Market analysis from Trade Nation

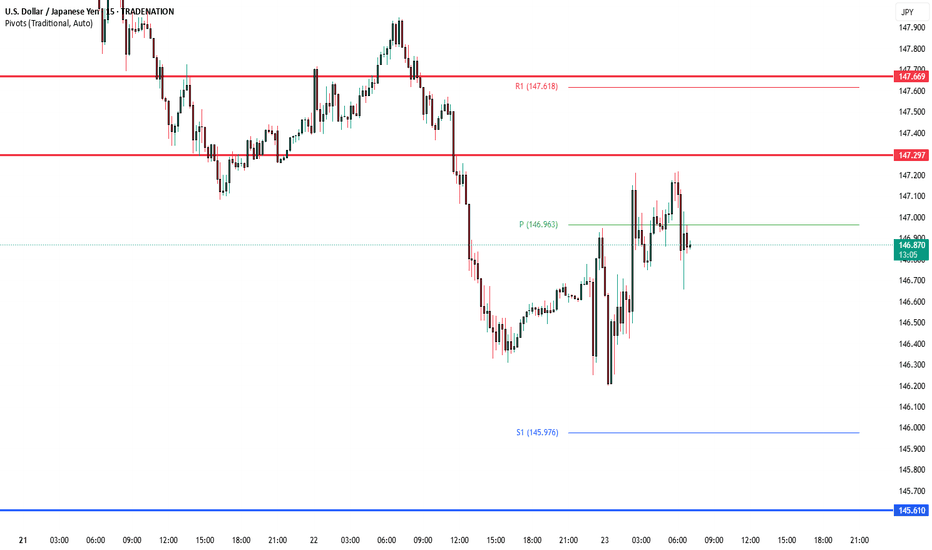

Donald Trump has agreed a new trade deal with Japan, setting 15% tariffs on US imports like cars and launching a $550 billion fund to boost investment in the US. This is lower than his earlier 25% tariff threat. Other allies saw mixed outcomes—the Philippines got a small tariff cut, while Canada’s talks stalled. Goldman Sachs now expects the US baseline tariff...

