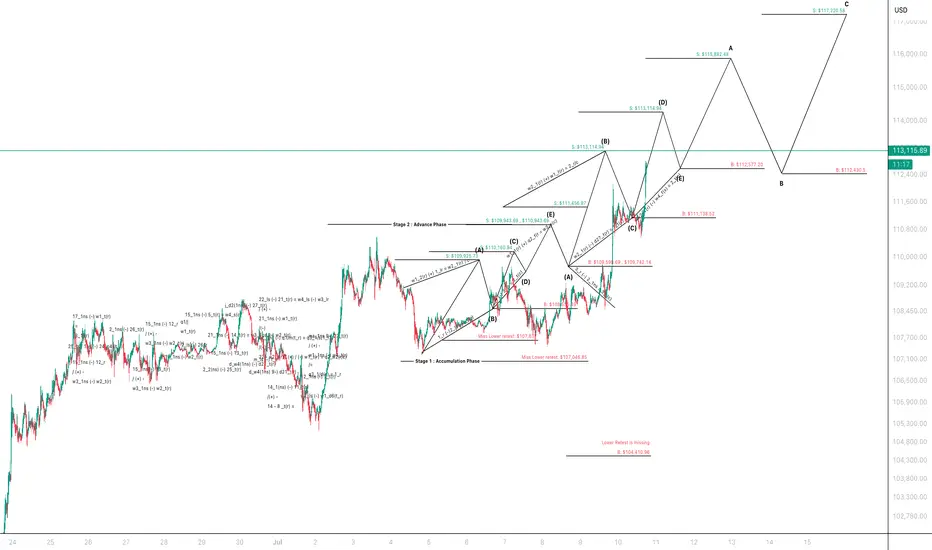

Model Type: Proprietary Market Forecasting Model

Asset: Bitcoin (BTC)

Phases Covered:

• Stage 1: Accumulation Phase

• Stage 2: Advance Phase

✅ Levels Completed

Level 1: Accumulation Phase Initiation

• Structure identified with a clear base formation.

• Price established a bottom around $107,046.85, narrowly missing the lower retest.

• Confirmed bullish reversal through July , Week 1 and Week2 structure completion.

Level 2: Early Breakout

• Marked by breakout above resistance at $109,925.73.

• Price pushed through to $110,160.94, validating the early advance.

• Completion of Week 2 of July indicating internal structure support.

Level 3: Mid-Cycle Rally

• Bullish continuation toward $110,943.69 and $111,456.97.

• Structure (C)-(D)-(E) confirms strong wave symmetry and market acceptance.

• Brief consolidation validated by backtest zones at $108,535.49 and $107,637.

Level 4: Expansion Phase

• Market continued to rally into $113,114.94, achieving projected top for (B).

• Retested support at $111,456.97, forming a new bullish foundation.

• Completion of Previous Month , Week 4 confirms higher - order fractal alignment.

Level 5: Distribution Setup

Price retested and reclaimed critical breakout zones:

• $109,598.69, $109,742.14, and $111,138.52.

• Completed fractal (C)-(E) cycle toward macro level (B).

• Finalised market structure transition from advance into early distribution.

🔍 Key Support & Resistance Levels

Support Zones (S):

• $109,925.73

• $110,160.94

• $110,943.69

• $111,456.97

Breakout Zones (B):

• $108,535.49

• $109,598.69

• $109,742.14

• $111,138.52

• $112,577.20

Missed Retests:

• $107,637

• $107,046.85

📌 Summary:

The BTC forecast published on July 5th has successfully completed Levels 1 through 5, with all key structural checkpoints met. The market followed the projected model fractals with high accuracy, including complex Week 1 & week2 structures covering June period, ABC-E corrections, and internal retests. This confirms the model’s live execution integrity and further solidifies its reliability for Q3 distribution forecasting.

Disclaimer: The following forecast is derived from a proprietary, hand-crafted mathematical model developed independently over several years. It does not rely on traditional indicators, technical patterns, or third-party frameworks such as Elliott Wave Theory.

This model calculates price action based on distribution phases, economic timing cycles, and natural market imbalances.

#BTC /USD #Market Structure #Cycle Analysis #Quant Model#Technical Outlook.

