Market analysis from Trade Nation

Friday, July 25 – Financial Market Summary (Trading Focus) Key Data Releases: US June Durable Goods Orders: A leading indicator of manufacturing activity. Strong growth may boost USD and treasury yields; weak numbers could fuel rate-cut bets. July Kansas City Fed Services Activity: Gauges regional service sector performance, often a directional cue for...

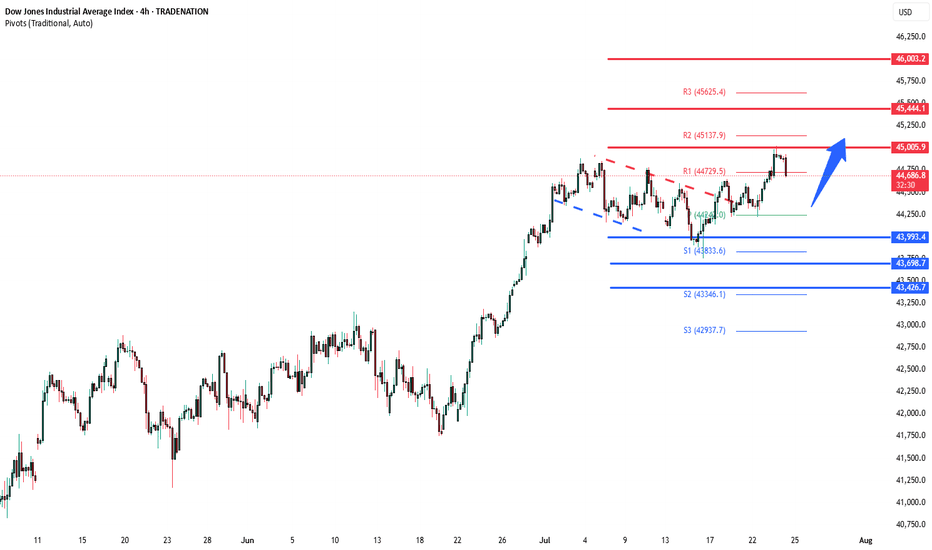

Key Support and Resistance Levels Resistance Level 1: 45000 Resistance Level 2: 45444 Resistance Level 3: 46000 Support Level 1: 43990 Support Level 2: 43700 Support Level 3: 43426 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is...

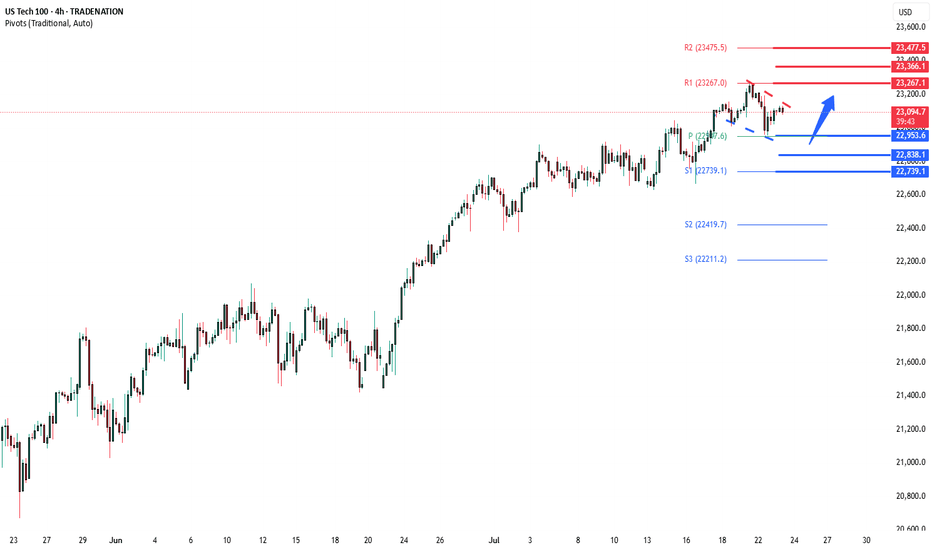

Key Developments: AI Drives Earnings Momentum Alphabet reported strong results, but flagged surging AI infrastructure costs, signaling increased capex ahead. SK Hynix posted record earnings and committed to expanding AI-related investments, reinforcing the sector’s critical growth role. Investor sentiment remains AI-positive, with capital rotation favoring tech...