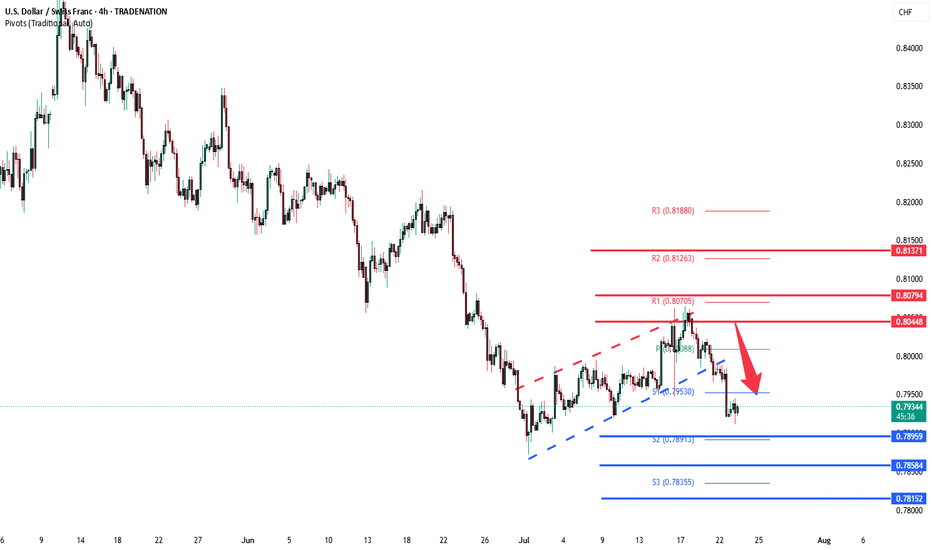

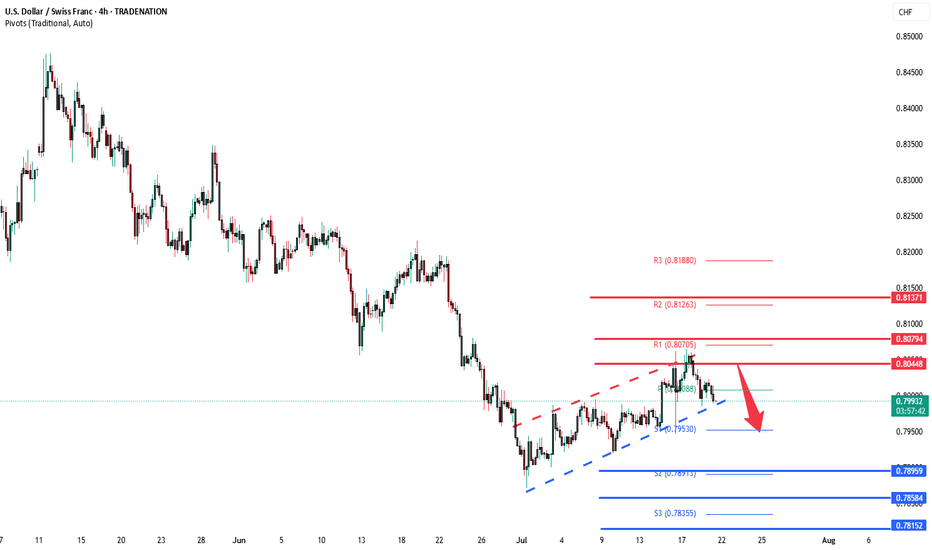

The USD/CHF pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend. Key resistance is located at 0.8045, a prior consolidation zone. This level will be critical in determining the next directional move. A bearish...

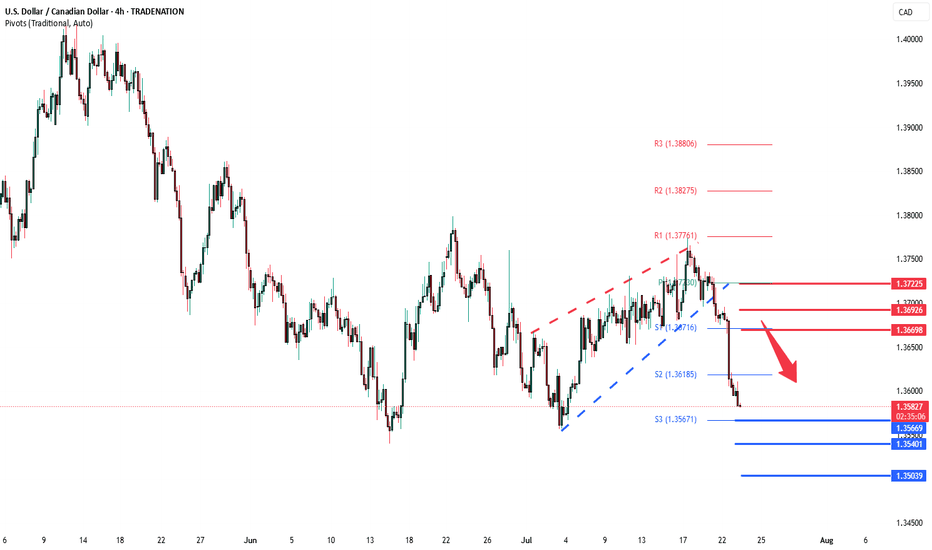

The USDCAD pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a continuation breakdown within the downtrend. Key resistance is located at 1.3670, a prior consolidation zone. This level will be critical in determining the next directional move. A bearish...

