Market analysis from OANDA

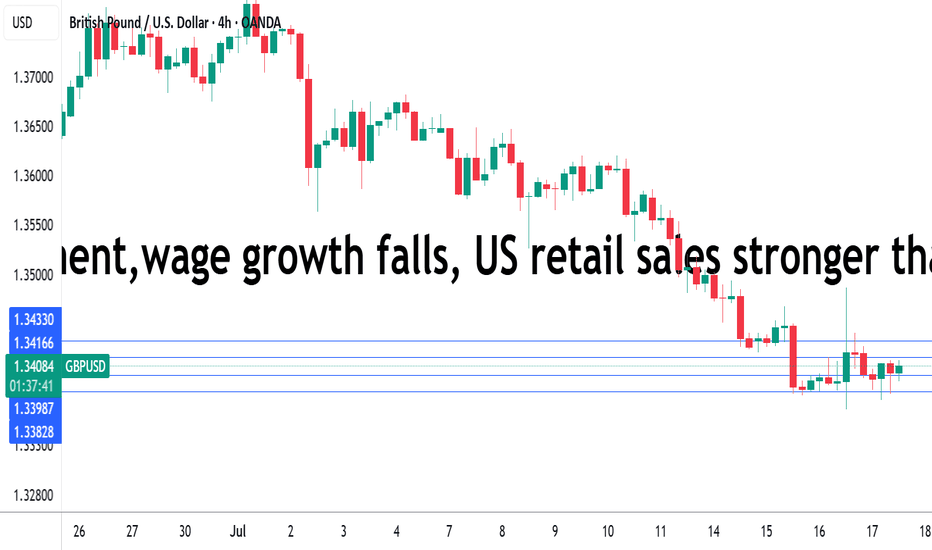

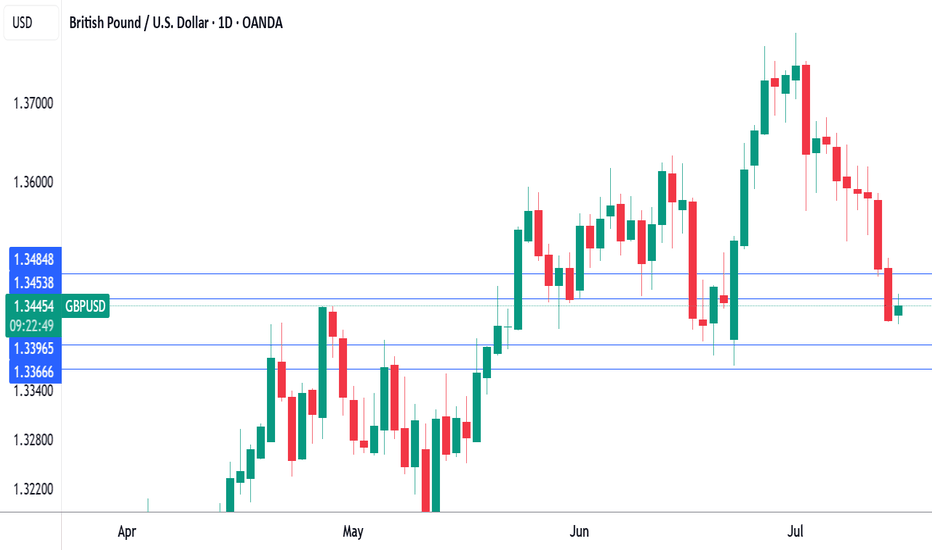

The British pound showing limited movement on Thursday. In the North American session, GBP/USD is trading at 1.3406, down 0.09% on the day. Today's UK employment report pointed to a cooling in the UK labor market. The number of employees on company payrolls dropped by 41 thousand in June after a decline of 25 thousand in May. Still, the May decline was downwardly...