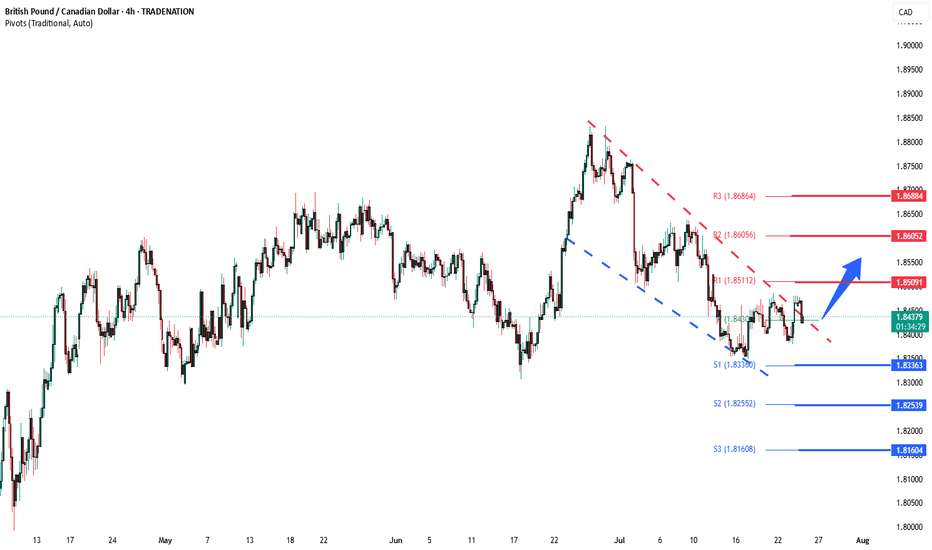

The GBPCAD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 1.8336 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 1.8336 would confirm ongoing upside momentum, with potential targets at: 1.8510 – initial...

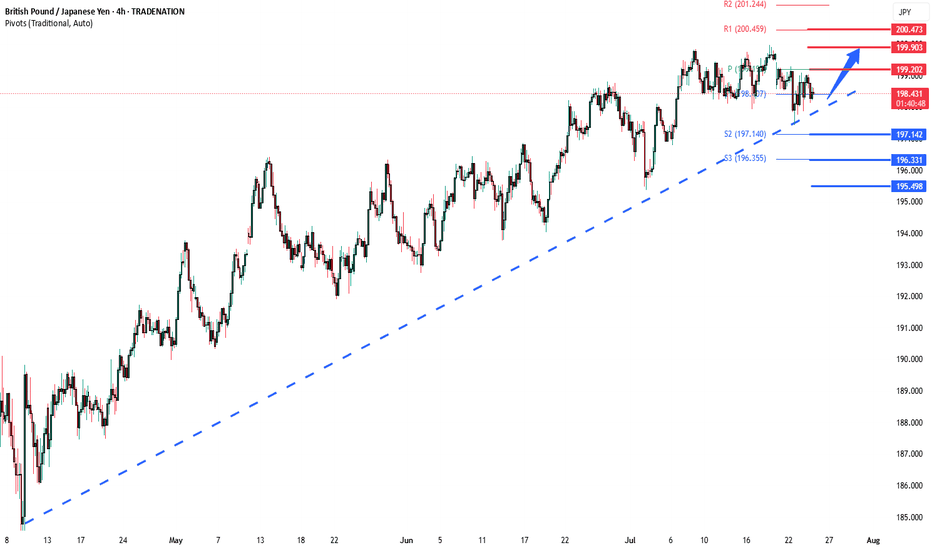

Key Support: 196.75 This level marks the prior consolidation zone and serves as a critical pivot. A corrective pullback toward 196.75 followed by a bullish reversal would validate the uptrend, with upside targets at: 199.20 – Initial resistance and short-term target 199.70 – Minor resistance zone 200.40 – Longer-term breakout objective However, a daily close...

