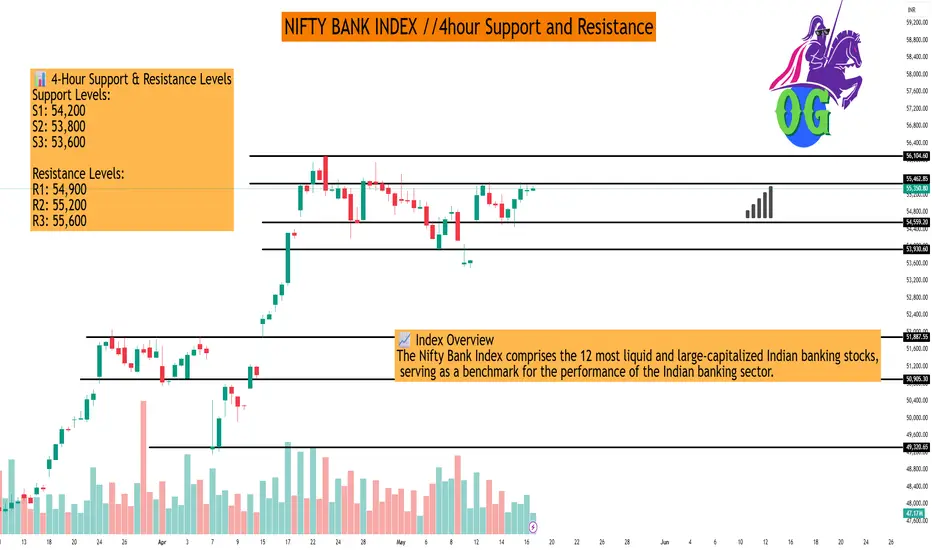

As of May 17, 2025, here are the key 4-hour support and resistance levels for the Nifty Bank Index (BANKNIFTY), based on recent technical analyses:

📊 4-Hour Support & Resistance Levels

Support Levels:

S1: 54,200

S2: 53,800

S3: 53,600

Resistance Levels:

R1: 54,900

R2: 55,200

R3: 55,600

These levels are derived from recent price actions and technical indicators, indicating potential zones where the index might find buying or selling pressure.

📈 Exponential Moving Averages (EMA) on 4-Hour Chart

EMA 50: 54,750

EMA 100: 54,400

EMA 200: 54,000

EMA 400: 53,600

These EMAs can act as dynamic support or resistance levels, providing insights into the index's short to medium-term trend.

🔍 Technical Outlook

Trend: The 4-hour timeframe indicates a bullish trend, with the index trading above key EMAs.

Momentum Indicators: Indicators such as RSI and MACD suggest positive momentum, supporting the bullish outlook.

Price Action: The index has recently bounced from the 54,500 support zone, indicating buying interest at lower levels.

📌 Summary

Immediate Support: 54,200

Immediate Resistance: 54,900

Trend: Bullish on 4-hour timeframe

Traders should monitor these levels closely, as a break above resistance could signal further upside, while a drop below support might indicate a potential reversal or consolidation.

If you need more detailed analysis or information on specific indicators, feel free to ask!

📊 4-Hour Support & Resistance Levels

Support Levels:

S1: 54,200

S2: 53,800

S3: 53,600

Resistance Levels:

R1: 54,900

R2: 55,200

R3: 55,600

These levels are derived from recent price actions and technical indicators, indicating potential zones where the index might find buying or selling pressure.

📈 Exponential Moving Averages (EMA) on 4-Hour Chart

EMA 50: 54,750

EMA 100: 54,400

EMA 200: 54,000

EMA 400: 53,600

These EMAs can act as dynamic support or resistance levels, providing insights into the index's short to medium-term trend.

🔍 Technical Outlook

Trend: The 4-hour timeframe indicates a bullish trend, with the index trading above key EMAs.

Momentum Indicators: Indicators such as RSI and MACD suggest positive momentum, supporting the bullish outlook.

Price Action: The index has recently bounced from the 54,500 support zone, indicating buying interest at lower levels.

📌 Summary

Immediate Support: 54,200

Immediate Resistance: 54,900

Trend: Bullish on 4-hour timeframe

Traders should monitor these levels closely, as a break above resistance could signal further upside, while a drop below support might indicate a potential reversal or consolidation.

If you need more detailed analysis or information on specific indicators, feel free to ask!

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.