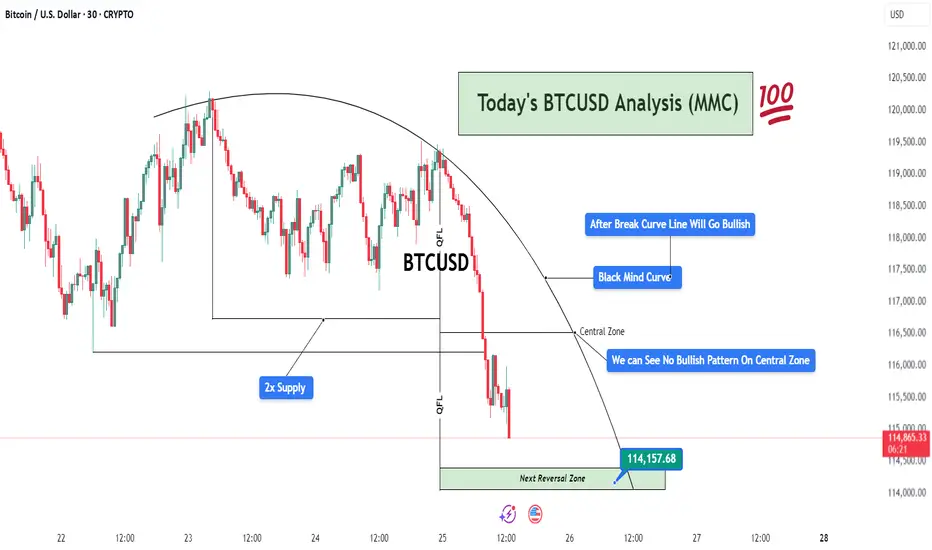

This 30-minute BTCUSD chart highlights a well-structured bearish movement following the MMC (Mirror Market Concepts) framework. The analysis centers around the Black Mind Curve, multiple QFL drops, and supply/demand imbalances, presenting a professional outlook on current price action and potential reversals.

🧠 Black Mind Curve – Mapping Market Psychology

The Black Mind Curve is a visual representation of the market’s psychological behavior and serves as a dynamic resistance throughout this structure. Price respected the curvature, slowly losing bullish strength while forming lower highs.

This curve mirrors a distribution phase, where smart money unloads long positions before initiating a downside move.

Your annotation: “After Break Curve Line Will Go Bullish” implies that unless the curve is cleanly broken with strong bullish conviction, the bias remains bearish.

So far, the price is respecting the curve, reinforcing sellers’ control.

🔵 2x Supply Zone – Aggressive Selling Region

The supply zone is tested twice, confirming the presence of institutional-level sellers. This zone becomes critical because:

First touch: Minor reaction, but no follow-through.

Second touch: Strong rejection with extended downside move.

The double rejection clearly shows that buyers are trapped, fueling bearish momentum.

From an MMC view, this confirms the beginning of the “Mirror Market Shift” — where smart money rotates out of longs and traps retail longs near resistance.

📉 QFL (Quick Flip Liquidity) Events – Momentum Crashes

Two major QFL-based breakdowns appear in the chart after price consolidated within ranges. These drops are essential to understand:

QFL reflects market structure breaks where liquidity is engineered, and a sharp sell-off follows.

The first QFL drop occurs after the curve-resistance rejection, and the second confirms continuation.

These are liquidity runs, used to clear stop-losses and maintain bearish pressure.

This creates a domino effect — each QFL level becomes a signal of deeper imbalance.

⚠️ Central Zone – No Bullish Pattern Detected

The Central Zone marks a temporary support or midpoint level — a place where price might find footing if buyers show up.

However, as you noted:

“We Can See No Bullish Pattern On Central Zone”

This confirms that buyers are either weak or absent in this zone. MMC traders use this info to stay with the dominant trend (bearish) until proven otherwise.

🟩 Next Reversal Zone – 114,157.68 (Critical Demand Zone)

The green zone marked as “Next Reversal Zone” is a key level to monitor:

This area aligns with historical demand, where BTC previously reversed or slowed down.

Price is likely to hunt liquidity below recent lows before a potential bullish reaction.

It’s a Smart Money zone — designed to trap breakout sellers and absorb volume for a reversal.

Traders should watch for:

Bullish engulfing patterns

Break of structure to the upside

Divergence with RSI/volume

Sweep and reclaim setup

Once the price enters this zone, MMC reversal tactics come into play — buyers may step in aggressively here.

📅 Fundamentals & Timing

At the bottom of the chart, we see upcoming U.S. economic news events, which can act as volatility catalysts. Price could reach the reversal zone just before or during high-impact news, which aligns perfectly with smart money manipulation.

Be cautious of fakeouts around news time.

Confirmation is key before entry.

