Market analysis from Trade Nation

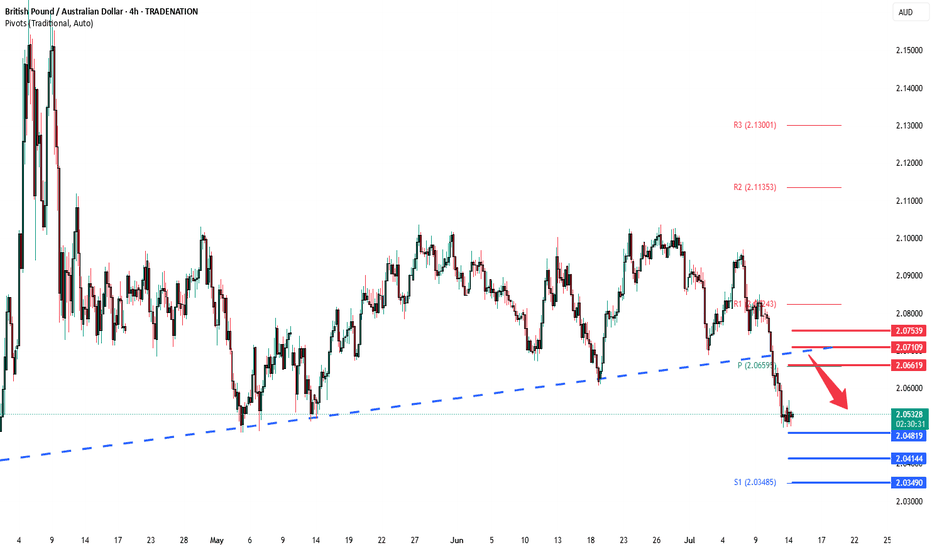

The GBPAUD pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the previous support zone, suggesting a temporary relief rally within the downtrend. Key resistance is located at 2.0660, a prior consolidation zone. This level will be critical in determining the next directional move. A...

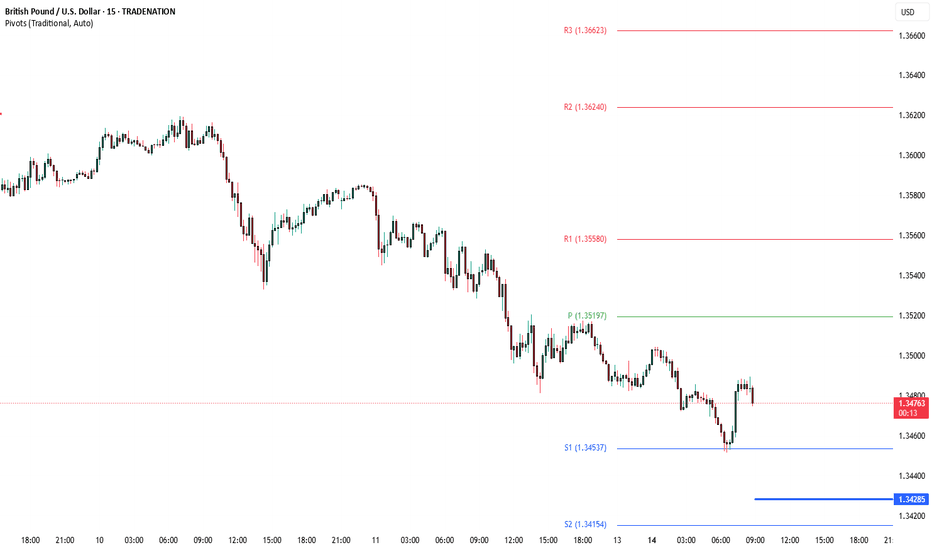

The GBPUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 1.3430 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 1.3430 would confirm ongoing upside momentum, with potential targets at: 1.3600 – initial...

The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 8880 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 8880 would confirm ongoing upside momentum, with potential targets at: 8900 – initial...

China – June Trade Balance Exports rose 5.8% year-on-year, beating expectations, as exporters rushed to ship goods before new U.S. tariffs. Imports increased 1.1% year-on-year, recovering slightly from a previous drop. Trade surplus expanded to $114.7 billion from $103.2 billion in May. Takeaway: Export strength is driven by temporary factors. Weak imports still...

Key Support and Resistance Levels Resistance Level 1: 45000 Resistance Level 2: 45445 Resistance Level 3: 46000 Support Level 1: 44000 Support Level 2: 43700 Support Level 3: 43430 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is...

Donald Trump escalated trade tensions again, threatening a 35% tariff on Canadian goods shortly after reopening trade talks, and floated doubling global tariffs to 20%. This reinforces his aggressive protectionist stance and puts renewed pressure on allies like Canada and Vietnam, the latter blindsided by a 20% levy. Meanwhile, US-China relations may be entering a...

The Silver remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend. Support Zone: 3686 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 3686 would confirm ongoing upside momentum, with potential targets at: 3814 – initial...

The Gold remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend. Support Zone: 3308 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 3308 would confirm ongoing upside momentum, with potential targets at: 3387 – initial...

The EURUSD currency pair continues to exhibit a bullish price action bias, supported by a sustained rising trend. Recent intraday movement reflects a sideways consolidation breakout, suggesting potential continuation of the broader uptrend. Key Technical Level: 1.1640 This level marks the prior consolidation range and now acts as pivotal support. A corrective...

The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 8880 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 8880 would confirm ongoing upside momentum, with potential targets at: 8900 – initial...

Friday, July 11 – Key Economic Data Summary: US: June federal budget balance will shed light on fiscal health. A wider deficit may raise debt concerns and impact bond markets. UK: May monthly GDP is crucial for gauging recession risk. Weak growth could pressure the pound and fuel rate cut expectations. Germany: June wholesale prices and May current account data...

The USDJPY pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend. Key resistance is located at 147.30, a prior consolidation zone. This level will be critical in determining the next directional move. A bearish...

Key Support and Resistance Levels Resistance Level 1: 45000 Resistance Level 2: 45445 Resistance Level 3: 46000 Support Level 1: 44000 Support Level 2: 43700 Support Level 3: 43430 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is...

US Secretary of State Marco Rubio is meeting Russian Foreign Minister Lavrov today at an ASEAN summit, as tensions remain high over the war in Ukraine. President Trump has criticized Putin and pledged more weapons for Ukraine. Meanwhile, Ukrainian allies are meeting in Rome to plan postwar rebuilding. Trump also announced new tariff plans—50% on Brazil and 20% on...

Key Support: 196.75 This level marks the prior consolidation zone and serves as a critical pivot. A corrective pullback toward 196.75 followed by a bullish reversal would validate the uptrend, with upside targets at: 199.20 – Initial resistance and short-term target 199.70 – Minor resistance zone 200.40 – Longer-term breakout objective However, a daily close...

The GBPCAD currency pair price action sentiment appears Bullish, supported by the current rising trend. The recent intraday price action seems to be a sideways consolidation breakout. The key trading level is at the 1.8500 level, the previous consolidation price range. A corrective pullback from the current levels and a bullish bounce back from the 1.8500 level...

The EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 0.8600 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 0.8600 would confirm ongoing upside momentum, with potential targets at: 0.8670 – initial...

The GBPUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 1.3544 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 1.3544 would confirm ongoing upside momentum, with potential targets at: 1.3770 – initial...