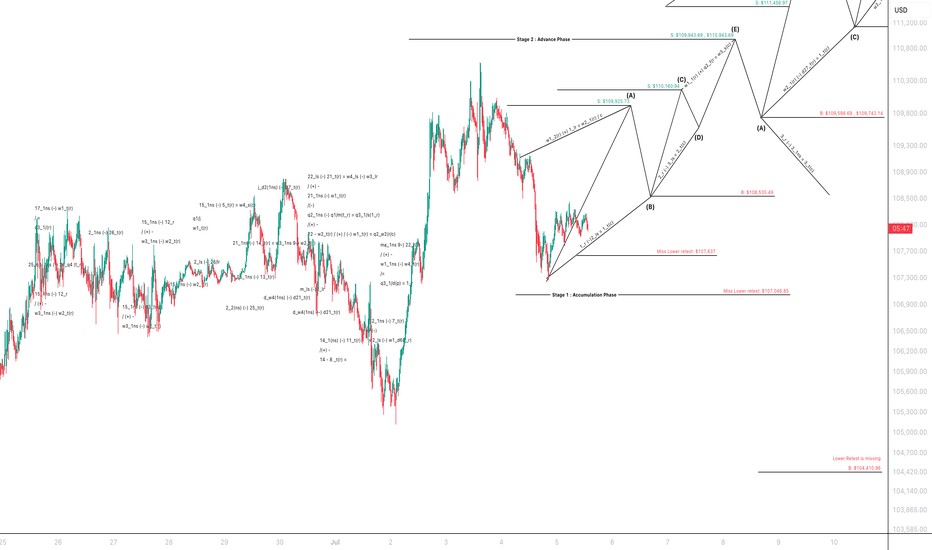

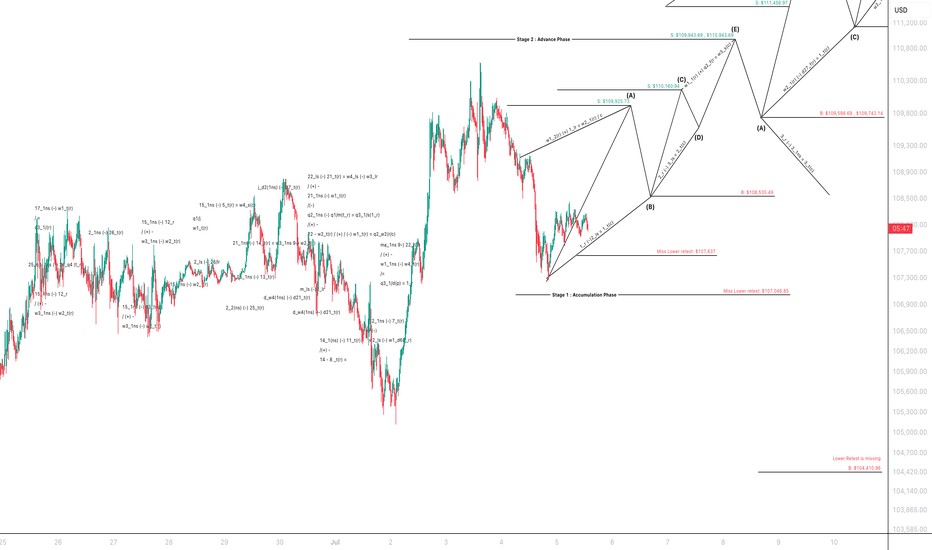

Asset: Bitcoin (BTC)

Phases Covered:

• Stage 1: Accumulation Phase

• Stage 2: Advance Phase

✅ Levels Completed

Level 1: Accumulation Phase Initiation

• Structure identified with a clear base formation.

• Price established a bottom around $107,046.85, narrowly missing the lower retest.

• Confirmed bullish reversal through July , Week 1 and Week2 structure completion.

Level 2: Early Breakout

• Marked by breakout above resistance at $109,925.73.

• Price pushed through to $110,160.94, validating the early advance.

• Completion of Week 2 of July indicating internal structure support.

Level 3: Mid-Cycle Rally

• Bullish continuation toward $110,943.69 and $111,456.97.

• Structure (C)-(D)-(E) confirms strong wave symmetry and market acceptance.

• Brief consolidation validated by backtest zones at $108,535.49 and $107,637.

Level 4: Expansion Phase

• Market continued to rally into $113,114.94, achieving projected top for (B).

• Retested support at $111,456.97, forming a new bullish foundation.

• Completion of Previous Month , Week 4 confirms higher - order fractal alignment.

Level 5: Distribution Setup

Price retested and reclaimed critical breakout zones:

• $109,598.69, $109,742.14, and $111,138.52.

• Completed fractal (C)-(E) cycle toward macro level (B).

• Finalised market structure transition from advance into early distribution.

🔍 Key Support & Resistance Levels

Support Zones (S):

• $109,925.73

• $110,160.94

• $110,943.69

• $111,456.97

Breakout Zones (B):

• $108,535.49

• $109,598.69

• $109,742.14

• $111,138.52

• $112,577.20

Missed Retests:

• $107,637

• $107,046.85

📌 Summary:

The BTC forecast published on July 5th has successfully completed Levels 1 through 5, with all key structural checkpoints met. The market followed the projected model fractals with high accuracy, including complex Week 1 & week2 structures covering June period, ABC-E corrections, and internal retests. This confirms the model’s live execution integrity and further solidifies its reliability for Q3 distribution forecasting.

Disclaimer: The following forecast is derived from a proprietary, hand-crafted mathematical model developed independently over several years. It does not rely on traditional indicators, technical patterns, or third-party frameworks such as Elliott Wave Theory.

This model calculates price action based on distribution phases, economic timing cycles, and natural market imbalances.

#BTC /USD #Market Structure #Cycle Analysis #Quant Model#Technical Outlook.

Institutional Note:

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Institutional Note:

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.