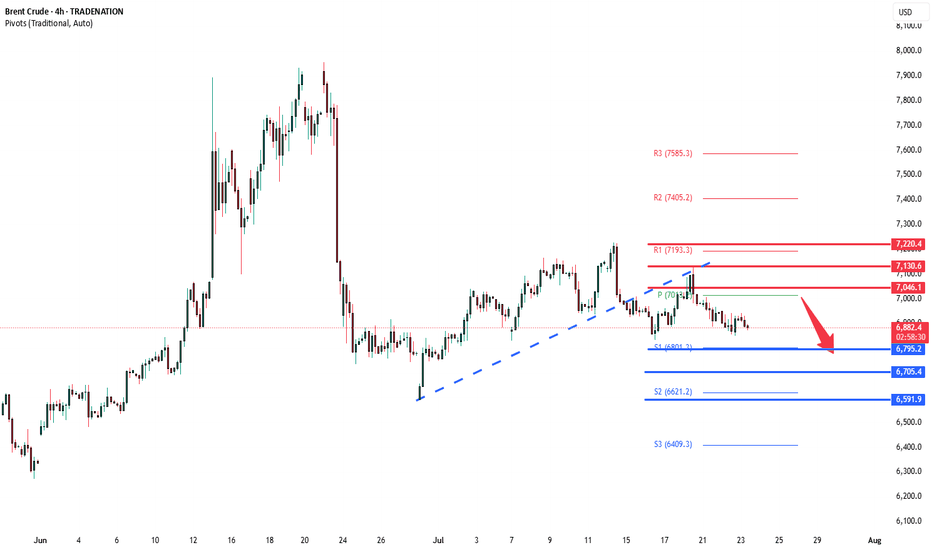

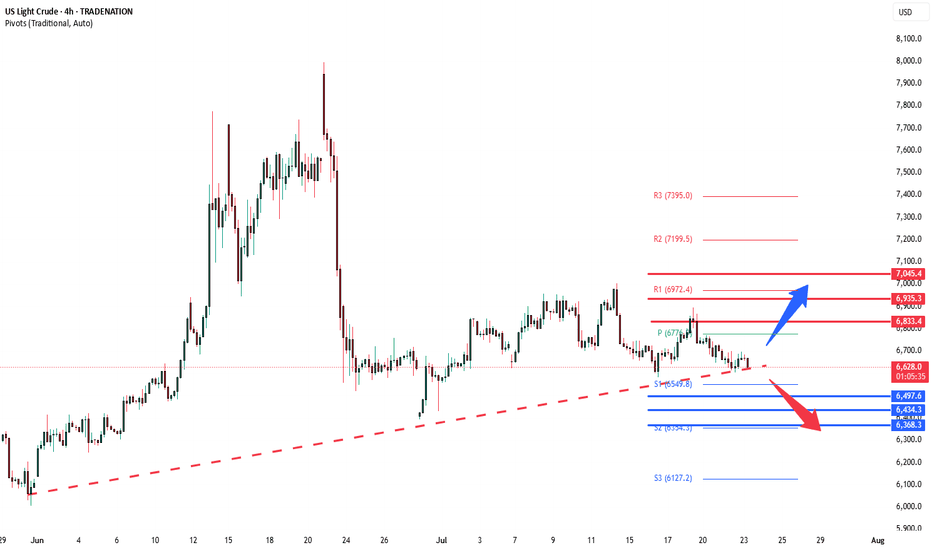

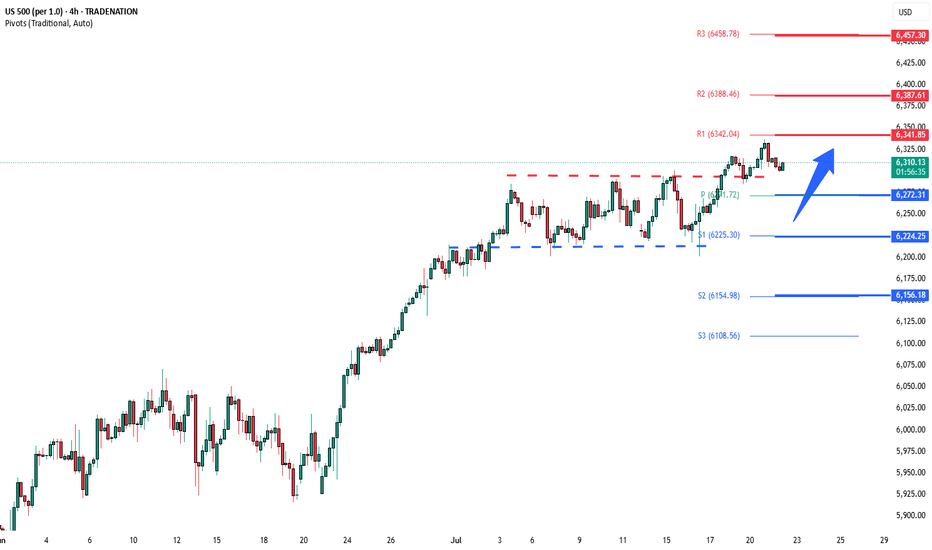

Key Support and Resistance Levels Resistance Level 1: 7050 Resistance Level 2: 7130 Resistance Level 3: 7220 Support Level 1: 6800 Support Level 2: 6700 Support Level 3: 6590 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not...

West Texas Intermediate (WTI) crude futures hovered near $66.30 during Wednesday’s European session, trading in a narrow range as investors awaited the latest US EIA crude inventory report. Market expectations point to a 1.4 million barrel drawdown, which would signal stronger demand and potentially support prices. However, crude failed to rally despite...

