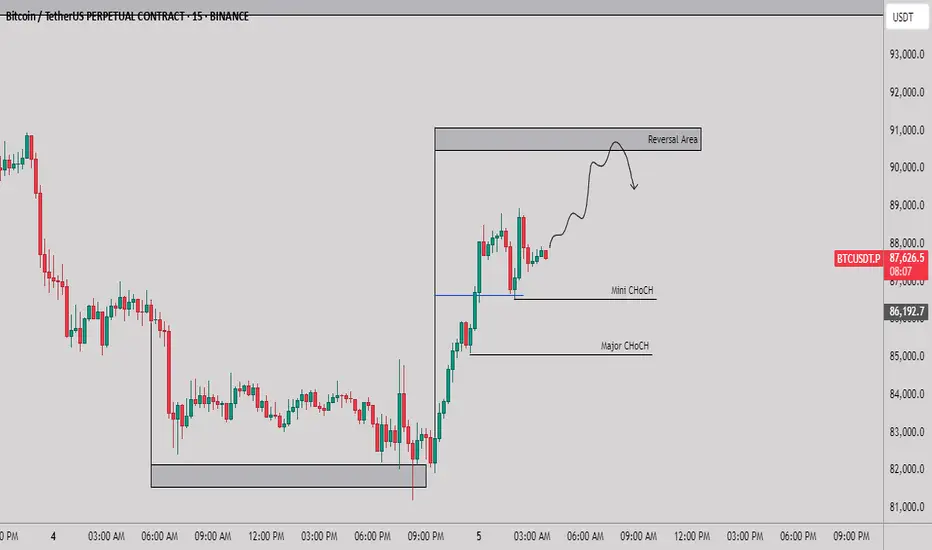

🔹 Asset: Bitcoin (BTC/USDT Perpetual Contract)

🔹 Timeframe: 15-Minutes

🔹 Exchange: Binance

📊 Market Overview:

Bitcoin has shown a strong bullish impulse after breaking key structure levels, confirming a shift in momentum. However, the price is now approaching a high-probability reversal area, where a reaction is expected.

📈 Key Technical Insights:

✅ Major CHoCH (Change of Character) confirmed, marking a potential trend shift.

✅ Mini CHoCH holding as local support, maintaining short-term bullish momentum.

✅ Reversal Area (Above $90,000): This zone represents previous liquidity zones where sellers could step in, leading to a correction.

📌 Trading Plan:

🔹 Long Entry Confirmation: If price retests the Mini CHoCH ($88,000) and shows bullish rejection, another leg up is possible.

🔹 Short Reversal Setup: If price reaches the Reversal Area ($90,000 - $91,000) and forms bearish confirmation patterns (e.g., engulfing, wicks, or volume divergence), a short trade targeting $87,000-$86,000 would be ideal.

🔹 Risk Management: Wait for confirmation before entering trades—false breakouts are possible.

📢 Final Thoughts:

📌 Breakout traders should be cautious of liquidity grabs.

📌 Reversal traders should look for bearish confirmation in the highlighted area.

📌 Price action confirmation is key before taking any position.

⚡ Stay sharp, manage risk, and trade smart! 🚀

🔹 Timeframe: 15-Minutes

🔹 Exchange: Binance

📊 Market Overview:

Bitcoin has shown a strong bullish impulse after breaking key structure levels, confirming a shift in momentum. However, the price is now approaching a high-probability reversal area, where a reaction is expected.

📈 Key Technical Insights:

✅ Major CHoCH (Change of Character) confirmed, marking a potential trend shift.

✅ Mini CHoCH holding as local support, maintaining short-term bullish momentum.

✅ Reversal Area (Above $90,000): This zone represents previous liquidity zones where sellers could step in, leading to a correction.

📌 Trading Plan:

🔹 Long Entry Confirmation: If price retests the Mini CHoCH ($88,000) and shows bullish rejection, another leg up is possible.

🔹 Short Reversal Setup: If price reaches the Reversal Area ($90,000 - $91,000) and forms bearish confirmation patterns (e.g., engulfing, wicks, or volume divergence), a short trade targeting $87,000-$86,000 would be ideal.

🔹 Risk Management: Wait for confirmation before entering trades—false breakouts are possible.

📢 Final Thoughts:

📌 Breakout traders should be cautious of liquidity grabs.

📌 Reversal traders should look for bearish confirmation in the highlighted area.

📌 Price action confirmation is key before taking any position.

⚡ Stay sharp, manage risk, and trade smart! 🚀

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.