Market analysis from Errante

Technical Analysis On the 4-hour chart, USD/CHF is building a recovery from the 0.79441 low. Notably, the pair is not retesting the previous falling trendline but is approaching a critical resistance at the last swing high of 0.79793. If bullish momentum persists, a break above 0.79793 (last swing top and 100% Fibonacci retracement) will open the way to 0.79889...

Market Overview: GBP/AUD has shown signs of recovery this Monday, bolstered by a modest improvement in risk appetite globally. The Australian dollar faces some pressure due to mixed domestic economic signals and external factors such as cautious investor sentiment on China’s growth prospects. Meanwhile, the British pound is supported by steady housing data,...

Technical Analysis The EUR/USD 4-hour chart reflects ongoing bearish pressure after failing to sustain above the 1.17647 resistance zone, indicating sellers are currently dominating the market. The pair trades below the 20-period EMA (blue line), which is beginning to slope downwards, confirming short-term bearish momentum. Price action remains beneath the...

Technical Analysis The CAD/CHF pair remains firmly in a downtrend on the 1-hour chart, with price consistently making lower highs and lower lows, underscoring sustained selling pressure. The price is trading below both the 20-period and 50-period weighted moving averages, which have turned downward, signaling bearish momentum. Price action recently tested the...

Technical Analysis The EUR/CHF 1-hour chart highlights a clear breakout from a symmetrical triangle consolidation pattern, indicating bullish momentum. The price has decisively breached the upper trendline resistance near 0.9335 and surged above the last top resistance at approximately 0.9343, signaling a strong upward impulse. Key levels and technical...

Technical Analysis The gold spot price recently tested resistance near $3,451, marking a significant swing high. Following this, the price has pulled back to the 61.8% Fibonacci retracement level at approximately $3,353, which currently acts as critical support. The daily chart shows gold holding above its 50-day weighted moving average (WMA) around $3,250, with...

Technical Analysis On the 4-hour chart, USD/CAD has broken above the 1.3746 resistance level, which corresponds to the top swing of the recent rally from 1.3687. The breakout above this level is a bullish signal, reinforced by a positive RSI reading above 70, indicating strong buying momentum. The MACD histogram is in positive territory, and the stochastic...

Technical Analysis On the 1-hour chart, EUR/USD is trading near 1.1408, showing a corrective pullback after recent gains. The pair breached a rising trendline support around 1.1411 and is approaching key Fibonacci retracement levels derived from the recent swing low to high. Immediate support lies at the 100% Fibonacci level near 1.1368, with further downside...

Technical Analysis – EUR/USD (1H Chart) EUR/USD is currently trading around 1.1367, slipping after a failed attempt to break above the recent swing high of 1.1406. The pair has now broken below a short-term ascending trendline and is testing the key support drawn from the last bullish leg at 1.1368. Breaking of this level can push the pair lower. The break of...

CAD/CHF Market Outlook – May 14, 2025 CAD/CHF remains in a bullish structure on the 4H chart, with price currently hovering near 0.6010 after rejecting resistance at 0.6032. The pair is testing the 61.8% Fibonacci retracement and holding just above a rising trendline and the WMA, which converge around the 0.5980–0.5994 zone. Momentum has flattened, with RSI at 52...

Technical Analysis On the hourly chart, AUD/CAD is attempting to complete a short-term bullish reversal pattern that began forming after the pair established a base at the psychological level of 0.90000. Buyers have successfully pushed the price above the resistance at 0.90189, gaining proximity to the 100-period moving average—a key area of interest. A sustained...

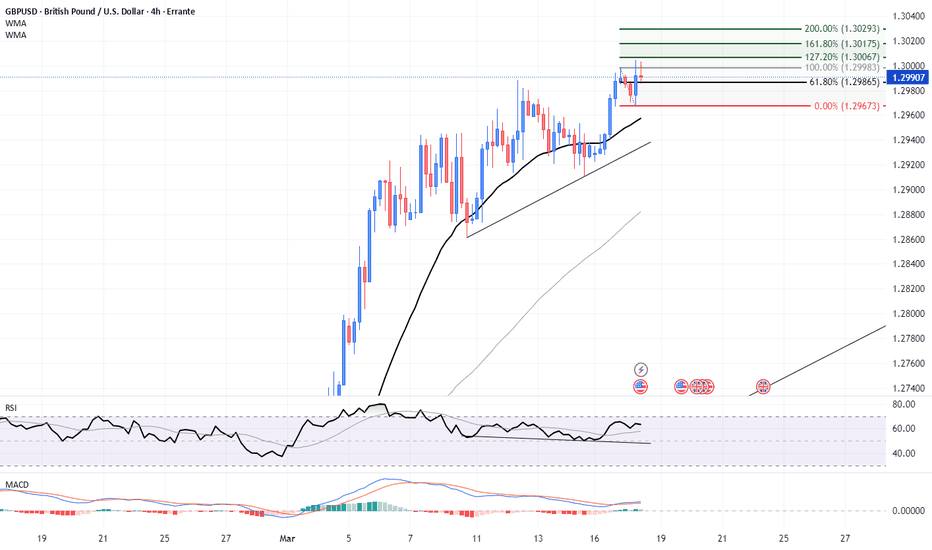

Market Overview The British Pound surged to a four-and-a-half-month high against the US Dollar on Tuesday as expectations grew that the Bank of England (BoE) would refrain from cutting interest rates later this week. Meanwhile, Sterling weakened against the Euro, driven by optimism surrounding Germany’s stimulus plans. The Euro’s strength has contributed to a...

On the four-hour chart, EUR/AUD has successfully broken above its previous downtrend and now trades above the 100-period moving average, reinforcing a short-term bullish outlook. Buyers have managed to clear the 1.65192 resistance level, extending the rally toward the 127.2% Fibonacci extension of the latest bearish swing at 1.65433. A sustained break above this...

GBP/CAD remains under pressure as investors brace for BoE’s rate decision and guidance on future cuts. A break below 1.78432 would confirm further downside, while a recovery beyond 1.79110 could delay further declines. The policy outlook from Governor Bailey remains the primary driver of GBP’s next move. Read the full article on our website: erranteacademy.com

China responded with retaliatory tariffs on US imports, announcing 15% duties on coal and liquefied natural gas (LNG) from the US, alongside 10% additional tariffs on crude oil, agricultural equipment, and automobiles. This deterioration in global trade relations has weakened commodity-linked currencies, particularly the Australian dollar, as China remains its...

The Japanese yen continues to strengthen against the British pound, benefiting from its safe-haven appeal as trade tensions escalate. Increasing speculation over potential US trade tariffs on the UK and the European Union has heightened uncertainty, prompting investors to seek refuge in low-yielding, risk-averse assets such as the yen. Technical Analysis On the...

Market Overview The Federal Reserve is widely expected to keep interest rates unchanged. Meanwhile, the Bank of Canada is projected to reduce its benchmark interest rate by 25 basis points, bringing it down to 3.00%. The pace of easing from the BoC remains a focal point, as a more aggressive rate-cut cycle in Canada could further widen the interest rate...

The pound remains in a corrective phase against the dollar, with sellers testing key support levels. While the broader uptrend remains intact, a break below 1.24255 would signal deeper corrections. Conversely, a move above 1.25227 would reaffirm bullish momentum. Read the full article here: erranteacademy.com