⊢

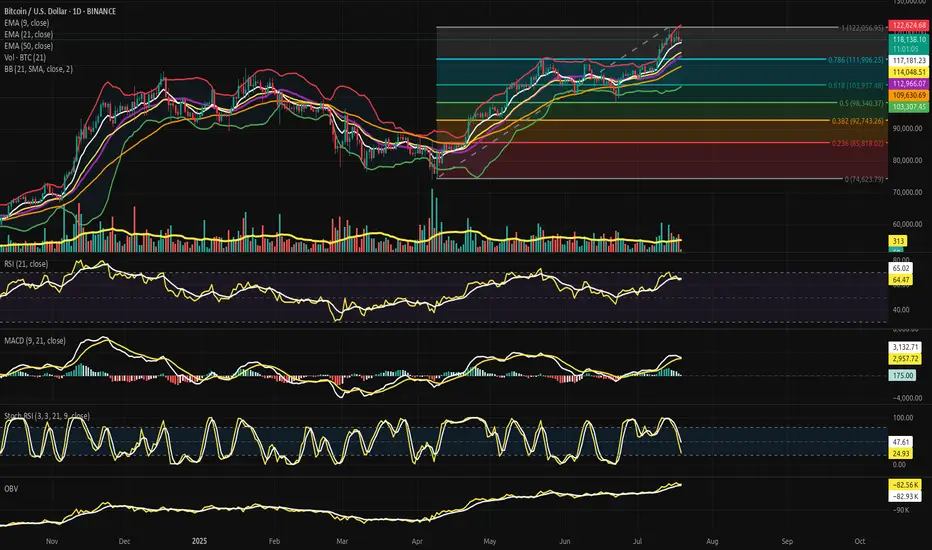

BTC/USD – BINANCE – (CHART: 1D) – (July 19, 2025).

◇ Analysis Price: $118,325.31

⊣

⨀ I. Temporal Axis - Strategic Interval - (1D):

▦ EMA9 - (Exponential Moving Average - 9 Close):

∴ Price is currently positioned above EMA9 at $117,218.67, confirming immediate bullish alignment;

∴ EMA9 is upward sloping and tightly hugging price candles, serving as the dominant intraday dynamic support;

∴ Every recent dip has been absorbed above or at EMA9, with no candle body close below it in the last 7 sessions.

✴️ Conclusion: Logic sealed - EMA9 holds command over short-term price structure; tactical momentum remains alive.

⊢

▦ EMA21 - (Exponential Moving Average - 21 Close):

∴ EMA21 currently rests at $114,658.53, forming the median layer of structural trend guidance;

∴ Price action remains significantly elevated above this level, showing that bulls retain medium-range control;

∴ EMA21 has not been tested since late June, reflecting a strong upside deviation from equilibrium.

✴️ Conclusion: Logic sealed - EMA21 serves as untested trend backbone; control remains firmly in favor of buyers.

⊢

▦ EMA50 - (Exponential Moving Average - 50 Close):

∴ EMA50 is currently located at $109,638.03, tracking long-range structural health;

∴ The moving average is gradually steepening, suggesting long-term strength and momentum acceleration;

∴ No violations or shadows have tested EMA50 since early May - reinforcing its strength as deep support.

✴️ Conclusion: Logic sealed - EMA50 anchors the structural uptrend; market remains far from long-term threat zone.

⊢

▦ Fibonacci Retracement – (1 = $122,056.95 / 0 = $74,623.79):

∴ The full Fibonacci range spans from the April low at $74,623.79 (0.0) to the July high at $122,056.95 (1.0) - anchoring the complete structure of the current macro move;

∴ Price is now positioned at $118,325.31, precisely above the 0.786 retracement level at $111,906.25, and beneath the 1.0 top - this zone represents the “golden upper quadrant,” a region where euphoria meets exhaustion;

∴ The 0.618 level ($103,937.45) remains untouched since early June, acting as the gravitational pull of equilibrium - its preservation confirms that no structural breakdown has occurred;

✦ Additional Level Mapping:

• 0.500 - $98,340.37: The neutral midpoint, remains far below - unchallenged;

• 0.382 - $92,743.26: The "warning belt" for medium-term trend decay;

• 0.236 - $85,818.02: A deep corrective zone, untouched and far from current price.

