🏛 Market Structure

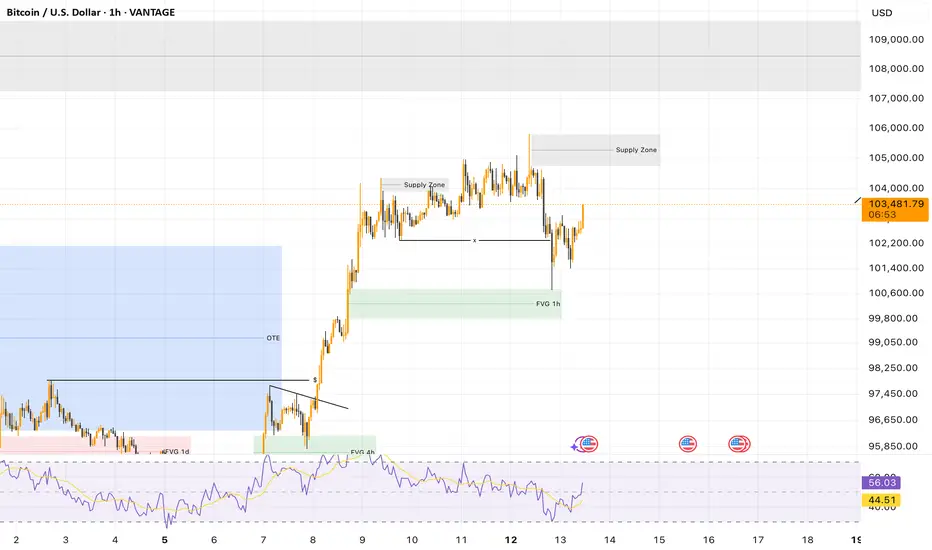

BTC continues to show strong bullish intent, holding near its recent highs after a brief dip.

🔎 Yesterday’s liquidity sweep below local support levels appears to have been a classic trap, designed to clean out weak hands before resuming the uptrend.

📈 Current Setup

🟩 1H FVG (Fair Value Gap) has acted as a strong support, with price bouncing cleanly off it.

🟫 Multiple supply zones above still need to be cleared, but BTC looks ready to challenge them again.

🔄 The reclaim of the previous range low and subsequent higher low suggest momentum is shifting back toward the bulls.

🎯 Short-Term Outlook

📈 Bullish Bias:

If the current structure holds, BTC could push back toward the $105K–$106K area.

The RSI is also curling back up from the lower bound, showing renewed momentum.

⚠️ Key to Watch:

Price must stay above the FVG (~$101K–$102K) to keep the bullish scenario valid.

A break back below this zone would expose BTC to another liquidity grab toward $99K.

✅ Conclusion

BTC is showing healthy consolidation with signs of accumulation just below resistance. The recovery after yesterday's sweep confirms that the market is still looking to push higher — especially if buyers can maintain control above $103K.

BTC continues to show strong bullish intent, holding near its recent highs after a brief dip.

🔎 Yesterday’s liquidity sweep below local support levels appears to have been a classic trap, designed to clean out weak hands before resuming the uptrend.

📈 Current Setup

🟩 1H FVG (Fair Value Gap) has acted as a strong support, with price bouncing cleanly off it.

🟫 Multiple supply zones above still need to be cleared, but BTC looks ready to challenge them again.

🔄 The reclaim of the previous range low and subsequent higher low suggest momentum is shifting back toward the bulls.

🎯 Short-Term Outlook

📈 Bullish Bias:

If the current structure holds, BTC could push back toward the $105K–$106K area.

The RSI is also curling back up from the lower bound, showing renewed momentum.

⚠️ Key to Watch:

Price must stay above the FVG (~$101K–$102K) to keep the bullish scenario valid.

A break back below this zone would expose BTC to another liquidity grab toward $99K.

✅ Conclusion

BTC is showing healthy consolidation with signs of accumulation just below resistance. The recovery after yesterday's sweep confirms that the market is still looking to push higher — especially if buyers can maintain control above $103K.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.