Market analysis from Trade Nation

Current Trend: Bullish (Long-term Uptrend) Pattern Formation: Expanding Triangle (Sideways Consolidation) Key Support Level: 5283 Key Resistance Levels: 5470, 5527, 5570 Bullish Scenario: The STOXX 50 remains within a long-term uptrend, with recent price action consolidating in an expanding triangle pattern. A pullback from current levels could find support at...

The DAX (DE40) equity index is exhibiting a bullish sentiment, driven by the prevailing longer-term uptrend. The recent intraday price action indicates a sideways consolidation near the breakout level, which previously acted as resistance and has now transformed into a new support zone. Key Support and Resistance Levels: Support Zone: The primary support level...

Friday March 14 Data: US March University of Michigan survey, UK January monthly GDP, Germany January current account balance, Italy January industrial production, general government debt, Canada January manufacturing sales Central banks: ECB's Cipollone speaks Earnings: BMW, Daimler Truck Holding This communication is for informational purposes only and...

Key Trading Level: 94.70 Bearish Scenario: The overall sentiment remains bearish, aligned with the longer-term prevailing downtrend. Recent price action suggests a sideways consolidation, indicating potential continuation of the downtrend. A bearish rejection from 94.70 could reinforce selling pressure, targeting 92.33 as the first support level, with further...

The GBP/CAD currency pair price action sentiment remains bullish, supported by the prevailing long-term uptrend. Recent intraday movements indicate sideways consolidation near the previous resistance level, which has now become a new support zone. Key Levels and Price Action The critical trading level to watch is 1.8516, representing the previous consolidation...

The GBP/JPY currency pair is currently exhibiting a bullish sentiment, supported by the prevailing uptrend. Recent intraday price action shows a sideways consolidation, suggesting the formation of a new support zone at the previous resistance level. This consolidation phase reflects a temporary pause within the broader bullish trend. The key trading level to...

New unemployment insurance claims in the US fell to 220,000 for the week ending March 8, slightly below expectations and down from the previous week's revised figure of 222,000 (originally 221,000). The insured unemployment rate remained steady at 1.2%, while the four-week moving average edged up by 1,500 to 226,000. Meanwhile, continuing jobless claims dropped by...

The US Producer Price Index (PPI) increased by 3.2% year-on-year in February, down from 3.7% in January and slightly below the expected 3.3%. The core PPI, which excludes food and energy prices, rose by 3.4% annually, also lower than the 3.8% recorded in January. On a monthly basis, the PPI remained unchanged, while the core PPI saw a slight 0.1% decline. Key...

The EUR/JPY currency pair price action sentiment remains bullish, underpinned by the prevailing long-term uptrend. Recent intraday movements indicate a bullish breakout above the previous resistance level, which has now established itself as a new support zone. Key Levels and Price Action The critical trading level to watch is 160.26, representing the previous...

The EUR/USD currency pair is exhibiting a bullish sentiment, underpinned by the prevailing long-term uptrend. Recent intraday price action shows a bullish breakout from a sideways consolidation phase, with the previous resistance now acting as a new support zone. Key Support and Resistance Levels: Support Zone: The critical support level is at 1.0809, marking...

Bullish Scenario: The EURGBP pair maintains a bullish intraday sentiment, supported by the longer-term uptrend. The key level to watch is 0.8420, which acts as a critical resistance zone. If the price rallies above 0.8420, the uptrend could resume, targeting 0.8440, with further resistance levels at 0.8460 and 0.8500 over the longer timeframe. Bearish Scenario: A...

The FTSE 100 index is currently exhibiting a bearish sentiment, as evidenced by the prevailing downtrend. The primary focus remains on the key resistance level at 8638, which corresponds to the current intraday swing high and the falling resistance trendline. This level is critical as it determines the next directional move of the index. From the current levels,...

Thursday March 13 Data: US February PPI, initial jobless claims, Q4 household change in net worth, UK February RICS house price balance, Italy Q4 unemployment rate, Canada January building permits Central banks: ECB's Guindos, Holzmann, Villeroy and Nagel speak Earnings: Enel, Generali, Dollar General Auctions: US 30-yr Bonds This communication is for...

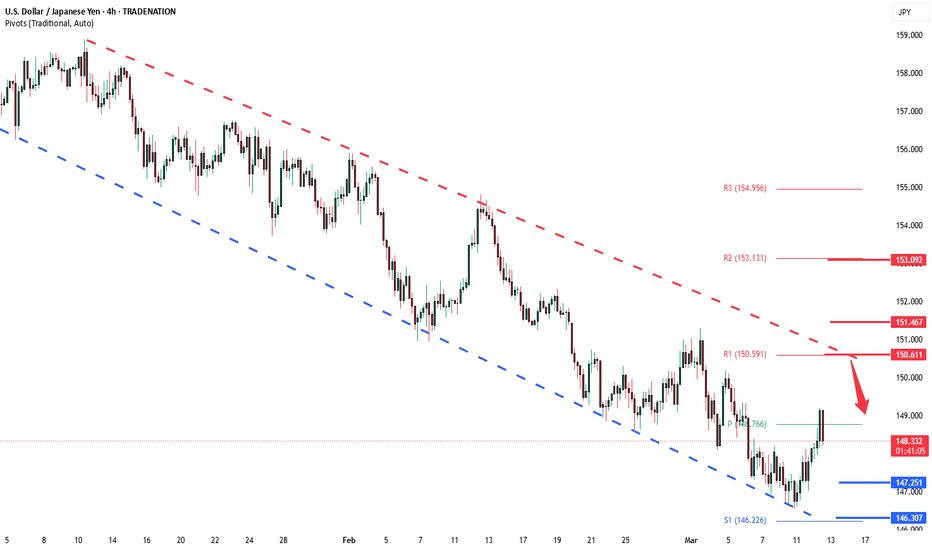

The USD/JPY price action sentiment appears bearish, aligned with the prevailing long-term downtrend. Recent price movements suggest potential for continued downward pressure, with a key resistance level in focus. Key Levels and Price Action The critical trading level to watch is 150.60, which marks the current intraday swing high and the falling resistance...

The GBP/CAD currency pair price action sentiment remains bullish, supported by the prevailing long-term uptrend. Recent intraday movements indicate sideways consolidation near the previous resistance level, which has now become a new support zone. Key Levels and Price Action The critical trading level to watch is 1.8516, representing the previous consolidation...

The USD/CAD currency pair price action sentiment remains bullish, supported by the prevailing long-term uptrend. Recent intraday movements indicate a bullish breakout above the previous resistance level, which has now established itself as a new support zone. Key Levels and Price Action The primary trading level to watch is 1.4390, representing the previous...

The softer-than-expected inflation data has fueled optimism among equity investors, as cooling inflation could alleviate pressure on the Federal Reserve to maintain an aggressive tightening stance. The positive market reaction suggests that participants are increasingly pricing in the possibility of a more gradual approach to interest rate adjustments. With...

US equity indices reacted positively to the latest US inflation figures released earlier today, as the data pointed to a moderation in price pressures. The Consumer Price Index (CPI) decreased to 2.8% year-over-year in February, down from 3.0% in January. This reading not only marked a decline but also came in below market expectations of 2.9%, signaling that...