Market analysis from IC Markets

USDCAD is approaching its resistance at 1.33759 (100% Fibonacci extension , 50% Fibonacci retracement , horizontal pullback resistance) where it could potentially drop to its support at 1.3346 (38.2% Fibonacci retracement ). Stochastic (89, 5, 3) is approaching its resistance at 98% where a corresponding bounce could occur. Trading CFDs on margin carries high...

NZDUSD is approaching its support at 0.6740 (61.8% Fibonacci extension *2, horizontal swing low support) where it could potentially bounce to its resistance at 0.6800 (38.2% Fibonacci retracement , horizontal swing high resistance). Stochastic (89, 5, 3) is approaching its support at 4% where a corresponding bounce could occur. Trading CFDs on margin carries...

our ago Euro index is approaching its resistance at 7.025 (100% Fibonacci extension , 61.8% Fibonacci retracement , horizontal swing high resistance) where it could potentially drop to its support at 6.9958 (76.4% Fibonacci retracement , horizontal swing low support). Stochastic (89, 5, 3) is approaching its resistance at 91% where a corresponding bounce...

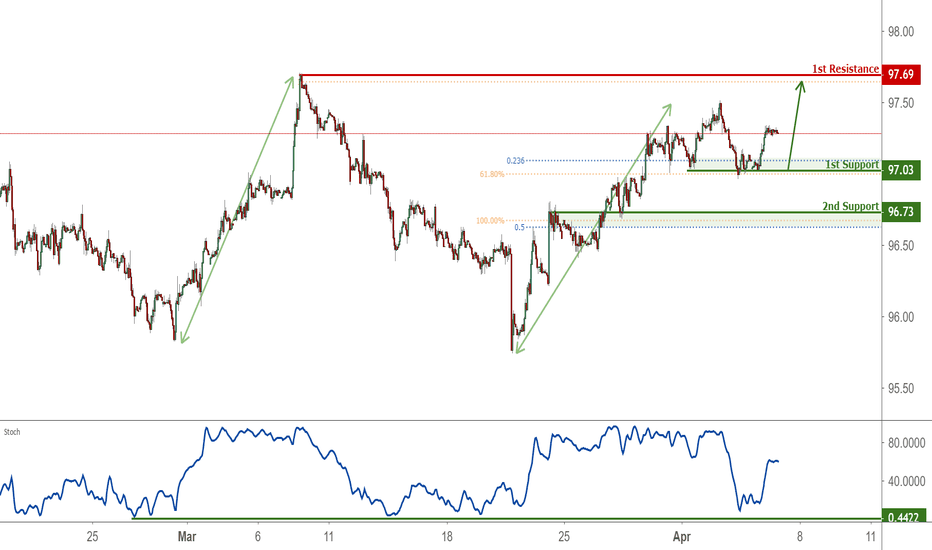

DXY bounced off its support at 97.03 (61.8% Fibonacci extension , horizontal swing low support, 23.6% Fibonacci retracement ) where it could potentially bounce to its resistance at 97.69 (100% Fibonacci extension , horizontal swing high resistance). Stochastic (89, 5, 3) is approaching its support at 4% where a corresponding bounce could occur. Trading CFDs on...

r ago CADCHF is approaching its support at 0.7464 (100% Fibonacci extension , 38.2% Fibonacci retracement , horizontal overlap support) where it could potentially bounce to its resistance at 0.7514 (50% Fibonacci retracement , horizontal swing high resistance). Stochastic (89, 5, 3) is approaching its support at 4% where a corresponding bounce could occur....

AUDCAD is approaching its resistance at 0.9507(61.8% Fibonacci extension ,61.8% Fibonacci retracement , horizontal swing high resistance) where it is expected to drop further to its support at 0.9440(76.4% Fibonacci retracement , horizontal pullback support,61.8% Fibonacci extension ). Stochastic (55, 5, 3) reversed off its resistance at 97% where a...

