Market analysis from Trade Nation

Key Support and Resistance Levels Resistance Level 1: 2278 Resistance Level 2: 2300 Resistance Level 3: 2318 Support Level 1: 2232 Support Level 2: 2213 Support Level 3: 2193 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not...

US equities pulled back, breaking a six-day winning streak for the S&P 500 (-0.30%) as sentiment cooled ahead of key earnings and the Federal Reserve’s rate decision. The Nasdaq 100 (NDX) was weighed down by weakness in megacap tech stocks—the Mag-7 fell -0.68%, with Meta declining -2.46% and Microsoft earnings due after the close. Post-earnings disappointments...

The Brent Crude remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 7133 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 7133 would confirm ongoing upside momentum, with potential targets at: 7352 – initial...

The WTI Crude remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 6857 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 6857 would confirm ongoing upside momentum, with potential targets at: 7123 – initial...

The CAC 40 index continues to display a bullish bias, underpinned by a well-established rising trend. Recent intraday price action indicates a breakout from consolidation, suggesting renewed upward momentum. Key Technical Levels: Support: 7770 – This level marks the prior consolidation zone and now serves as critical support. 7740 – Secondary support, guarding...

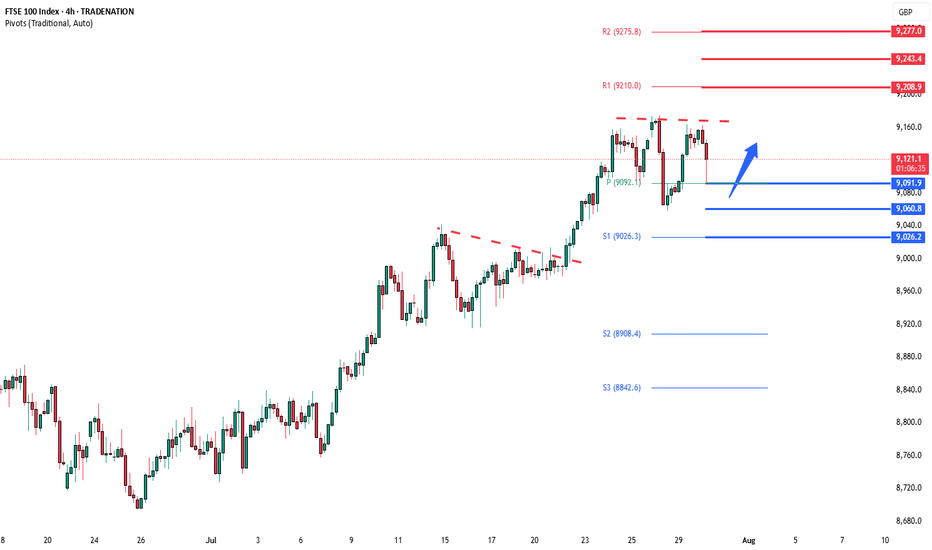

The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 9092 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 9092 would confirm ongoing upside momentum, with potential targets at: 9210 – initial...

Key Data Releases: US: Q2 GDP – Crucial insight into US economic momentum. July ADP Employment – A labor market pulse-check ahead of Friday's payrolls. June Pending Home Sales – Gauges housing market resilience. Europe: Germany, France, Italy, Eurozone Q2 GDP – A comprehensive picture of Eurozone growth trajectory. June Retail Sales (Germany), Consumer...

The BTCUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 114,850 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 114,850 would confirm ongoing upside momentum, with potential targets at: 122,900 –...

The ETHSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 3,667 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 3,667 would confirm ongoing upside momentum, with potential targets at: 4,020 – initial...

The LTCUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 1,070 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 1,070 would confirm ongoing upside momentum, with potential targets at: 1.132 – initial...

Key Support and Resistance Levels Resistance Level 1: 45197 Resistance Level 2: 45507 Resistance Level 3: 46000 Support Level 1: 44390 Support Level 2: 43900 Support Level 3: 43590 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is...

US equities were largely subdued, with the S&P 500 inching up +0.02%, marking its sixth straight record high, the longest streak since July 2023. Despite the headline gain, over 70% of S&P 500 stocks declined, revealing weak breadth and suggesting index gains are being driven by a narrow group of large-cap tech names. Tech led the way, with the information...

The EURAUD pair is currently trading with a bearish bias, aligned with the broader range-bound sideway consolidation. Recent price action shows a retest of the resistance, (previous rising support) Key resistance is located at 1.7907, a prior consolidation zone. This level will be critical in determining the next directional move. A bearish rejection from...

The EURCHF pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend. Key resistance is located at 0.9340, a prior consolidation zone. This level will be critical in determining the next directional move. A bearish...

The EURUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 1.1526 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 1.1526 would confirm ongoing upside momentum, with potential targets at: 1.1714 – initial...

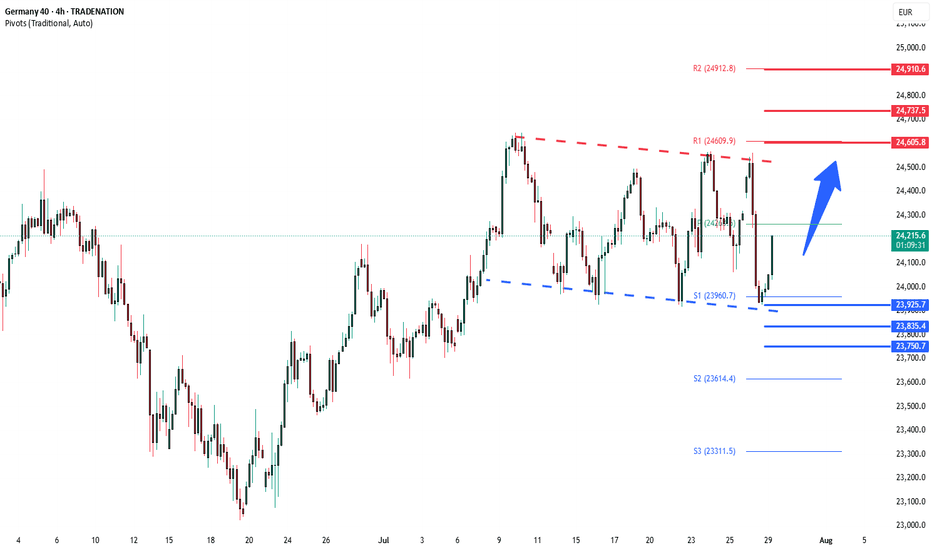

The DAX remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 23925 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 23925 would confirm ongoing upside momentum, with potential targets at: 24605 – initial...

Key Data Releases US: JOLTS (June): Provides insight into labor market slack; a tighter reading could delay Fed rate cuts. Advance Goods Trade Balance & Wholesale Inventories: Important for Q2 GDP revisions. Consumer Confidence (July): A strong print would reflect continued consumer resilience, a weak one could pressure cyclicals. Dallas Fed Services Activity...

Trend Overview: The AUDUSD currency price remains in a bullish trend, characterised by higher highs and higher lows. The recent intraday price action is forming a continuation consolidation pattern, suggesting a potential pause before a renewed move higher. Key Technical Levels: Support: 0.6465 (primary pivot), followed by 0.6445 and 0.6400 Resistance: 0.6570...