🧭 Final Outlook & MMC Strategy

Trend Direction: Bearish until 114,157.68 zone is hit.

Momentum Drivers: QFL drops, strong rejection from 2x supply, absence of bullish signals.

Key Watch Level: 114,157.68 – wait for MMC reversal pattern here.

Invalidation: If price breaks and closes above the Black Mind Curve with volume.

📌 Trade Idea Summary (For Caption Use):

BTCUSD respecting MMC Black Mind Curve. 2x Supply Zone triggered QFL breakdowns. No bullish confirmation at Central Zone. Eyes on Next Reversal Block near 114,157.68. Watch for reaction and potential reversal setup. #SmartMoneyMoves

🧠 Black Mind Curve – Mapping Market Psychology

The Black Mind Curve is a visual representation of the market’s psychological behavior and serves as a dynamic resistance throughout this structure. Price respected the curvature, slowly losing bullish strength while forming lower highs.

This curve mirrors a distribution phase, where smart money unloads long positions before initiating a downside move.

Your annotation: “After Break Curve Line Will Go Bullish” implies that unless the curve is cleanly broken with strong bullish conviction, the bias remains bearish.

So far, the price is respecting the curve, reinforcing sellers’ control.

🔵 2x Supply Zone – Aggressive Selling Region

The supply zone is tested twice, confirming the presence of institutional-level sellers. This zone becomes critical because:

First touch: Minor reaction, but no follow-through.

Second touch: Strong rejection with extended downside move.

The double rejection clearly shows that buyers are trapped, fueling bearish momentum.

From an MMC view, this confirms the beginning of the “Mirror Market Shift” — where smart money rotates out of longs and traps retail longs near resistance.

📉 QFL (Quick Flip Liquidity) Events – Momentum Crashes

Two major QFL-based breakdowns appear in the chart after price consolidated within ranges. These drops are essential to understand:

QFL reflects market structure breaks where liquidity is engineered, and a sharp sell-off follows.

The first QFL drop occurs after the curve-resistance rejection, and the second confirms continuation.

These are liquidity runs, used to clear stop-losses and maintain bearish pressure.

This creates a domino effect — each QFL level becomes a signal of deeper imbalance.

⚠️ Central Zone – No Bullish Pattern Detected

The Central Zone marks a temporary support or midpoint level — a place where price might find footing if buyers show up.

However, as you noted:

“We Can See No Bullish Pattern On Central Zone”

- No bullish engulfing candle.

- No pin bar rejection.

- No spike in volume.

- No market structure shift.

This confirms that buyers are either weak or absent in this zone. MMC traders use this info to stay with the dominant trend (bearish) until proven otherwise.

🟩 Next Reversal Zone – 114,157.68 (Critical Demand Zone)

The green zone marked as “Next Reversal Zone” is a key level to monitor:

This area aligns with historical demand, where BTC previously reversed or slowed down.

Price is likely to hunt liquidity below recent lows before a potential bullish reaction.

It’s a Smart Money zone — designed to trap breakout sellers and absorb volume for a reversal.

Traders should watch for:

Bullish engulfing patterns

Break of structure to the upside

Divergence with RSI/volume

Sweep and reclaim setup

Once the price enters this zone, MMC reversal tactics come into play — buyers may step in aggressively here.

📅 Fundamentals & Timing

At the bottom of the chart, we see upcoming U.S. economic news events, which can act as volatility catalysts. Price could reach the reversal zone just before or during high-impact news, which aligns perfectly with smart money manipulation.

Be cautious of fakeouts around news time.

Confirmation is key before entry.

🧭 Final Outlook & MMC Strategy

Trend Direction: Bearish until 114,157.68 zone is hit.

Momentum Drivers: QFL drops, strong rejection from 2x supply, absence of bullish signals.

Key Watch Level: 114,157.68 – wait for MMC reversal pattern here.

Invalidation: If price breaks and closes above the Black Mind Curve with volume.

📌 Trade Idea Summary (For Caption Use):

BTCUSD respecting MMC Black Mind Curve. 2x Supply Zone triggered QFL breakdowns. No bullish confirmation at Central Zone. Eyes on Next Reversal Block near 114,157.68. Watch for reaction and potential reversal setup. #SmartMoneyMoves

For Daily Trade Setups and Forecast: 📈 t.me/xauusdoptimizer

Premium Signals Fr33: 💯 t.me/xauusdoptimizer

🥰🥳🤩

Premium Signals Fr33: 💯 t.me/xauusdoptimizer

🥰🥳🤩

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

For Daily Trade Setups and Forecast: 📈 t.me/xauusdoptimizer

Premium Signals Fr33: 💯 t.me/xauusdoptimizer

🥰🥳🤩

Premium Signals Fr33: 💯 t.me/xauusdoptimizer

🥰🥳🤩

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.