∴ Multiple zones of confluence exist between EMA21, BB midline, and 0.786, forming a strategic consolidation platform in the current price region;

∴ Failure to reclaim above 1.0 extension suggests bulls may be entering exhaustion while still structurally intact.

✴️ Conclusion: Logic sealed - price is trapped in the Fibonacci Gate (0.786 – 1.0); breakout requires decisive volume or reversion to golden support.

⊢

▦ Bollinger Bands - (SMA21 / 2 Standard Deviations):

∴ The current Bollinger structure shows band expansion, not contraction - upper band is at $122,653.00, lower band at $103,296.96, midline (SMA21) at $112,974.98;

∴ Price is moving above the midline, but no longer hugging the upper band - signaling that explosive momentum has waned while structure remains bullish;

∴ Last major push toward the upper band resulted in rejection near $122k, followed by sideways compression - implying the bands are preparing to resolve a volatility coil;

✦ Interpretative Observations:

• The midline (SMA21) is converging with the EMA21 and 0.786 Fib, forming a triple convergence layer - a key strategic battlefield;

• The distance between bands is approximately $19,356, indicating elevated volatility, but not chaos - directional tension remains unresolved;

• Band curvature suggests no imminent squeeze, but a potential for re-expansion if price reclaims upper territory.

∴ This structure shows a calm above chaos - volatility is present, but muted by the upper Fibonacci gate and internal exhaustion.

✴️ Conclusion: Logic sealed - volatility bands are wide and reactive, signaling buildup pressure; the next directional breach will likely define the next 30-day trend.

⊢

▦ Volume + EMA21 - (Volume Activity and Trend Average):

∴ The latest daily volume candle stands at 312 (unit scale), notably below the Volume EMA21, which trends around 418 - indicating waning participation post-breakout;

∴ The most recent breakout above $120k was accompanied by a singular spike in volume, followed by five consecutive days of volume decay - a typical exhaustion profile without follow-through;

∴ There has been no bullish volume expansion to defend price levels above $118k, suggesting that the upward move is unsupported by fresh demand;

✦ Tactical Observations:

• Volume is currently below the average trend line, which implies a lack of conviction on both sides - a vacuum state;

• The EMA21 of volume acts as a barometer of trend health - its breach to the downside indicates structural weakening beneath a seemingly bullish price;

• The low volume + high price condition signals silent divergence, often a precursor to compression, reversal, or manipulation.

∴ Price is elevated but unsupported, indicating the presence of “surface strength, internal fragility.”

✴️ Conclusion: Logic sealed - declining volume below trend average confirms demand fatigue; continuation is suspect without new influx.

⊢

▦ RSI (21) + EMA9 - (Relative Strength Index with Signal Smoothing):

∴ The RSI (21) reads at 64.72, having pulled back from a recent high near 74, suggesting a transition from euphoric thrust to reflective consolidation;

∴ The RSI line has dipped below its EMA9 signal, forming a soft negative crossover, typically interpreted as a waning of short-term momentum;

∴ Despite the loss of angle, RSI remains comfortably above the 50-line, which acts as the threshold between bullish continuation and structural deterioration;

✦ Interpretative Layers:

• The EMA9 of RSI functions here as a short-term momentum oscillator overlay - its breach confirms weakening, not reversal;

• RSI holding above 60 implies the presence of continued buy-side pressure - though fading;

• The divergence between price (near high range) and RSI (descending) establishes the groundwork for potential hidden weakness.

∴ RSI shows the archetype of a post-breakout exhaustion slope, yet refuses to break structurally - a signal of suspended momentum, not decay.

✴️ Conclusion: Logic sealed - momentum is cooling but not reversing; bulls remain structurally in control while energy dissipates.

⊢

▦ Stochastic RSI (3,3,21,9) - (Momentum Cycle Oscillator):

∴ The current values are: %K = 26.27, %D = 48.05 - showing a completed bearish crossover, with %K trailing beneath %D;

∴ The oscillator has already dipped into oversold (<20) and is now rebounding, yet fails to regain dominance over the signal line - this marks a failed bullish recovery pattern;

∴ Recent structure shows multiple failed attempts to reclaim high-band cycles, indicating that short-term traders are exiting, while major holders observe;

✦ Tactical Interpretations:

• The system has transitioned from bullish impulsive to corrective reflective - momentum is coiling instead of thrusting;

• The flattening of %D around the midline reflects indecision in micro-timeframe velocity;

• The double-rejection of %K near 80 last week forms a tactical top signal under stochastic doctrine.