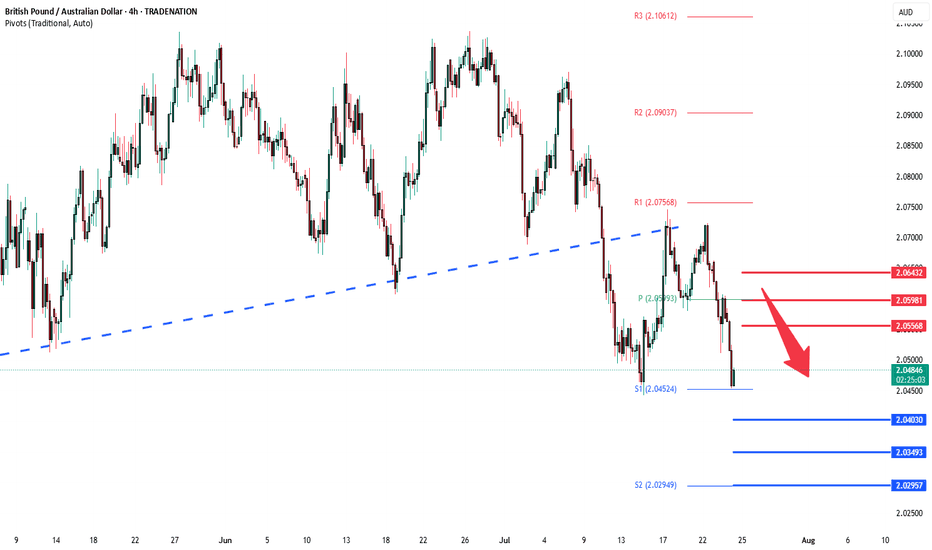

The GBPAUD pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the resistance, suggesting a temporary relief rally within the downtrend. Key resistance is located at 2.0555, a prior consolidation zone. This level will be critical in determining the next directional move. A bearish...

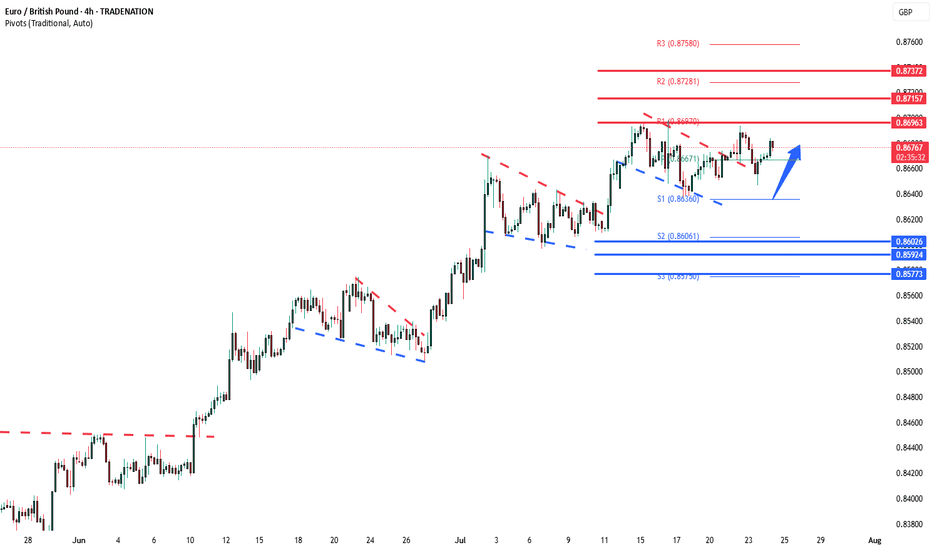

The EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 0.8620 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 0.8620 would confirm ongoing upside momentum, with potential targets at: 0.8700 – initial...

