As of May 13, 2025, Bharat Electronics Ltd (NSE: BEL) closed at ₹335.75, reflecting a 4.21% gain for the day.

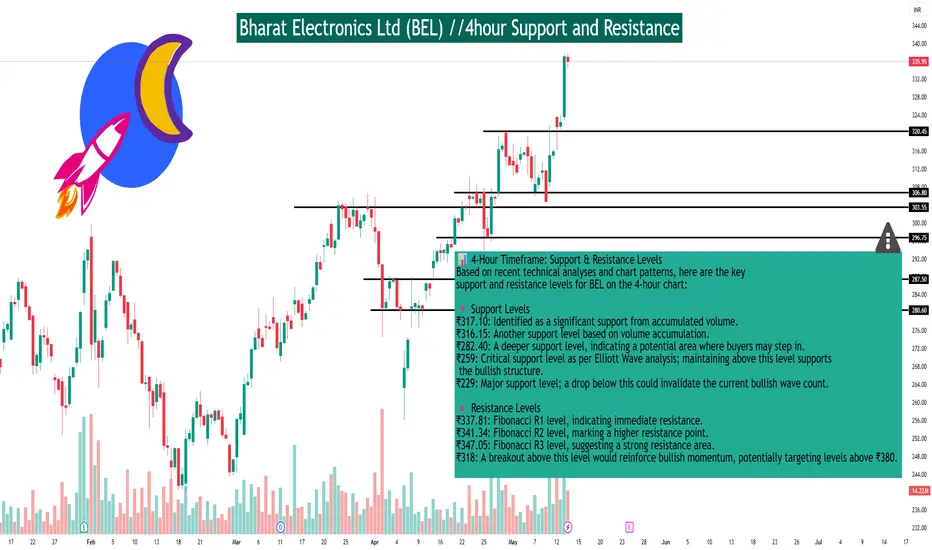

📊 4-Hour Timeframe: Support & Resistance Levels

Based on recent technical analyses and chart patterns, here are the key support and resistance levels for BEL on the 4-hour chart:

🔻 Support Levels

₹317.10: Identified as a significant support from accumulated volume.

₹316.15: Another support level based on volume accumulation.

₹282.40: A deeper support level, indicating a potential area where buyers may step in.

₹259: Critical support level as per Elliott Wave analysis; maintaining above this level supports the bullish structure.

₹229: Major support level; a drop below this could invalidate the current bullish wave count.

🔺 Resistance Levels

₹337.81: Fibonacci R1 level, indicating immediate resistance.

₹341.34: Fibonacci R2 level, marking a higher resistance point.

₹347.05: Fibonacci R3 level, suggesting a strong resistance area.

₹318: A breakout above this level would reinforce bullish momentum, potentially targeting levels above ₹380.

📈 Technical Outlook

BEL is currently in an upward trajectory within Minute Wave ((iii)) of Minor Wave 5, according to Elliott Wave analysis. To maintain this bullish structure, the price should stay above ₹259, with ₹229 being a critical support level. A breakout above ₹318 would confirm bullish control, with potential targets exceeding ₹380.

🔍 Additional Insights

Trend: The stock is in a strong rising trend in the short term, with expectations to rise 24.62% over the next 3 months, potentially reaching between ₹372.57 and ₹423.65.

Volatility: BEL has average daily movements with good trading volume, indicating medium risk.

Stop-Loss Recommendation: A suggested stop-loss is at ₹320.09, considering the medium daily movements and risk

📊 4-Hour Timeframe: Support & Resistance Levels

Based on recent technical analyses and chart patterns, here are the key support and resistance levels for BEL on the 4-hour chart:

🔻 Support Levels

₹317.10: Identified as a significant support from accumulated volume.

₹316.15: Another support level based on volume accumulation.

₹282.40: A deeper support level, indicating a potential area where buyers may step in.

₹259: Critical support level as per Elliott Wave analysis; maintaining above this level supports the bullish structure.

₹229: Major support level; a drop below this could invalidate the current bullish wave count.

🔺 Resistance Levels

₹337.81: Fibonacci R1 level, indicating immediate resistance.

₹341.34: Fibonacci R2 level, marking a higher resistance point.

₹347.05: Fibonacci R3 level, suggesting a strong resistance area.

₹318: A breakout above this level would reinforce bullish momentum, potentially targeting levels above ₹380.

📈 Technical Outlook

BEL is currently in an upward trajectory within Minute Wave ((iii)) of Minor Wave 5, according to Elliott Wave analysis. To maintain this bullish structure, the price should stay above ₹259, with ₹229 being a critical support level. A breakout above ₹318 would confirm bullish control, with potential targets exceeding ₹380.

🔍 Additional Insights

Trend: The stock is in a strong rising trend in the short term, with expectations to rise 24.62% over the next 3 months, potentially reaching between ₹372.57 and ₹423.65.

Volatility: BEL has average daily movements with good trading volume, indicating medium risk.

Stop-Loss Recommendation: A suggested stop-loss is at ₹320.09, considering the medium daily movements and risk

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.