∴ This oscillator, sensitive to short-term flows, declares the loss of tactical initiative by the bulls.

✴️ Conclusion: Logic sealed - short-term momentum cycle is decaying; the structure now favors consolidation or soft pullback.

⊢

▦ MACD (9,21) - (Moving Average Convergence Divergence):

∴ Current MACD line: (+2,961.80), Signal line: (+3,153.14) - indicating an active bearish crossover, as the MACD line has dropped below the signal;

∴ Histogram bars are negative and expanding, a key sign that downward momentum is growing, even as price remains elevated;

∴ This crossover has occurred at a relatively high amplitude, meaning the pullback potential is non-trivial - it is not a shallow fluctuation, but a structural transition;

✦ Structural Implications:

• The bearish crossover happened after divergence with price action - while Bitcoin reached new highs, MACD momentum did not, forming a classical bearish divergence;

• Momentum began decaying several sessions before price peaked - the indicator warned of exhaustion before price responded;

• The slope of the MACD line has steepened downward - a sign of gathering corrective force.

∴ This marks the first true warning from the momentum engine beneath the price - a shift from thrust to counter-pressure.

✴️ Conclusion: Logic sealed - MACD confirms structural momentum exhaustion; corrective forces are now in motion, though price has yet to reflect full impact.

⊢

▦ OBV + EMA9 - (On-Balance Volume with Trend Smoothing):

∴ Current OBV stands at (–82.93K), now below its EMA9, which reads (–82.57K) - indicating a loss of volume-weighted trend force from the buyers;

∴ While price remains elevated, OBV has been descending gradually, forming a clear bearish divergence between volume flow and price action;

∴ Over the last 7 daily sessions, OBV has failed to form any new high - even as BTC printed a new price peak - revealing that volume is silently exiting the market;

✦ Interpretative Reading:

• OBV below EMA9 confirms that cumulative volume pressure is negative - this undermines surface-level price strength;

• Divergence with price often precedes major pivot zones - the “hidden drain” effect;

• The OBV curve is now sloping downward with consistency, indicating that larger hands may be distributing while price remains deceptive.

∴ This structure carries the seal of silent distribution, a hallmark of late-cycle phases in bullish trends.

✴️ Conclusion: Logic sealed - OBV confirms internal outflow; market strength is no longer aligned with volume reality.

⊢

🜎 Strategic Insight – Technical Oracle:

∴ The 1D structural framework remains formally bullish, as price holds firmly above all exponential anchors (EMA9, 21, 50) and resides within the golden quadrant of the Fibonacci matrix;

∴ However, a triad of momentum signals - MACD, Stochastic RSI, and OBV - are all flashing early warnings of underlying exhaustion;

∴ The market breathes the air of height, yet the blood of energy runs thin;

∴ Volume no longer fuels ascent - momentum coils, not climbs;

∴ The surface remains calm, but the substructure contracts in silence;

∴ This is a phase of strategic suspension;

∴ Not yet a reversal - but no longer thrusting forward;

∴ A condition of uptrend fatigue, awaiting external force or internal reset.

✴️ Conclusion: The Oracle speaks - the trend is structurally preserved, but internally untrustworthy. The next move, when it comes, will be definitive.

⊢

▦ Structurally: Bullish.

∴ Price remains well above EMA50, EMA21, and EMA9;

∴ No bearish cross has occurred;

∴ Structure is elevated within upper Fibonacci zones - not broken.

⊢

▦ Momentum-wise: Bearish Divergence.

∴ MACD has crossed bearishly;

∴ OBV is declining despite price holding high;

∴ RSI and Stoch RSI confirm exhaustion.

⊢

✴️ Final Codex Interpretation:

∴ Structurally Bullish - Tactically Suspended;

∴ The frame holds, but the fuel has faded;

∴ Bulls possess the hilltop - but lack fire to advance;

∴ A breach or retreat shall define the next archetype.