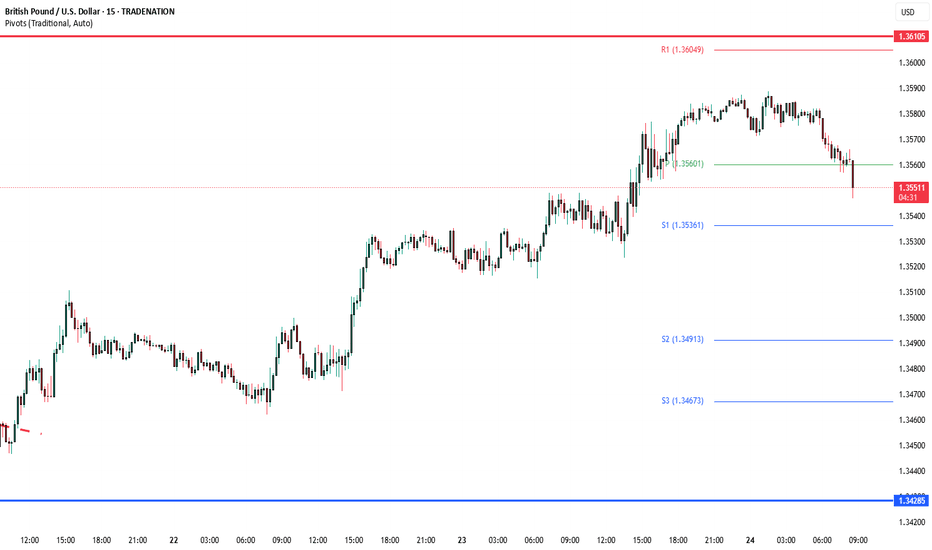

The GBPUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 1.3430 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 1.3430 would confirm ongoing upside momentum, with potential targets at: 1.3600 – initial...

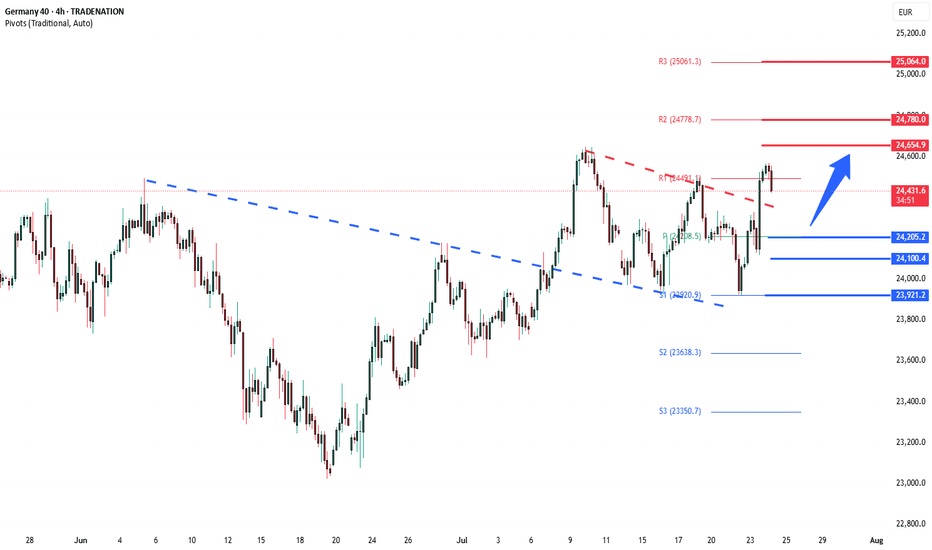

The DAX remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 24205 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 24205 would confirm ongoing upside momentum, with potential targets at: 24655 – initial...

1. Economic Data Global Flash PMIs (July) US, UK, Eurozone, Germany, France, Japan: Flash PMIs will provide early insights into economic momentum. A drop in manufacturing could signal slower global growth, while a resilient services PMI may support the soft-landing narrative. US Data: Chicago Fed National Activity Index (June): Gauges overall economic activity...

