Market analysis from Trade Nation

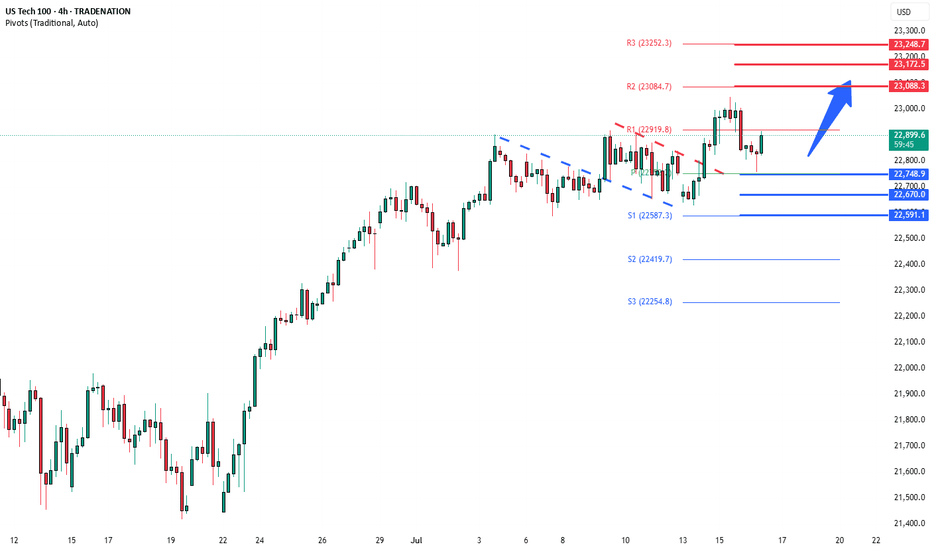

Tariff Expansion Threat: Donald Trump signaled upcoming tariffs on pharmaceuticals and semiconductors, two sectors heavily represented in the NASDAQ 100. These measures could: Raise consumer costs. Disrupt tech and healthcare supply chains. Add margin pressure on multinational firms. Corporate Impact: Rio Tinto revealed $300M in losses from US aluminum tariffs on...

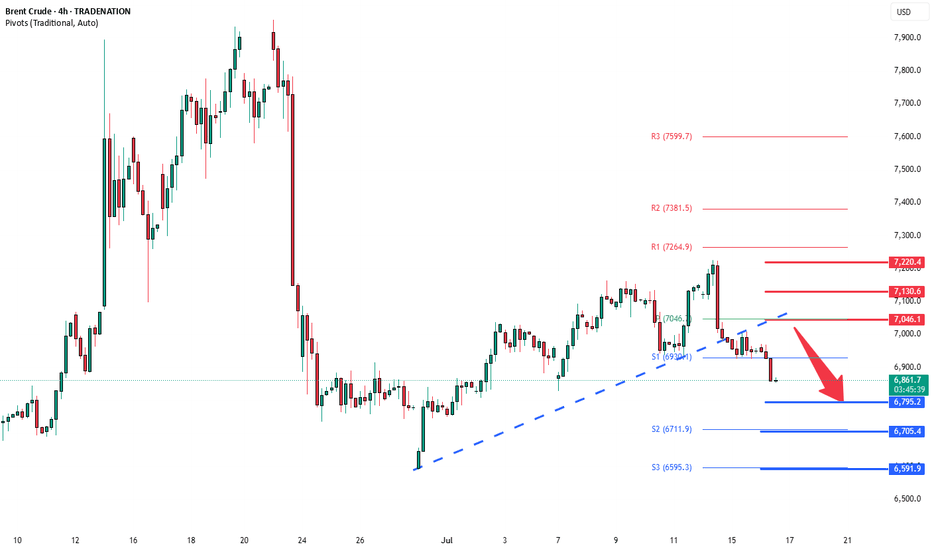

Key Support and Resistance Levels Resistance Level 1: 7050 Resistance Level 2: 7130 Resistance Level 3: 7220 Support Level 1: 6800 Support Level 2: 6700 Support Level 3: 6590 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not...