⊢

⧉

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

⚜️ ⌬ - Wisdom begins in silence. Precision unfolds in strategy - ⌬ ⚜️

⧉

⊢

BTC/USD – BINANCE – (CHART: 1D) – (July 19, 2025).

◇ Analysis Price: $118,325.31

⊣

⨀ I. Temporal Axis - Strategic Interval - (1D):

▦ EMA9 - (Exponential Moving Average - 9 Close):

∴ Price is currently positioned above EMA9 at $117,218.67, confirming immediate bullish alignment;

∴ EMA9 is upward sloping and tightly hugging price candles, serving as the dominant intraday dynamic support;

∴ Every recent dip has been absorbed above or at EMA9, with no candle body close below it in the last 7 sessions.

✴️ Conclusion: Logic sealed - EMA9 holds command over short-term price structure; tactical momentum remains alive.

⊢

▦ EMA21 - (Exponential Moving Average - 21 Close):

∴ EMA21 currently rests at $114,658.53, forming the median layer of structural trend guidance;

∴ Price action remains significantly elevated above this level, showing that bulls retain medium-range control;

∴ EMA21 has not been tested since late June, reflecting a strong upside deviation from equilibrium.

✴️ Conclusion: Logic sealed - EMA21 serves as untested trend backbone; control remains firmly in favor of buyers.

⊢

▦ EMA50 - (Exponential Moving Average - 50 Close):

∴ EMA50 is currently located at $109,638.03, tracking long-range structural health;

∴ The moving average is gradually steepening, suggesting long-term strength and momentum acceleration;

∴ No violations or shadows have tested EMA50 since early May - reinforcing its strength as deep support.

✴️ Conclusion: Logic sealed - EMA50 anchors the structural uptrend; market remains far from long-term threat zone.

⊢

▦ Fibonacci Retracement – (1 = $122,056.95 / 0 = $74,623.79):

∴ The full Fibonacci range spans from the April low at $74,623.79 (0.0) to the July high at $122,056.95 (1.0) - anchoring the complete structure of the current macro move;

∴ Price is now positioned at $118,325.31, precisely above the 0.786 retracement level at $111,906.25, and beneath the 1.0 top - this zone represents the “golden upper quadrant,” a region where euphoria meets exhaustion;

∴ The 0.618 level ($103,937.45) remains untouched since early June, acting as the gravitational pull of equilibrium - its preservation confirms that no structural breakdown has occurred;

✦ Additional Level Mapping:

• 0.500 - $98,340.37: The neutral midpoint, remains far below - unchallenged;

• 0.382 - $92,743.26: The "warning belt" for medium-term trend decay;

• 0.236 - $85,818.02: A deep corrective zone, untouched and far from current price.

∴ Multiple zones of confluence exist between EMA21, BB midline, and 0.786, forming a strategic consolidation platform in the current price region;

∴ Failure to reclaim above 1.0 extension suggests bulls may be entering exhaustion while still structurally intact.

✴️ Conclusion: Logic sealed - price is trapped in the Fibonacci Gate (0.786 – 1.0); breakout requires decisive volume or reversion to golden support.

⊢

▦ Bollinger Bands - (SMA21 / 2 Standard Deviations):

∴ The current Bollinger structure shows band expansion, not contraction - upper band is at $122,653.00, lower band at $103,296.96, midline (SMA21) at $112,974.98;

∴ Price is moving above the midline, but no longer hugging the upper band - signaling that explosive momentum has waned while structure remains bullish;

∴ Last major push toward the upper band resulted in rejection near $122k, followed by sideways compression - implying the bands are preparing to resolve a volatility coil;

✦ Interpretative Observations:

• The midline (SMA21) is converging with the EMA21 and 0.786 Fib, forming a triple convergence layer - a key strategic battlefield;

• The distance between bands is approximately $19,356, indicating elevated volatility, but not chaos - directional tension remains unresolved;

• Band curvature suggests no imminent squeeze, but a potential for re-expansion if price reclaims upper territory.

∴ This structure shows a calm above chaos - volatility is present, but muted by the upper Fibonacci gate and internal exhaustion.

✴️ Conclusion: Logic sealed - volatility bands are wide and reactive, signaling buildup pressure; the next directional breach will likely define the next 30-day trend.

