BTCUSD Breaks and Holds Above Key Resistance, Poised for New All-Time High

Analysis by: Krisada Yoonaisil, Financial Markets Strategist at Exness

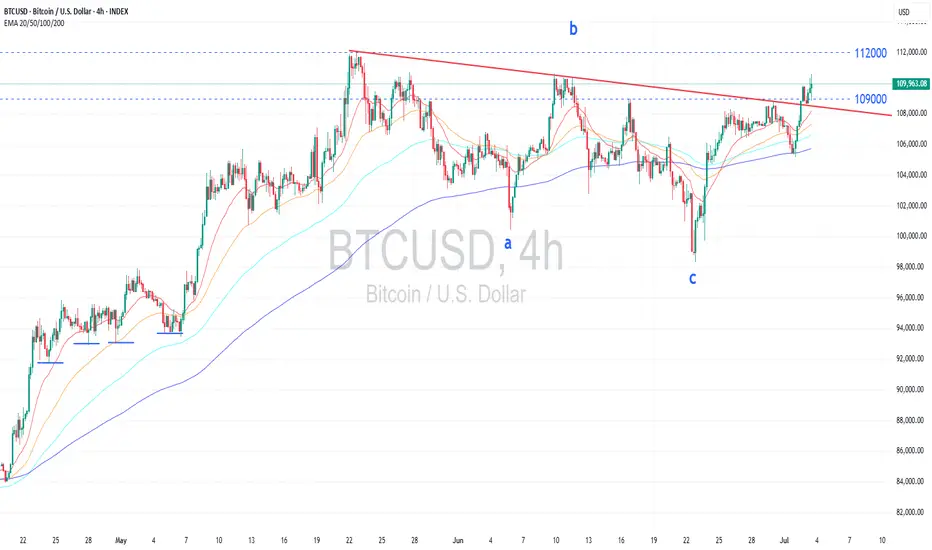

- BTC price has held above the descending resistance line after breaking out yesterday, indicating a confirmed breakout. This suggests that bitcoin's price may continue its upward trend sustainably.

- The BTC price is currently testing the prior high at 110500. A decisive close above this level would provide further bullish confirmation signal, following its earlier formation of a Higher Low.

- A break above the all-time high at 112000 would significantly ignite bullish momentum.

- From an Elliott wave perspective, Bitcoin has recently completed a simple corrective wave consolidation, characterized by its three sub-waves. This completion strongly indicates that the price is now moving in an impulsive uptrend.

- In terms of on-chain analysis, the supply held by LTH is at an all-time high of approximately 14 million bitcoins, indicating coin accumulation. This market characteristic represents an accumulation phase, which is typically the beginning of a bullish trend before prices accelerate during the distribution phase in the market cycle analysis.

- Furthermore, the Balance on Exchange has fallen to its lowest level in four and a half years, at approximately 3 million bitcoins. This shows a trend of coins being withdrawn from exchanges for storage in personal wallets or custodians for long-term holding purposes, further reducing the circulating supply in the market.

- Fundamentally, the market's growing acceptance of this asset class is clear. More regulators are embracing it, and rules are continuously easing at both state and country levels. This suggests it's increasingly viewed as a conventional investment rather than a speculative tool.

- The Fed's rate cut cycle is not yet over. As the central bank potentially eases further, risky assets like Bitcoin also have room to grow.

Analysis by: Krisada Yoonaisil, Financial Markets Strategist at Exness

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.