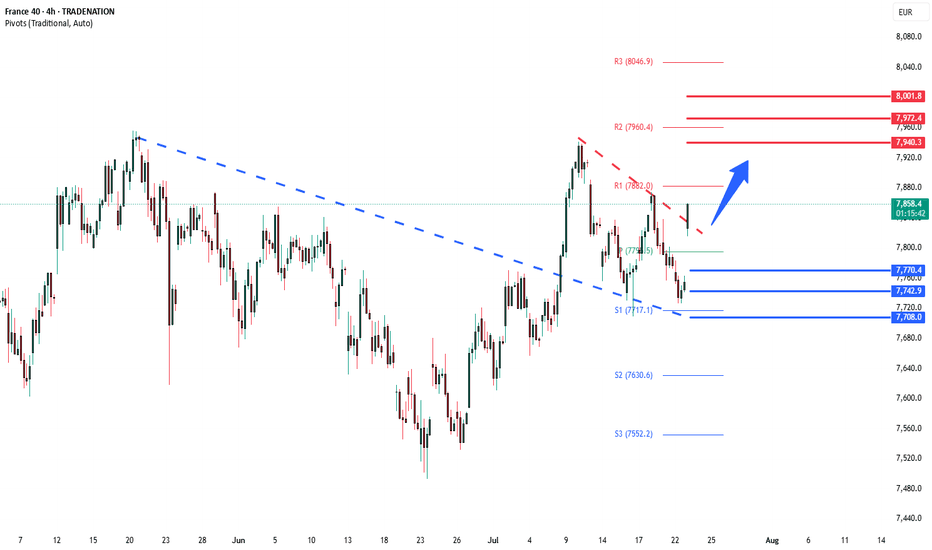

The CAC40 price action sentiment appears Bullish, supported by the current rising trend. The recent intraday price action appears to be a consolidation breakout. The key trading level is at the 7770 level, the previous consolidation price range. A corrective pullback from current levels and a bullish bounce back from the 7770 level could target the upside...

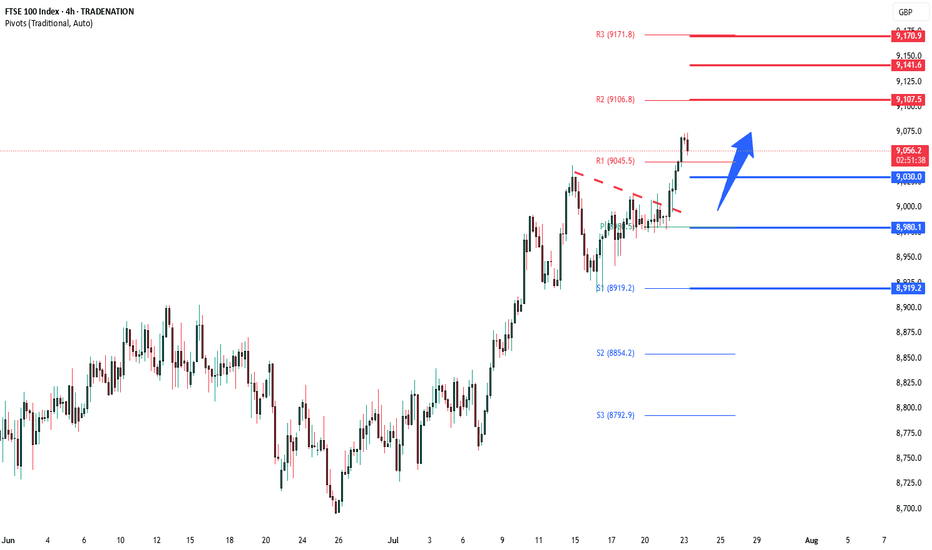

The FTSE remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend. Support Zone: 9030 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 9030 would confirm ongoing upside momentum, with potential targets at: 9107 – initial...

Economic Data US June Existing Home Sales (10:00 ET): Will gauge housing demand resilience amid high mortgage rates. A weaker print may support rate cut expectations. Eurozone July Consumer Confidence (Flash): Important for sentiment around ECB rate policy. Any downside surprise could weigh on the euro. Central Banks BoJ’s Uchida Speaks: Watch for any shift in...