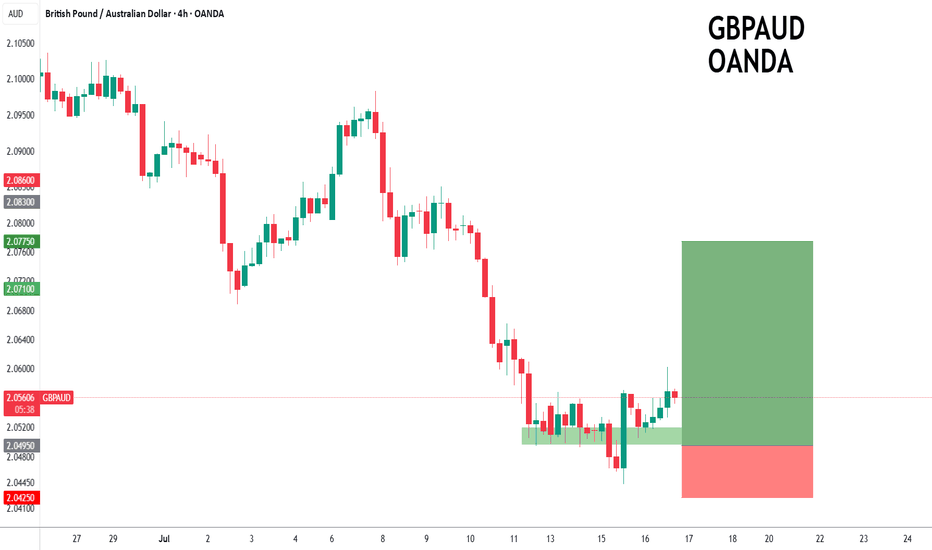

GBPAUD - 24h expiry The primary trend remains bullish. Price action looks to be forming a bottom. We look for a temporary move lower. Preferred trade is to buy on dips. Bespoke support is located at 2.0495. We look to Buy at 2.0495 (stop at 2.0425) Our profit targets will be 2.0775 and 2.0820 Resistance: 2.0670 / 2.0750 / 2.0830 Support: 2.0490 / 2.0440...

The British pound has stabilized on Wednesday and is trading at 1.3389 in the European session, up 0.07% on the day. This follows a four-day losing streak in which GBP/USD dropped 1.5%. On Tuesday, the pound fell as low as 1.3378, its lowest level since June 23. Today's UK inflation report brought news that the Bank of England would have preferred not to hear. UK...

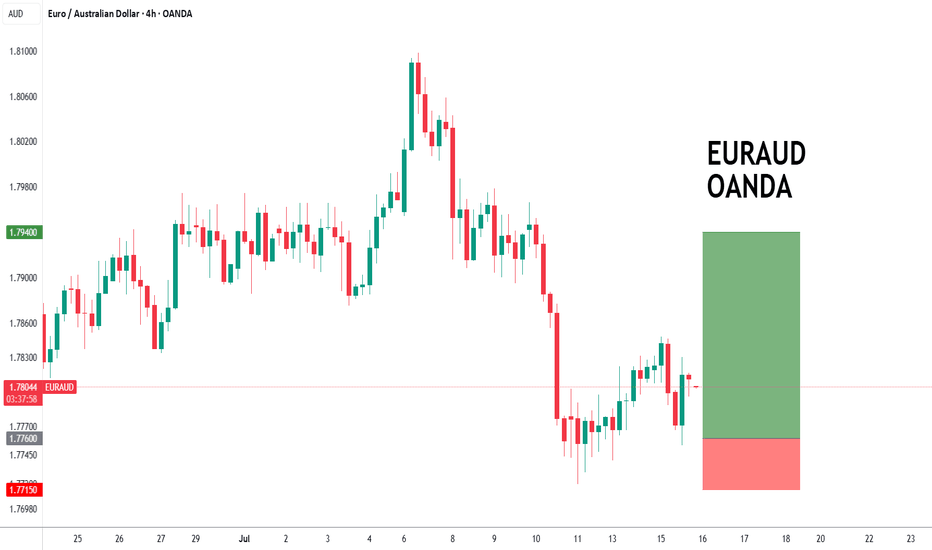

EURAUD - 24h expiry The primary trend remains bullish. The selloff has posted an exhaustion count on the daily chart. Preferred trade is to buy on dips. Risk/Reward would be poor to call a buy from current levels. Bespoke support is located at 1.7760. We look to Buy at 1.7760 (stop at 1.7715) Our profit targets will be 1.7940 and 1.7970 Resistance:...

The British pound has edged up higher on Tuesday. In the European session, GBP/USD is trading at 1.3453, up 0.21% on the day. Earlier, GBP/USD touched a low of 1.3416, its lowest level since June 23. All eyes will be on the UK inflation report for June, which will be released on Wednesday. Headline CPI is expected to remain unchanged at 3.4% y/y, as is core CPI...