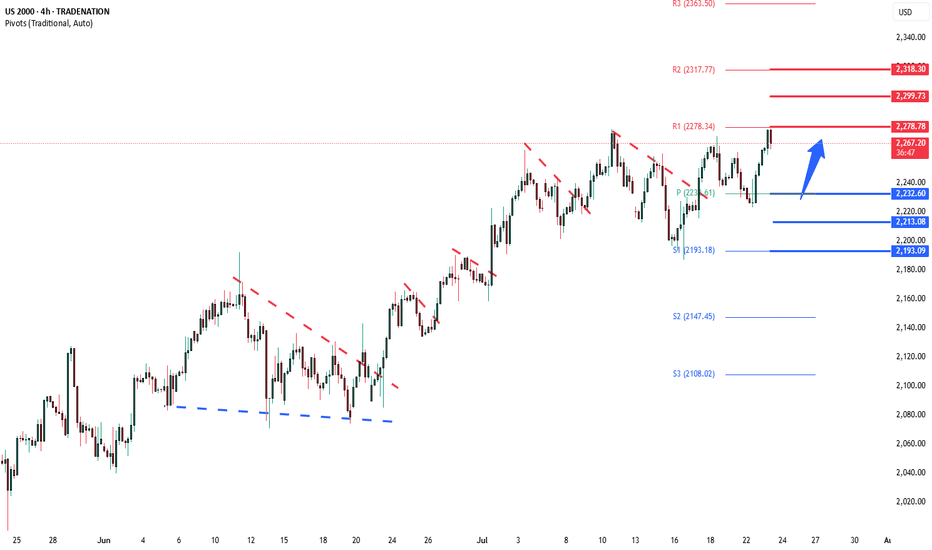

Key Support and Resistance Levels Resistance Level 1: 2278.80 Resistance Level 2: 2299.70 Resistance Level 3: 2318.30 Support Level 1: 2232.60 Support Level 2: 2213.00 Support Level 3: 2193.00 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment...

Donald Trump has agreed a new trade deal with Japan, setting 15% tariffs on US imports like cars and launching a $550 billion fund to boost investment in the US. This is lower than his earlier 25% tariff threat. Other allies saw mixed outcomes—the Philippines got a small tariff cut, while Canada’s talks stalled. Goldman Sachs now expects the US baseline tariff...

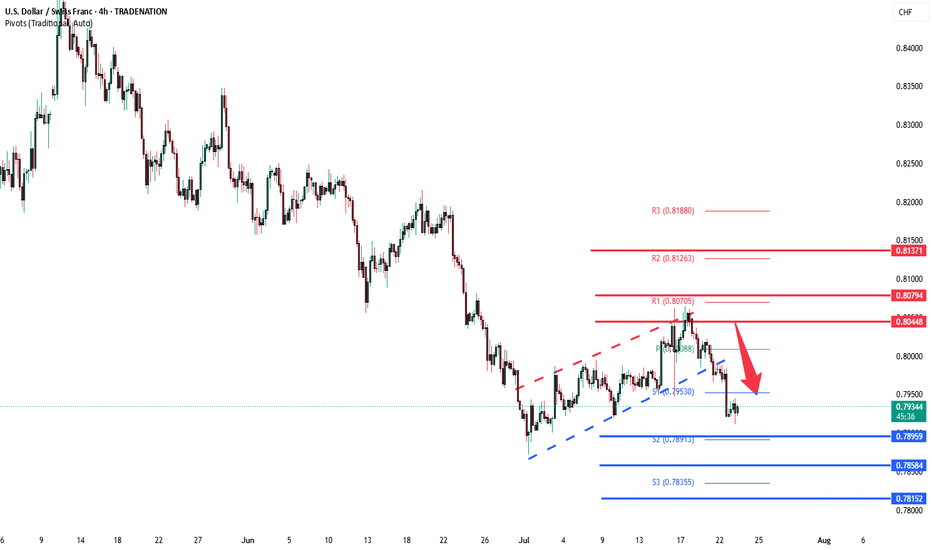

The USD/CHF pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend. Key resistance is located at 0.8045, a prior consolidation zone. This level will be critical in determining the next directional move. A bearish...