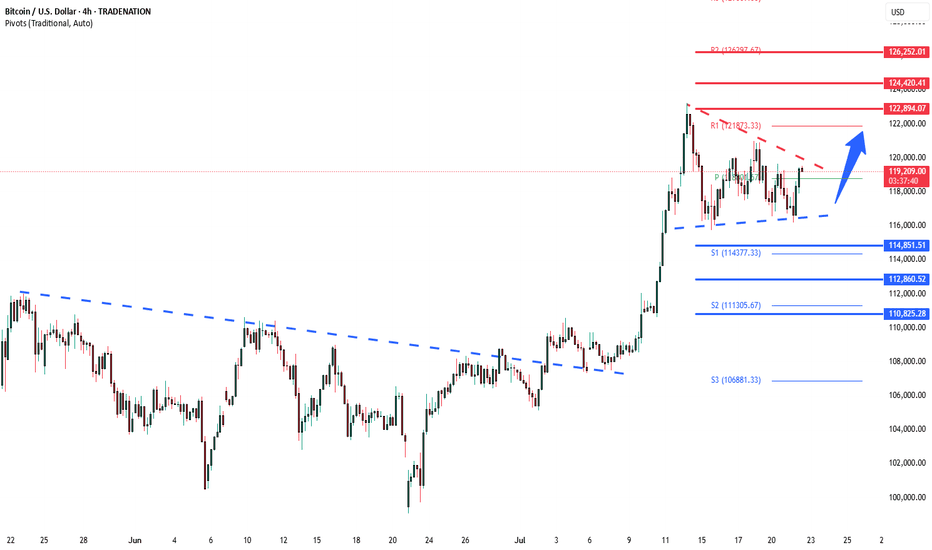

The BTCUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 114,850 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 114,850 would confirm ongoing upside momentum, with potential targets at: 122,900 –...