NZDJPY - 24h expiry Trading has been mixed and volatile. Price action looks to be forming a top. We look for a temporary move higher. Preferred trade is to sell into rallies. Bespoke resistance is located at 88.45. We look to Sell at 88.45 (stop at 88.65) Our profit targets will be 87.65 and 87.50 Resistance: 88.50 / 88.65 / 88.90 Support: 87.90 / 87.60...

The Australian dollar has edged lower on Monday. In the North American session, AUD/USD is trading at 0.6555, down 0.32% on the day. The Aussie took advantage of US dollar weakness last week as it touched a high of 0.6593, its highest level since November 2024. China's economy is expected to have grown by 5.1% in the second quarter, after back-to-back quarters of...

The British pound continues to have a quiet week. In the European session, GBP/USD is trading at 1.3530, down 0.30% on the day. The UK wrapped up the week on a down note, as GDP contracted in May by 0.1% m/m. This followed a 0.3% decline in April and missed the consensus of 0.1%. The decline was driven by a 1% decline in manufacturing and a 0.6% contraction in...

GBPNZD - 24h expiry The medium term bias remains bullish. We look for a temporary move lower. Preferred trade is to buy on dips. Bespoke support is located at 2.2485. Risk/Reward is ample to buy at market. We look to Buy at 2.2485 (stop at 2.2430) Our profit targets will be 2.2705 and 2.2730 Resistance: 2.2650 / 2.2740 / 2.2790 Support: 2.2500 / 2.2450 /...

The Japanese yen is showing limited movement on Thursday. In the North American session, USD/JPY is trading at 146.45, up 0.10% on the day. Japan's Producer Price Index rose 2.9% y/y in June, down from an upwardly revised 3.3% in May and matching the consensus. This marked the lowest increase since August 2024. On a monthly basis, PPI fell 0.2%, a second straight...

NZDJPY - 24h expiry The primary trend remains bullish. Short term RSI is moving lower. Preferred trade is to buy on dips. Risk/Reward would be poor to call a buy from current levels. Bespoke support is located at 87.50. We look to Buy at 87.50 (stop at 87.30) Our profit targets will be 88.30 and 88.50 Resistance: 88.00 / 88.30 / 88.50 Support: 87.50 /...

The Australian dollar is almost unchanged on Wednesday. In the European session, AUD/USD is trading at 0.6532, up 0.03% on the day. China's producer price index surprised on the downside in June, with a steep 3.6% y/y decline. TThe soft PPI report was driven by weak domestic demand and the continuing uncertainty over US tariffs. The lack of consumer demand was...

CHN50 - 24h expiry Selling posted close to the previous high of 13800. 13868 has been pivotal. Bespoke resistance is located at 13800. Early optimism is likely to lead to gains although extended attempts higher are expected to fail. We look for a temporary move higher. We look to Sell at 13795 (stop at 13890) Our profit targets will be 13515 and 13435...

The Australian dollar is in positive territory after a three-day skid, declining 1.5%. In the North American session, AUD/USD is trading at 0.6532, up 0.50% on the day. The Australian dollar rose as much as 0.95% earlier before retreating. The Reserve Bank of Australia blindslided the markets on Tuesday as the central bank held the cash rate at 3.85%. The markets...

The Australian dollar is in positive territory after a three-day skid, declining 1.5%. In the North American session, AUD/USD is trading at 0.6532, up 0.50% on the day. The Australian dollar rose as much as 0.95% earlier before retreating. The Reserve Bank of Australia blindslided the markets on Tuesday as the central bank held the cash rate at 3.85%. The markets...

NZDUSD - 24h expiry The correction lower is assessed as being complete. We expect a reversal in this move. Risk/Reward would be poor to call a buy from current levels. A move through 0.6025 will confirm the bullish momentum. The measured move target is 0.6075. We look to Buy at 0.6000 (stop at 0.5975) Our profit targets will be 0.6050 and 0.6075...

CHN50 - 24h expiry Selling posted close to the previous high of 13800. 13868 has been pivotal. Bespoke resistance is located at 13800. Early optimism is likely to lead to gains although extended attempts higher are expected to fail. We look for a temporary move higher. We look to Sell at 13795 (stop at 13875) Our profit targets will be 13555 and 13505...

The Japanese yen is negative ground on Thursday. In the North American session, USD/JPY is trading at 144.06, up 0.47%. The US and Japan are racing to reach a trade deal before a deadline of July 9. There are some serious roadblocks to a deal, including the current US tariff of 25% on Japanese cars and opening Japan's agricultural sector, particularly rice....