⊢

▦ Volume + EMA21 - (Volume Activity and Trend Average):

∴ The latest daily volume candle stands at 312 (unit scale), notably below the Volume EMA21, which trends around 418 - indicating waning participation post-breakout;

∴ The most recent breakout above $120k was accompanied by a singular spike in volume, followed by five consecutive days of volume decay - a typical exhaustion profile without follow-through;

∴ There has been no bullish volume expansion to defend price levels above $118k, suggesting that the upward move is unsupported by fresh demand;

✦ Tactical Observations:

• Volume is currently below the average trend line, which implies a lack of conviction on both sides - a vacuum state;

• The EMA21 of volume acts as a barometer of trend health - its breach to the downside indicates structural weakening beneath a seemingly bullish price;

• The low volume + high price condition signals silent divergence, often a precursor to compression, reversal, or manipulation.

∴ Price is elevated but unsupported, indicating the presence of “surface strength, internal fragility.”

✴️ Conclusion: Logic sealed - declining volume below trend average confirms demand fatigue; continuation is suspect without new influx.

⊢

▦ RSI (21) + EMA9 - (Relative Strength Index with Signal Smoothing):

∴ The RSI (21) reads at 64.72, having pulled back from a recent high near 74, suggesting a transition from euphoric thrust to reflective consolidation;

∴ The RSI line has dipped below its EMA9 signal, forming a soft negative crossover, typically interpreted as a waning of short-term momentum;

∴ Despite the loss of angle, RSI remains comfortably above the 50-line, which acts as the threshold between bullish continuation and structural deterioration;

✦ Interpretative Layers:

• The EMA9 of RSI functions here as a short-term momentum oscillator overlay - its breach confirms weakening, not reversal;

• RSI holding above 60 implies the presence of continued buy-side pressure - though fading;

• The divergence between price (near high range) and RSI (descending) establishes the groundwork for potential hidden weakness.

∴ RSI shows the archetype of a post-breakout exhaustion slope, yet refuses to break structurally - a signal of suspended momentum, not decay.

✴️ Conclusion: Logic sealed - momentum is cooling but not reversing; bulls remain structurally in control while energy dissipates.

⊢

▦ Stochastic RSI (3,3,21,9) - (Momentum Cycle Oscillator):

∴ The current values are: %K = 26.27, %D = 48.05 - showing a completed bearish crossover, with %K trailing beneath %D;

∴ The oscillator has already dipped into oversold (<20) and is now rebounding, yet fails to regain dominance over the signal line - this marks a failed bullish recovery pattern;

∴ Recent structure shows multiple failed attempts to reclaim high-band cycles, indicating that short-term traders are exiting, while major holders observe;

✦ Tactical Interpretations:

• The system has transitioned from bullish impulsive to corrective reflective - momentum is coiling instead of thrusting;

• The flattening of %D around the midline reflects indecision in micro-timeframe velocity;

• The double-rejection of %K near 80 last week forms a tactical top signal under stochastic doctrine.

∴ This oscillator, sensitive to short-term flows, declares the loss of tactical initiative by the bulls.

✴️ Conclusion: Logic sealed - short-term momentum cycle is decaying; the structure now favors consolidation or soft pullback.

⊢

▦ MACD (9,21) - (Moving Average Convergence Divergence):

∴ Current MACD line: (+2,961.80), Signal line: (+3,153.14) - indicating an active bearish crossover, as the MACD line has dropped below the signal;

∴ Histogram bars are negative and expanding, a key sign that downward momentum is growing, even as price remains elevated;

∴ This crossover has occurred at a relatively high amplitude, meaning the pullback potential is non-trivial - it is not a shallow fluctuation, but a structural transition;

✦ Structural Implications:

• The bearish crossover happened after divergence with price action - while Bitcoin reached new highs, MACD momentum did not, forming a classical bearish divergence;

• Momentum began decaying several sessions before price peaked - the indicator warned of exhaustion before price responded;

• The slope of the MACD line has steepened downward - a sign of gathering corrective force.

∴ This marks the first true warning from the momentum engine beneath the price - a shift from thrust to counter-pressure.