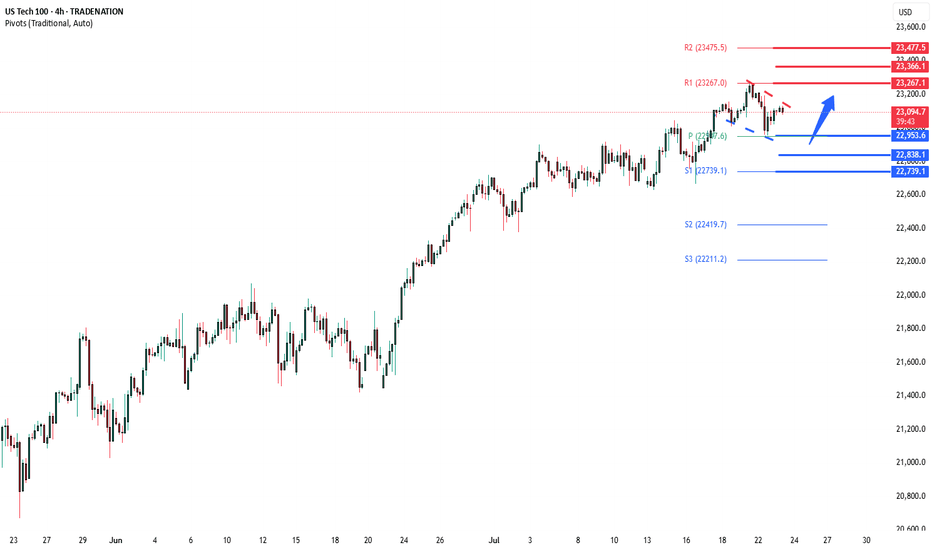

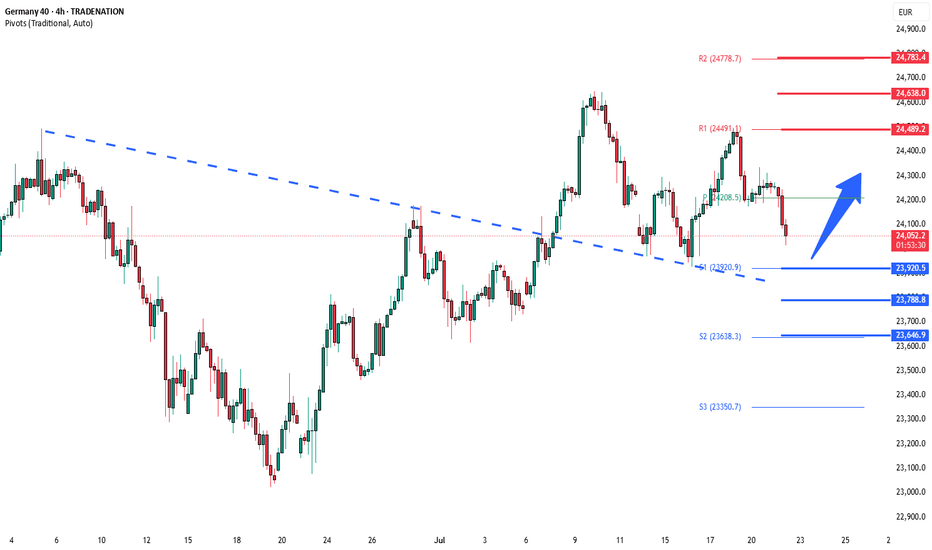

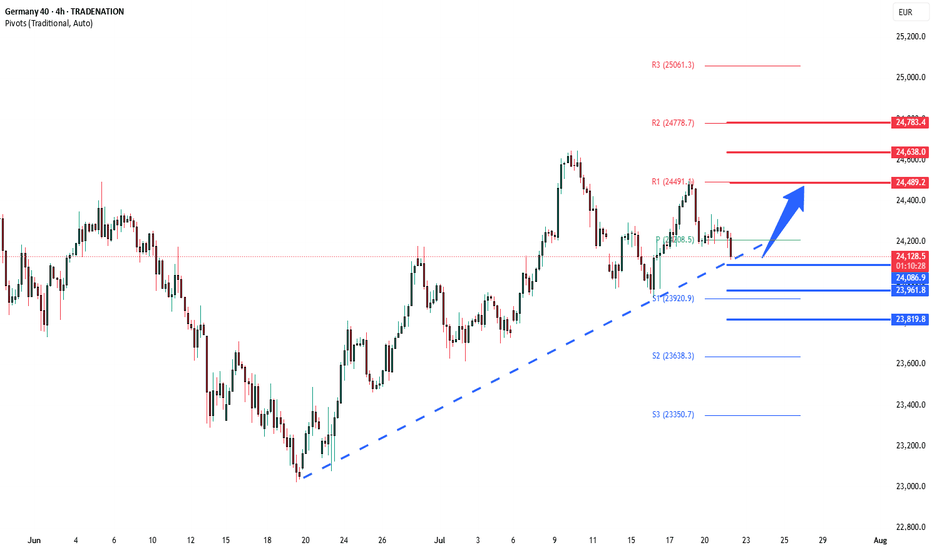

Key Support and Resistance Levels Resistance Level 1: 24490 Resistance Level 2: 24640 Resistance Level 3: 24780 Support Level 1: 23920 Support Level 2: 23790 Support Level 3: 23646 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is...

Key Developments: Fed Politics: Treasury Secretary Scott Bessent called for a review of the Fed’s $2.5B HQ renovation, continuing political pressure on Jerome Powell. This adds to the uncertainty around Fed independence and rate path. Meme Stock Surge: Opendoor soared 121% amid a retail-driven frenzy. Major institutional investors are also chasing the rally,...

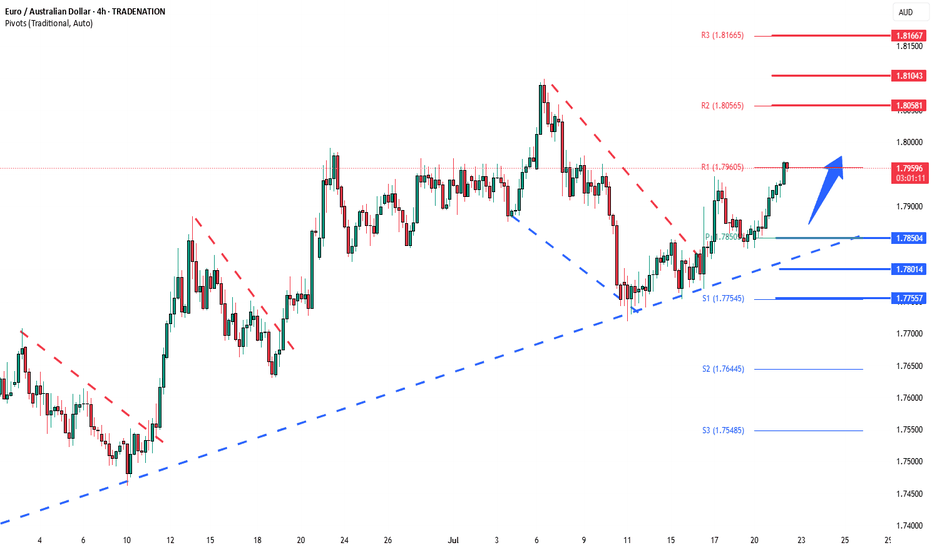

The EURAUD remains in a bullish trend, with recent price action indicating a continuation breakout within the broader uptrend. Support Zone: 1.7850 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 1.7850 would confirm ongoing upside momentum, with potential targets at: 1.8060 – initial...