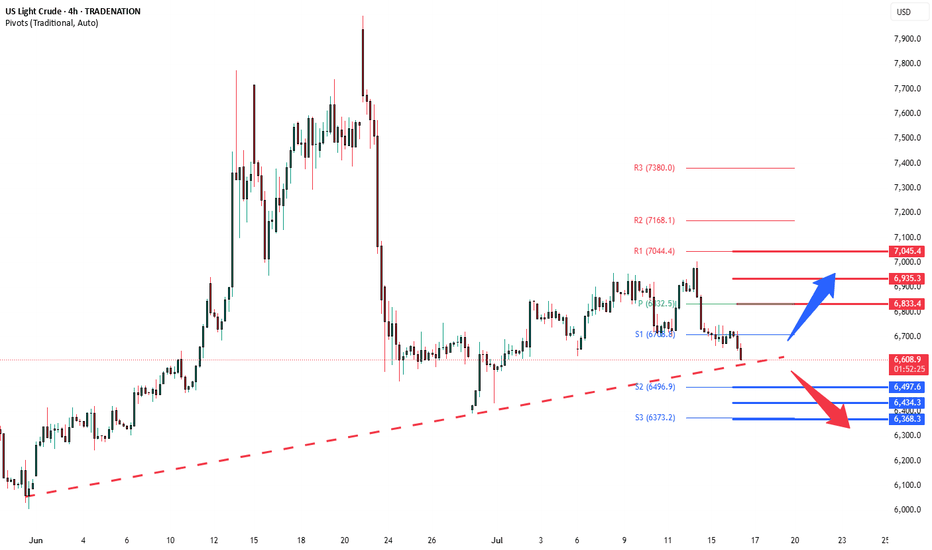

Trade Tensions & Inflation Impact on WTI Crude Tariff Announcement: The US has imposed reciprocal tariffs on 22 nations, including major trade partners such as the EU, Japan, Canada, Mexico, and South Korea, after a failed trade agreement during the 90-day negotiation window. EU Response: The EU is preparing retaliatory tariffs unless a deal is reached before the...

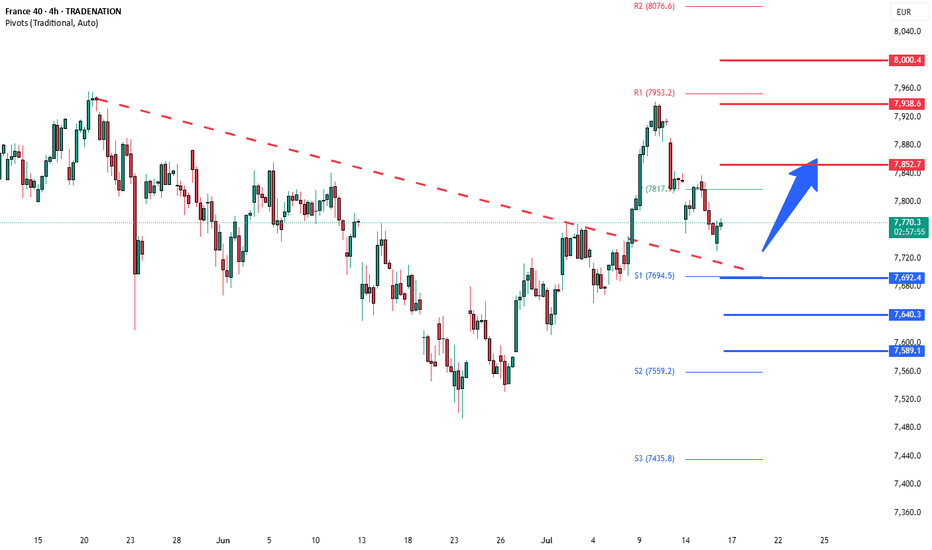

The CAC40 remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 7960 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 7690 would confirm ongoing upside momentum, with potential targets at: 7850 – initial...