✴️ Conclusion: Logic sealed - MACD confirms structural momentum exhaustion; corrective forces are now in motion, though price has yet to reflect full impact.

⊢

▦ OBV + EMA9 - (On-Balance Volume with Trend Smoothing):

∴ Current OBV stands at (–82.93K), now below its EMA9, which reads (–82.57K) - indicating a loss of volume-weighted trend force from the buyers;

∴ While price remains elevated, OBV has been descending gradually, forming a clear bearish divergence between volume flow and price action;

∴ Over the last 7 daily sessions, OBV has failed to form any new high - even as BTC printed a new price peak - revealing that volume is silently exiting the market;

✦ Interpretative Reading:

• OBV below EMA9 confirms that cumulative volume pressure is negative - this undermines surface-level price strength;

• Divergence with price often precedes major pivot zones - the “hidden drain” effect;

• The OBV curve is now sloping downward with consistency, indicating that larger hands may be distributing while price remains deceptive.

∴ This structure carries the seal of silent distribution, a hallmark of late-cycle phases in bullish trends.

✴️ Conclusion: Logic sealed - OBV confirms internal outflow; market strength is no longer aligned with volume reality.

⊢

🜎 Strategic Insight – Technical Oracle:

∴ The 1D structural framework remains formally bullish, as price holds firmly above all exponential anchors (EMA9, 21, 50) and resides within the golden quadrant of the Fibonacci matrix;

∴ However, a triad of momentum signals - MACD, Stochastic RSI, and OBV - are all flashing early warnings of underlying exhaustion;

∴ The market breathes the air of height, yet the blood of energy runs thin;

∴ Volume no longer fuels ascent - momentum coils, not climbs;

∴ The surface remains calm, but the substructure contracts in silence;

∴ This is a phase of strategic suspension;

∴ Not yet a reversal - but no longer thrusting forward;

∴ A condition of uptrend fatigue, awaiting external force or internal reset.

✴️ Conclusion: The Oracle speaks - the trend is structurally preserved, but internally untrustworthy. The next move, when it comes, will be definitive.

⊢

▦ Structurally: Bullish.

∴ Price remains well above EMA50, EMA21, and EMA9;

∴ No bearish cross has occurred;

∴ Structure is elevated within upper Fibonacci zones - not broken.

⊢

▦ Momentum-wise: Bearish Divergence.

∴ MACD has crossed bearishly;

∴ OBV is declining despite price holding high;

∴ RSI and Stoch RSI confirm exhaustion.

⊢

✴️ Final Codex Interpretation:

∴ Structurally Bullish - Tactically Suspended;

∴ The frame holds, but the fuel has faded;

∴ Bulls possess the hilltop - but lack fire to advance;

∴ A breach or retreat shall define the next archetype.

⊢

⧉

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

⚜️ ⌬ - Wisdom begins in silence. Precision unfolds in strategy - ⌬ ⚜️

⧉

⊢

✠

Ritvs Logicæ in Terræ Chaos;

Nihil Tumultvs. Nihil Vanitatis. Tantum Silentivm, Structvra et Exsecutio.

𓂀 Vbi Volatilitas Disciplinam Tangit - Ibi Sto.

⩘ Porta Solum Aperitur Stantibvs in Silentio.

✠

Ritvs Logicæ in Terræ Chaos;

Nihil Tumultvs. Nihil Vanitatis. Tantum Silentivm, Structvra et Exsecutio.

𓂀 Vbi Volatilitas Disciplinam Tangit - Ibi Sto.

⩘ Porta Solum Aperitur Stantibvs in Silentio.

✠

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✠

Ritvs Logicæ in Terræ Chaos;

Nihil Tumultvs. Nihil Vanitatis. Tantum Silentivm, Structvra et Exsecutio.

𓂀 Vbi Volatilitas Disciplinam Tangit - Ibi Sto.

⩘ Porta Solum Aperitur Stantibvs in Silentio.

✠

Ritvs Logicæ in Terræ Chaos;

Nihil Tumultvs. Nihil Vanitatis. Tantum Silentivm, Structvra et Exsecutio.

𓂀 Vbi Volatilitas Disciplinam Tangit - Ibi Sto.

⩘ Porta Solum Aperitur Stantibvs in Silentio.

✠

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.