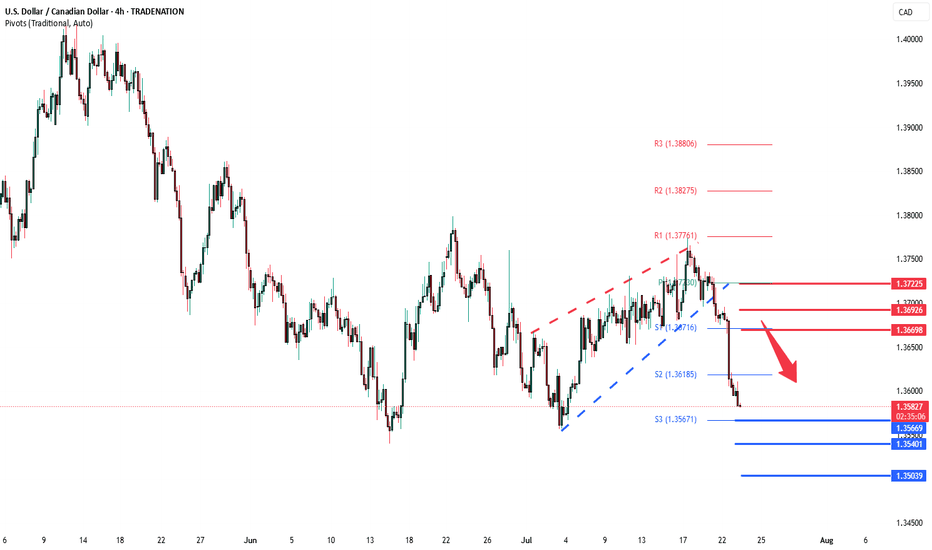

The USDCAD pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a continuation breakdown within the downtrend. Key resistance is located at 1.3670, a prior consolidation zone. This level will be critical in determining the next directional move. A bearish...

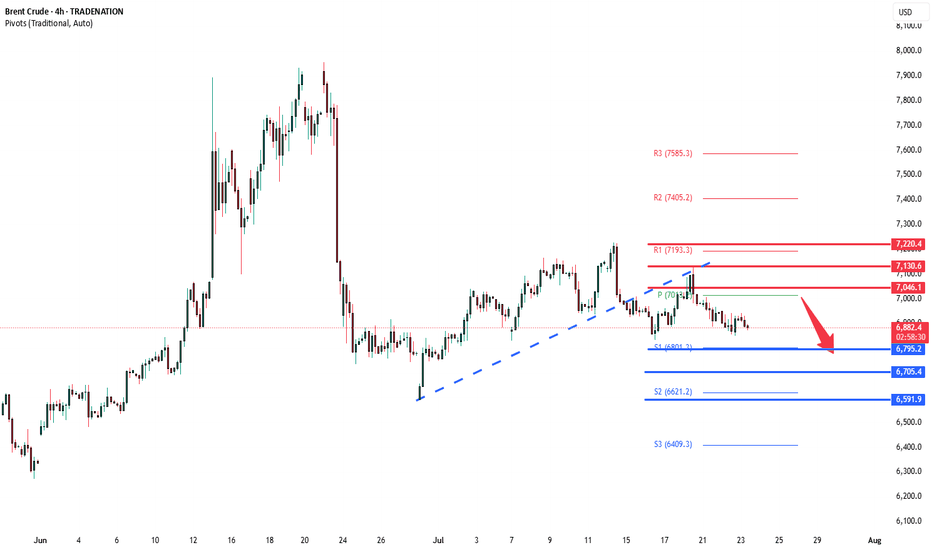

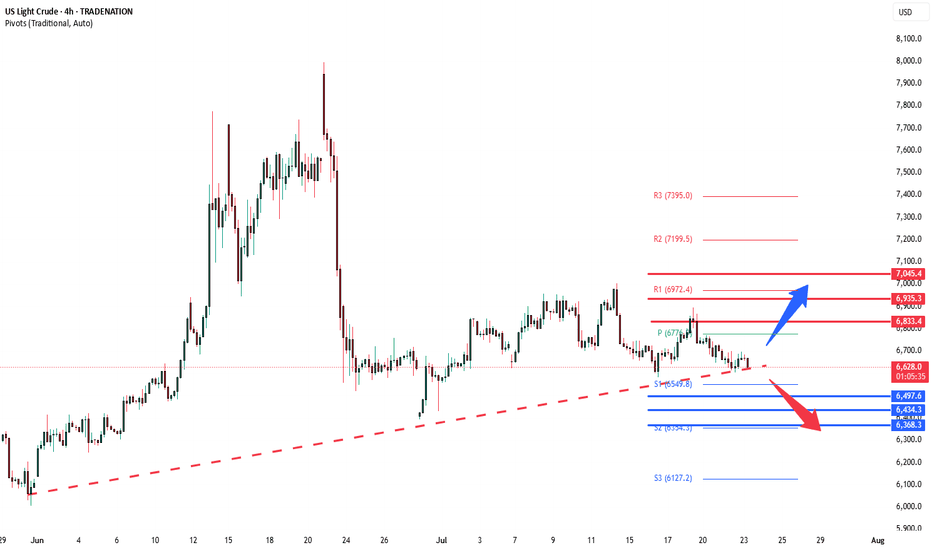

Key Support and Resistance Levels Resistance Level 1: 7050 Resistance Level 2: 7130 Resistance Level 3: 7220 Support Level 1: 6800 Support Level 2: 6700 Support Level 3: 6590 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not...

