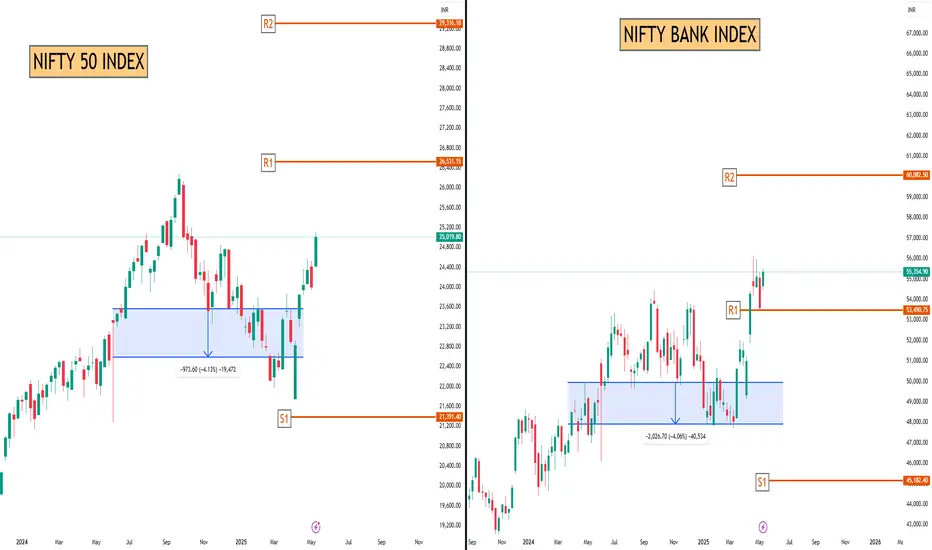

#NIFTY50

#NIFTYBANK

This is not a buy or sell recommendation only for educational purposes and I am not a SEBI registered.

Indian Stock Market Outlook - Monday, May 19, 2025

Market Overview

The Indian equity markets are poised for a cautious start to the week, following a volatile session on Friday, May 16, where the Nifty 50 closed at 25,019.8 and the Bank Nifty at 55,354.9.

The recent rally has been underpinned by easing geopolitical tensions, notably the India-Pakistan ceasefire, and renewed Foreign Institutional Investor (FII) interest. However, profit-booking at higher levels and global uncertainties may temper bullish sentiments.

Global & Domestic Factors Influencing the Market

India-Pakistan Ceasefire: The ceasefire agreement effective from May 10 has alleviated immediate geopolitical concerns, potentially supporting market stability.

FIl Activity: Renewed FII inflows have been observed, driven by easing global tensions and attractive valuations in Indian equities.

India-US Trade Relations: Ongoing negotiations between India and the US aim to resolve tariff disputes, with potential implications for sectors like pharmaceuticals and automotive.

US Economic Indicators: Recent US jobless claims and PMI data will be closely watched for cues on global economic health and potential impacts on emerging markets.

Q4 Earnings Season: Corporate earnings announcements will continue to influence stock-specific movements and sectoral trends.

Fundamental Analysis

Valuation Metrics: The Nifty 50's Price-to-Earnings (P/E) ratio remains elevated, suggesting cautious optimism among investors.

Sectoral Performance: Banking and Financial Services have shown resilience, while Information Technology and Metal sectors may face headwinds due to global factors.

Currency Fluctuations: The INR's performance against the USD will be critical, especially in light of recent US credit rating concerns.

✰ Stocks in Focus

1. IRFC (Indian Railway Finance Corporation):

Anticipated to benefit from increased infrastructure spending and government initiatives in the railway sector.

2. SJVN (Satluj Jal Vidyut Nigam):

Positive outlook due to its involvement in renewable energy projects and recent capacity expansions.

3. NBCC (India) Limited:

Expected to gain from government contracts and urban development projects.

4. Yes Bank:

Recent quarterly results indicate a significant improvement in profitability, suggesting a potential turnaround.

5. Tata Elxsi:

Despite a dip in net profit, the company's focus on design and technology services positions it well for future growth.

6. Mastek:

While facing short-term challenges, its strategic acquisitions and digital transformation services offer long-term potential.

7. State Bank of India (SBI):

Continues to demonstrate strength in asset quality and credit growth, reinforcing its leadership in the banking sector.