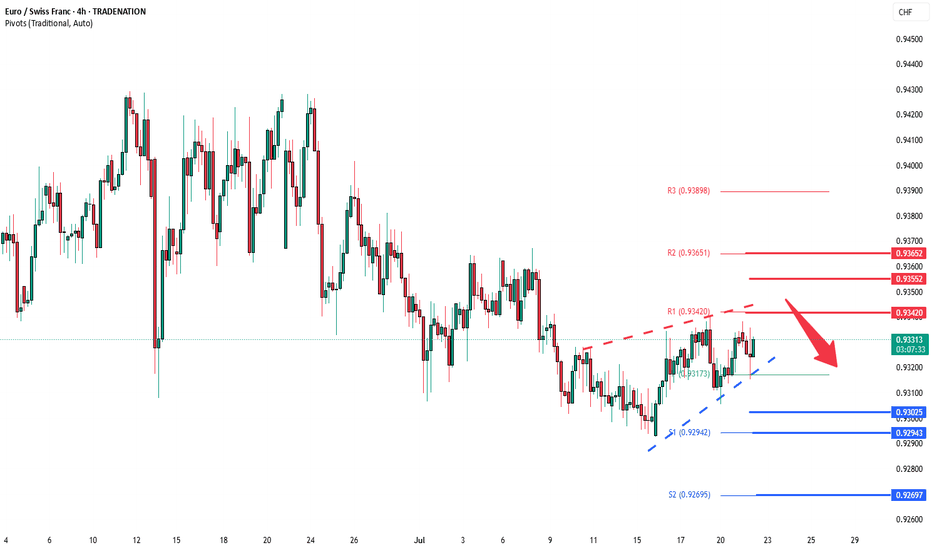

The EURCHF pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend. Key resistance is located at 0.9340, a prior consolidation zone. This level will be critical in determining the next directional move. A bearish...