West Texas Intermediate (WTI) crude futures hovered near $66.30 during Wednesday’s European session, trading in a narrow range as investors awaited the latest US EIA crude inventory report. Market expectations point to a 1.4 million barrel drawdown, which would signal stronger demand and potentially support prices. However, crude failed to rally despite...

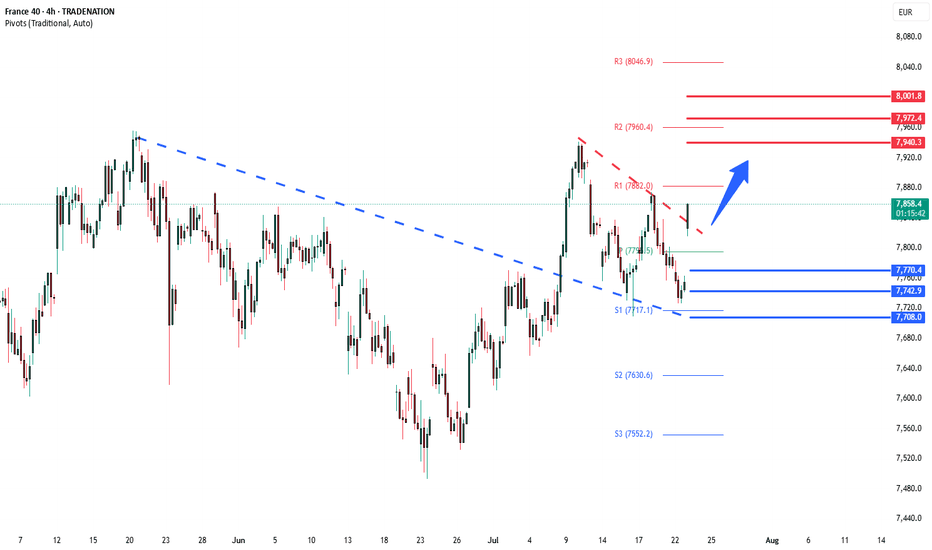

The CAC40 price action sentiment appears Bullish, supported by the current rising trend. The recent intraday price action appears to be a consolidation breakout. The key trading level is at the 7770 level, the previous consolidation price range. A corrective pullback from current levels and a bullish bounce back from the 7770 level could target the upside...

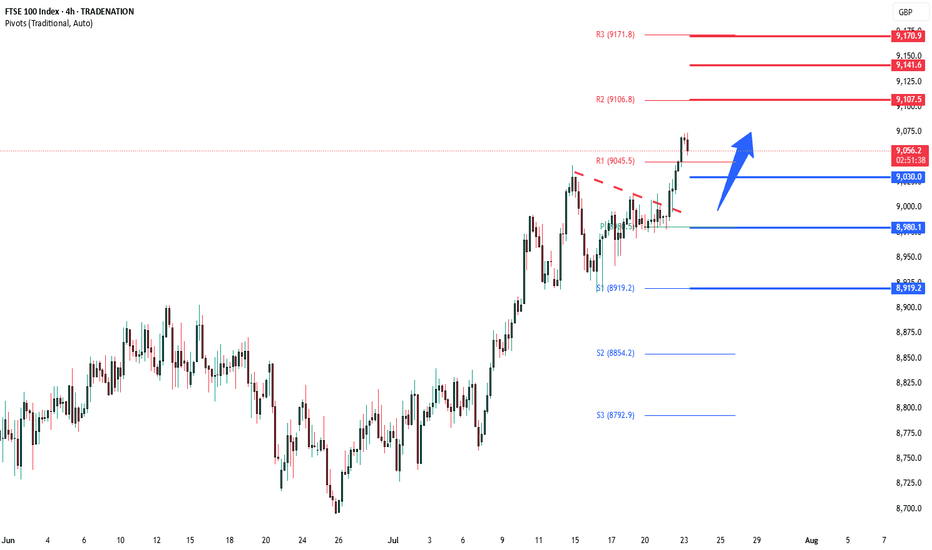

The FTSE remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend. Support Zone: 9030 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 9030 would confirm ongoing upside momentum, with potential targets at: 9107 – initial...