expected to show further strength in the coming period, supported by recent positive economic data, most notably, and the annual Consumer Price Index (CPI) - which came in at 2.7%, the highest reading in the last four...

After its recent surge to reach the highest levels since September 2011, silver is showing short-to-medium-term negative signals on the 4-hour timeframe, before potentially resuming its upward trend on the daily chart. As seen in the chart above, the price dropped quickly below the 38.37 level, forming a new low and shifting the 4-hour trend from bullish to...

After the recent rebound of the US dollar following two quarters of decline, the USD/JPY pair has been on an upward trajectory, forming a series of higher highs on both the 4-hour and daily charts. However, the recent drop below the 146.515 level and the formation of a new low suggests a potential shift in trend on the 4-hour timeframe from bullish to bearish....

US President Donald Trump announced a postponement of the suspension of tariffs from July 9 to August 1, stressing that this deadline is final and will not be delayed again. This decision has left the markets cautious, particularly US indices, but the Dow Jones Index has taken a different route compared to the S&P 500 and Nasdaq, which are generally trending...

Global markets rose on Wednesday, with the dollar hovering near a three-year low of 96, as investors considered the increasing likelihood of US interest rate reduction and the push for trade agreements ahead of President Donald Trump's July 9 tariff deadline. Meanwhile on the radar, the U.S. official Job report would be on the wire later this week and as always,...

The EUR/GBP pair had been trading in a general uptrend on the 4-hour chart, forming higher highs and higher lows, until the recent pullback on June 24, 2025. During this decline, the price broke below the last higher low located at the 0.85257 level and recorded a lower low. This recent drop suggests the end of the uptrend on the 4-hour chart and a shift toward a...

Bitcoin held steady on Thursday, supported by improving risk sentiment as the Middle East ceasefire continued to hold, calming broader market fears. Despite the stability, BTC remained confined within its recent trading range, reflecting a cautious tone among traders. In the previous session, Bitcoin rose 0.44% to $108,328, fueled by renewed institutional...

US indices rebounded following the US president’s announcing a ceasefire deal in the Middle East, which brought some optimism to the markets and among investors, positively impacting US markets in particular. The Dow Jones Index rose at the start of this week by approximately 2.62%, reaching a new high above the 42,711 level, which represents the last lower high...

With rising geopolitical tensions in the Middle East, many analysts and global financial institutions have begun betting on a potential increase in gold prices. Some major banks have even raised their forecasts for gold to as high as $4,000 per ounce, raising a critical question: Will gold prices truly rise as expected, or are the markets heading toward a...

GBP/USD hovers around the 1.3400 mark following the Bank of England’s decision to keep interest rates steady at 4.25%, as widely expected. The hold reflects the central bank’s cautious approach amid slowing economic data and persistent global uncertainties. Meanwhile, during the Asian session, the pair dropped sharply, hitting a one-month low of 1.3382, equivalent...

The rise in the US Dollar Index has led to a rebound against several currencies such as the Canadian dollar, the euro, and the Japanese yen, shifting the medium-term bearish trend into a bullish one. One of the pairs that could benefit from the USD’s strength is the USD/CAD. After the USD/CAD pair recorded a new high by breaking the last lower high, the recent...

In the wake of the escalating geopolitical tension in the Middle East, markets have been reacting sharply. Focusing on USDJPY pair, as the conflict shows signs of intensifying, investors turned to traditional safe-haven assets notably the Japanese yen amid fears of a broader regional spillover. Beyond geopolitical tension in the Middle East, both economies are set...

The EUR/JPY pair is trading in a general uptrend, forming higher highs and higher lows, which maintains a bullish momentum. What’s the pair’s next expected move? As long as the 164.556 level is not broken with a 4-hour candle closing below it, any pullback remains corrective. The pair is likely to rebound from the 164.823 level to target the 165.510 level.

Earlier today, the UK’s Claimant Count Change (jobless claim) i.e. the number of people in the UK claiming unemployment related benefits for the month of May was released with a whopping 33.1k against 9.5k projection and average earnings index plus bonus witnessed a decline to 5.3% against 5.5% forecast. Today’s disappointing UK labor market report prompted a...

With just minutes to go before the European Central Bank (ECB) announces its highly anticipated rate decision, market participants are maintaining a cautious stance. The EUR/USD pair remains relatively calm, reflecting a wait-and-see approach ahead of the official release. According to broad market consensus, the ECB is expected to implement a 25-basis point rate...

Several negative data points were released this week for the US dollar, led by the ADP Non-Farm Employment Change, which posted its lowest reading since March 2023 at just 37K. Additionally, the Non-Manufacturing PMI fell below the key 50 level, recording 49.9. These readings add further downside pressure on the US dollar. On the other hand, the Bank of Canada...

During governor Kazuo Ueda’s speech on Tuesday, he emphasized that the central bank would raise interest rates once it is convinced enough that economic and price growth will re-accelerate after a period of stagnation. He further signaled the central bank will continue to taper its huge bond buying even after an existing plan running through March expires,...

From a technical standpoint, USD/JPY found support around the 142.11 level, which triggered a break above the descending trendline on the 4-hour chart. This breakout suggests a shift in momentum, favoring the bulls in the short term. However, the upward movement is currently facing resistance near the minor supply zone at 144.20, where price has temporarily...