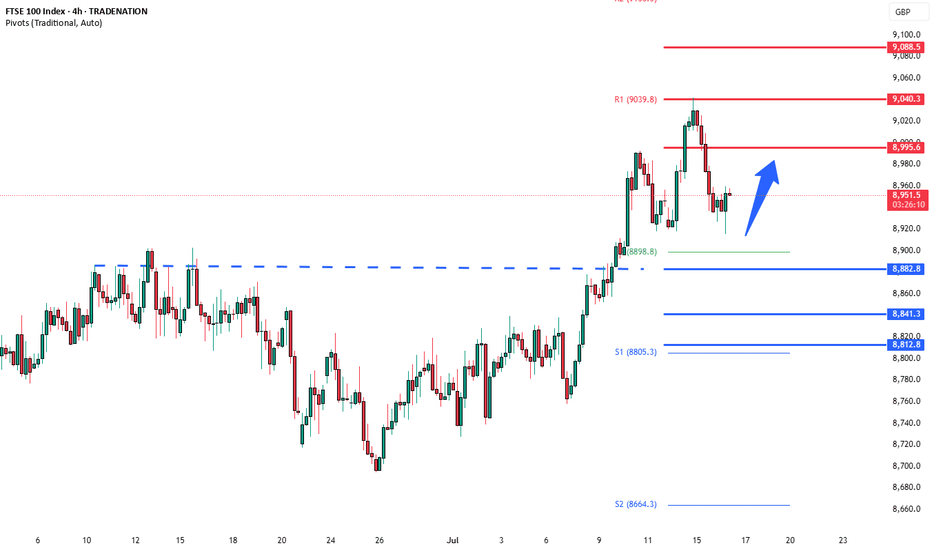

The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 8880 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 8880 would confirm ongoing upside momentum, with potential targets at: 8900 – initial...

United States June PPI: Not released yet — important for inflation outlook. Industrial Production (June): –0.2% month-on-month (weaker than expected). Capacity Utilisation: Fell to 77.4% from 77.7%. NY Fed Services Business Activity (July): Awaiting release. United Kingdom CPI (June): +3.6% year-on-year — higher than May’s 3.4%. Driven by food and air...

The BTCUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 114,850 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 114,850 would confirm ongoing upside momentum, with potential targets at: 122,900 –...

Key Support and Resistance Levels Resistance Level 1: 45000 Resistance Level 2: 45440 Resistance Level 3: 46000 Support Level 1: 43990 Support Level 2: 43700 Support Level 3: 43420 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is...

Trump’s $3.4 Trillion Tax Plan Favors wealthy investors: Tax burden shifts based on how you earn, not how much. Winners: Business owners, investors, high-income earners. Losers: Immigrants, elite universities. Trade Tensions EU Tariffs: Brussels targets $72B in US goods (e.g., Boeing, cars, bourbon) in response to Trump’s tariff threats. Impact: Risk to...

The EURAUD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 1.7720 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 1.7720 would confirm ongoing upside momentum, with potential targets at: 1.7920 – initial...

The EURCHF pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the previous support zone, suggesting a temporary sideways consolidation within the downtrend. Key resistance is located at 0.9320, a prior consolidation zone. This level will be critical in determining the next directional...

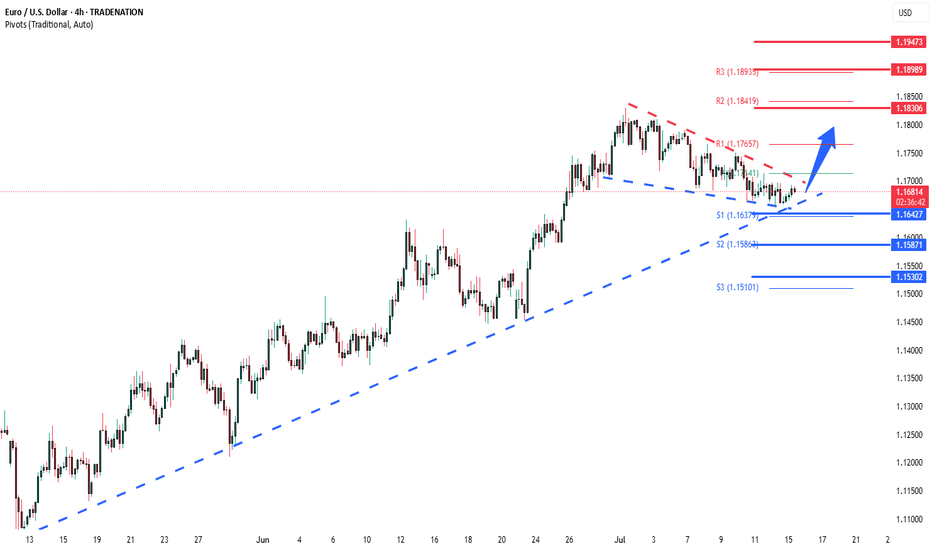

The EURUSD currency pair continues to exhibit a bullish price action bias, supported by a sustained rising trend. Recent intraday movement reflects a sideways consolidation breakout, suggesting potential continuation of the broader uptrend. Key Technical Level: 1.1640 This level marks the prior consolidation range and now acts as pivotal support. A corrective...