Euro index is approaching its resistance at 7.025 (100% Fibonacci extension , 61.8% Fibonacci retracement , horizontal swing high resistance) where it could potentially drop to its support at 6.9958 (76.4% Fibonacci retracement , horizontal swing low support). Stochastic (89, 5, 3) is approaching its resistance at 91% where a corresponding bounce could occur....

Kiwi index is approaching its resistance at 7.050(100% Fibonacci extension , 50% Fibonacci retracement , horizontal swing high resistance) where it could potentially drop to its support at 6.990 (61.8% Fibonacci extension ,50% Fibonacci retracement , horizontal swing low support). Stochastic (89, 5, 3) is approaching its resistance at 91% where a corresponding...

DXY is approaching its support at 97.03 (horizontal swing low support, 61.8% Fibonacci extension , 23.6% Fibonacci retracement ) where it could bounce to its resistance at 97.69 (100% Fibonacci extension , horizontal swing low support). Stochastic (34, 5, 3) is approaching its support at 5% where a corresponding bounce is expected. Trading CFDs on margin...

EURJPY is approaching its resistance at 125.21(61.8% Fibonacci extension ,50% Fibonacci retracement , horizontal swing high resistance) where it is expected to drop further to its support at 124.59(61.8% Fibonacci retracement , horizontal swing low support). Stochastic (55, 5, 3) reversed off its resistance at 95% where a corresponding drop is expected.

CADJPY is approaching its resistance at 84.04(100% Fibonacci extension ,61.8% Fibonacci retracement , horizontal swing high resistance) where it is expected to drop further to its support at 82.80(50% Fibonacci retracement , horizontal overlap support). Stochastic (55, 5, 3) reversed off its resistance at 97% where a corresponding drop is expected.

Euro index is approaching its resistance at 6.9504(100% Fibonacci extension , 61.8% Fibonacci retracement , horizontal swing high resistance) where it could potentially drop to its support at 6.9159 (61.8% Fibonacci extension , horizontal swing low support). Stochastic (34, 5, 3) is approaching its resistance at 91% where a corresponding bounce could occur.

DXY is approaching its support at 97.03 (horizontal swing low support, 61.8% Fibonacci extension , 23.6% Fibonacci retracement ) where it could bounce to its resistance at 97.69 (100% Fibonacci extension , horizontal swing low support). Stochastic (34, 5, 3) is approaching its support at 5% where a corresponding bounce is expected.

GBP/USD: The British pound rose against its US counterpart Tuesday as concerns over a no-deal Brexit eased. UK PM May stated the UK needs a further extension of Article 50, and would end when a deal has been passed. The PM further added she will reach out to UK opposition leader Corbyn to help break the Brexit logjam. After clocking a session low at 1.3013, the...

GBPJPY reversed off its resistance at 146.45 (100% Fibonacci extension ,50% Fibonacci retracement , horizontal swing high resistance) where it is expected to drop further to its support at 145.18(50% Fibonacci retracement , horizontal overlap support). Stochastic (55, 5, 3) reversed off its resistance at 95% where a corresponding drop is expected.

Kiwi index is approaching its support at 6.8787(61.8% Fibonacci extension , 50% Fibonacci retracement , horizontal swing low support) where it could potentially bounce to its resistance at 6.9528 (50% Fibonacci retracement , 61.8% Fibonacci extension , horizontal swing high resistance). Stochastic (55, 5, 3) is approaching its support at 3% where a corresponding...

USDCAD is approaching its support at 1.32492(100% Fibonacci extension , 61.8% Fibonacci retracement , horizontal swing low support) where it could potentially bounce to its resistance at 1.3339 (38.2% Fibonacci retracement , horizontal overlap resistance). Stochastic (55, 5, 3) is approaching its support at2% where a corresponding bounce could occur. Trading...

XY is approaching its resistance at 97.69 (horizontal swing high resistance, 100% Fibonacci extension*2 ) where it could reverse down to its support at 97.03 (38.2% Fibonacci retracement , horizontal swing low support). Stochastic (89, 5, 3) is approaching its resistance at 97% where a corresponding reversal is expected.