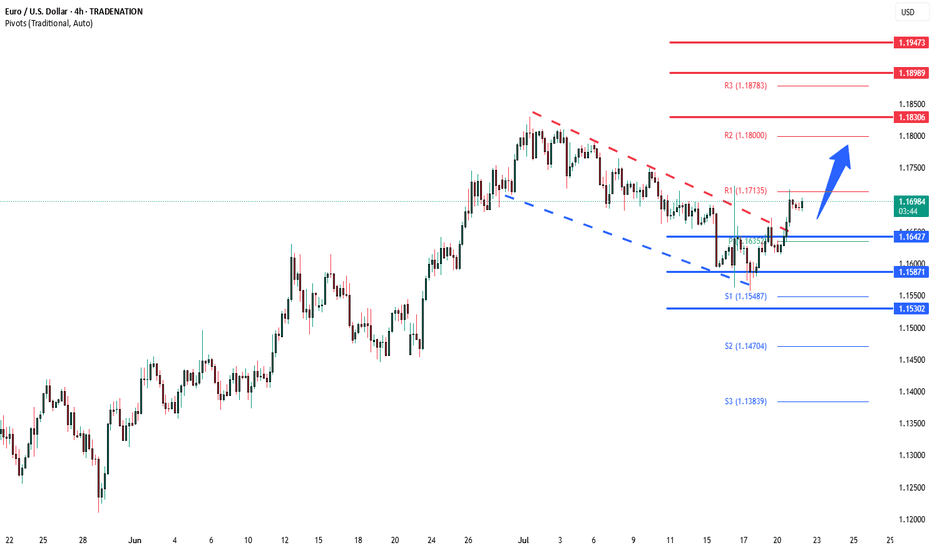

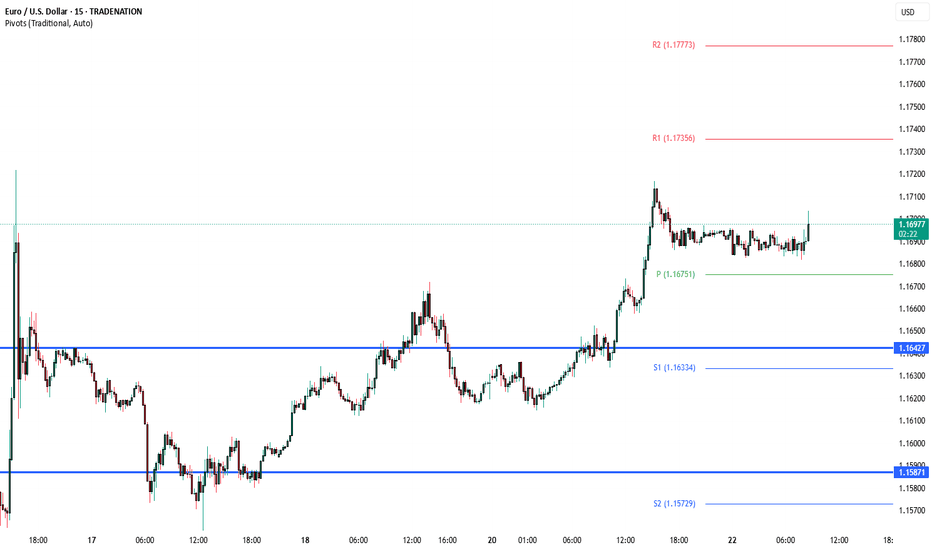

The EURUSD currency pair continues to exhibit a bullish price action bias, supported by a sustained rising trend. Recent intraday movement reflects a sideways consolidation breakout, suggesting potential continuation of the broader uptrend. Key Technical Level: 1.1640 This level marks the prior consolidation range and now acts as pivotal support. A corrective...

The DAX remains in a bullish trend, with recent price action showing signs of a resistance breakout within the broader uptrend. Support Zone: 24085 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 24085 would confirm ongoing upside momentum, with potential targets at: 24490 – initial...

Key Data Releases: US: Philadelphia Fed non-manufacturing activity – A pulse-check on services sector strength. Positive surprise could boost USD and Treasury yields. Richmond Fed manufacturing & business conditions – Insight into regional factory health; any contraction signals broader economic weakness. UK: June Public Finances – Higher borrowing may raise...

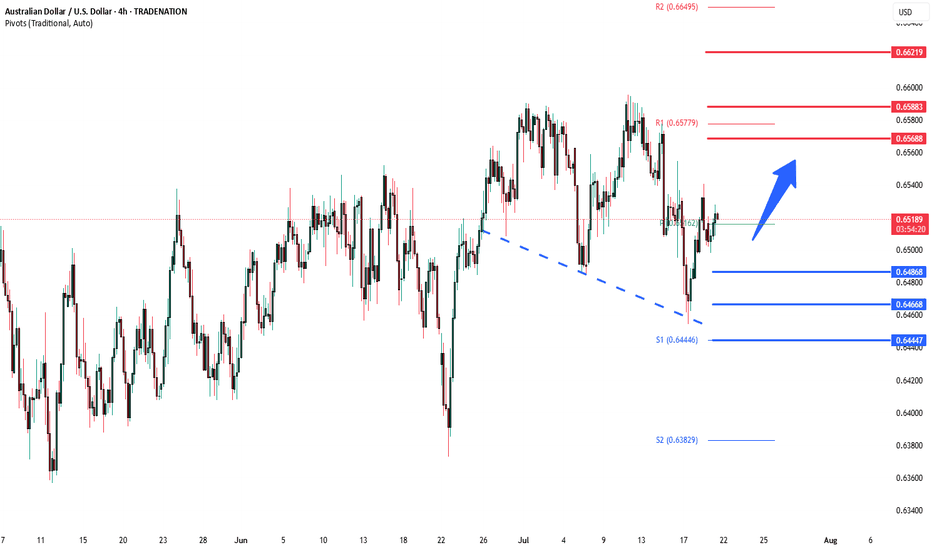

Trend Overview: The AUDUSD currency price remains in a bullish trend, characterised by higher highs and higher lows. The recent intraday price action is forming a continuation consolidation pattern, suggesting a potential pause before a renewed move higher. Key Technical Levels: Support: 0.6465 (primary pivot), followed by 0.6445 and 0.6400 Resistance: 0.6570...

The USD/CHF pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend. Key resistance is located at 0.8045, a prior consolidation zone. This level will be critical in determining the next directional move. A bearish...