The DAX remains in a bullish trend, with recent price action showing signs of a resistance breakout within the broader uptrend. Support Zone: 24085 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 24085 would confirm ongoing upside momentum, with potential targets at: 24650 – initial...

Macro Data Highlights United States June CPI – Crucial inflation gauge; likely to shape Fed rate expectations. Empire Manufacturing Index (July) – Regional economic activity snapshot. China Q2 GDP – Key read on the health of the world’s second-largest economy. June Retail Sales / Industrial Production / Home Prices – Important for tracking domestic demand and...

The USD/CHF pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend. Key resistance is located at 0.8045, a prior consolidation zone. This level will be critical in determining the next directional move. A bearish...

The Silver remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend. Support Zone: 3770 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 3770 would confirm ongoing upside momentum, with potential targets at: 4000 – initial...

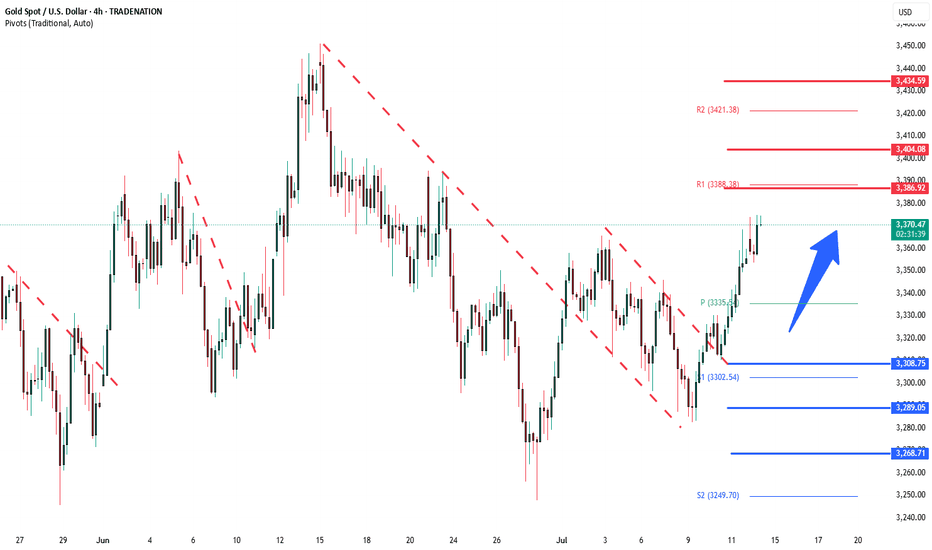

The Gold remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend. Support Zone: 3308 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 3308 would confirm ongoing upside momentum, with potential targets at: 3387 – initial...

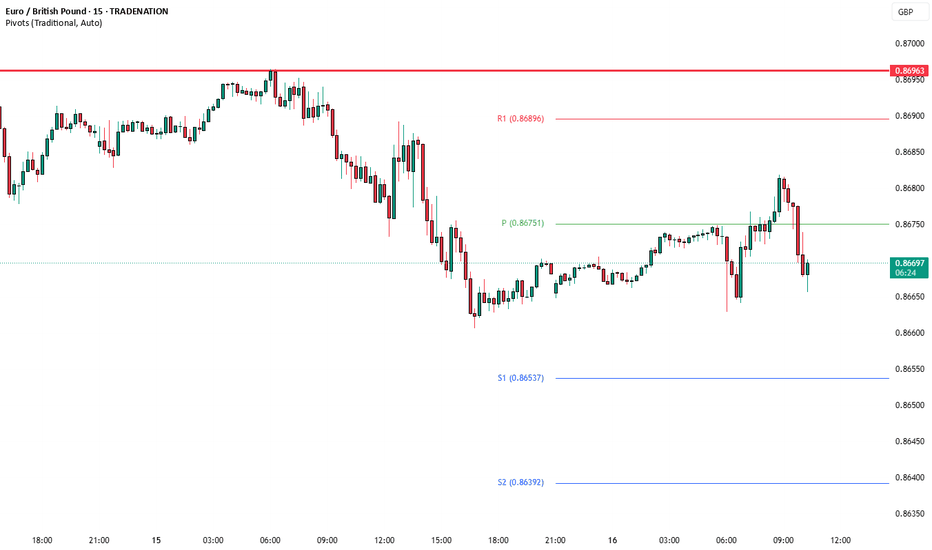

The EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 0.8620 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 0.8620 would confirm ongoing upside momentum, with potential targets at: 0.8700 – initial...