8. LTIMindtree:

Upcoming ex-dividend date and consistent performance in IT services make it a stock to watch.

9. Page Industries:

Investor interest may be piqued due to its impending ex-dividend date and strong brand presence in the apparel sector.

10. Havells India:

Focus on consumer electricals and expansion into new markets could drive future earnings.

Strategic Considerations for Traders

Risk Management: Given the current market volatility, implementing strict stop- loss orders is advisable.

Sector Rotation: Monitor shifts in sectoral leadership, particularly between defensives like FMCG and cyclicals like infrastructure.

Global Cues: Stay attuned to international developments, especially US economic data and geopolitical events, which could impact market sentiment.

*Note: This analysis is based on information available as of May 19, 2025, and is intended for informational purposes only. Investors should conduct their own research or consult financial advisors before making investment decisions.*

#NIFTYBANK

This is not a buy or sell recommendation only for educational purposes and I am not a SEBI registered.

Indian Stock Market Outlook - Monday, May 19, 2025

Market Overview

The Indian equity markets are poised for a cautious start to the week, following a volatile session on Friday, May 16, where the Nifty 50 closed at 25,019.8 and the Bank Nifty at 55,354.9.

The recent rally has been underpinned by easing geopolitical tensions, notably the India-Pakistan ceasefire, and renewed Foreign Institutional Investor (FII) interest. However, profit-booking at higher levels and global uncertainties may temper bullish sentiments.

Global & Domestic Factors Influencing the Market

India-Pakistan Ceasefire: The ceasefire agreement effective from May 10 has alleviated immediate geopolitical concerns, potentially supporting market stability.

FIl Activity: Renewed FII inflows have been observed, driven by easing global tensions and attractive valuations in Indian equities.

India-US Trade Relations: Ongoing negotiations between India and the US aim to resolve tariff disputes, with potential implications for sectors like pharmaceuticals and automotive.

US Economic Indicators: Recent US jobless claims and PMI data will be closely watched for cues on global economic health and potential impacts on emerging markets.

Q4 Earnings Season: Corporate earnings announcements will continue to influence stock-specific movements and sectoral trends.

Fundamental Analysis

Valuation Metrics: The Nifty 50's Price-to-Earnings (P/E) ratio remains elevated, suggesting cautious optimism among investors.

Sectoral Performance: Banking and Financial Services have shown resilience, while Information Technology and Metal sectors may face headwinds due to global factors.

Currency Fluctuations: The INR's performance against the USD will be critical, especially in light of recent US credit rating concerns.

✰ Stocks in Focus

1. IRFC (Indian Railway Finance Corporation):

Anticipated to benefit from increased infrastructure spending and government initiatives in the railway sector.

2. SJVN (Satluj Jal Vidyut Nigam):

Positive outlook due to its involvement in renewable energy projects and recent capacity expansions.

3. NBCC (India) Limited:

Expected to gain from government contracts and urban development projects.

4. Yes Bank:

Recent quarterly results indicate a significant improvement in profitability, suggesting a potential turnaround.

5. Tata Elxsi:

Despite a dip in net profit, the company's focus on design and technology services positions it well for future growth.

6. Mastek:

While facing short-term challenges, its strategic acquisitions and digital transformation services offer long-term potential.

7. State Bank of India (SBI):

Continues to demonstrate strength in asset quality and credit growth, reinforcing its leadership in the banking sector.

8. LTIMindtree:

Upcoming ex-dividend date and consistent performance in IT services make it a stock to watch.

9. Page Industries:

Investor interest may be piqued due to its impending ex-dividend date and strong brand presence in the apparel sector.

10. Havells India:

Focus on consumer electricals and expansion into new markets could drive future earnings.

Strategic Considerations for Traders

Risk Management: Given the current market volatility, implementing strict stop- loss orders is advisable.

Sector Rotation: Monitor shifts in sectoral leadership, particularly between defensives like FMCG and cyclicals like infrastructure.

Global Cues: Stay attuned to international developments, especially US economic data and geopolitical events, which could impact market sentiment.

*Note: This analysis is based on information available as of May 19, 2025, and is intended for informational purposes only. Investors should conduct their own research or consult financial advisors before making investment decisions.*

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.