Supply Chain Breakdown Reloaded: Fading the BTC Spike at Rejecti

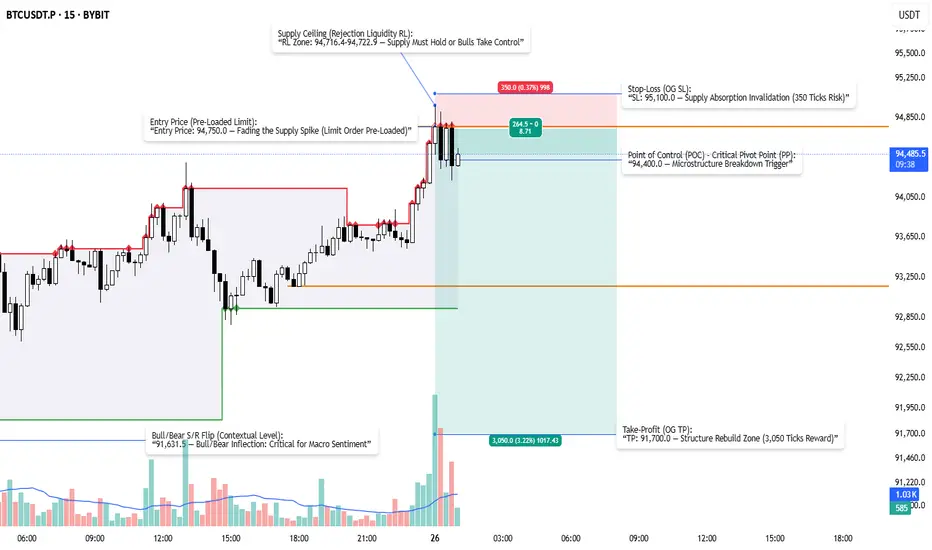

BTCUSDT 15m — Short Thesis anchored in supply exhaustion and structural inefficiency. Price surged into the Rejection Liquidity (RL) Zone between 94,716.4–94,722.9, where repeated rejection wicks and elevated sell-side volume confirmed supply reloading. Bulls failed to absorb overhead liquidity, signaling vulnerability for a structural fade.

This is a pre-loaded limit short, positioned for One Shot, One Kill, targeting asymmetric downside with strictly defined risk parameters.

Trade Details:

Entry Price: 94,750.0

Pre-set limit beneath RL zone, fading the supply spike at exhaustion.

Stop-Loss (OG SL): 95,100.0

Supply absorption invalidation.

Tick distance: 350 ticks (risk exposure: 0.70 USDT).

Take-Profit (OG TP): 91,700.0

Targeting the Structure Rebuild Zone where demand could reassert control.

Tick distance: 3,050 ticks (reward potential: 6.10 USDT).

Risk-Reward Ratio: 8.71 : 1

Engineered for extreme asymmetry, capturing downside inefficiency while minimizing capital at risk.

Position Details:

Pair: BTCUSDT Perpetuals

Direction: Short

Leverage: 100x Isolated

Position size: 0.002 BTC

Margin used: 189.50 USDT

Execution time: 2025-04-25 23:57:01

Fee structure:

Entry fee: 0.0379 USDT (≈2% of margin)

Exit fee (estimated): ~0.04 USDT

Expected Outcomes:

If stop-loss hits: ~0.74 USDT total loss (risk + fees).

If take-profit hits: ~6.02 USDT net gain (post fees).

Structural Context:

Rejection Liquidity (RL) Zone: 94,716.4–94,722.9

Supply apex. Bulls must reclaim or face breakdown.

Point of Control (POC) – Critical Pivot Point (PP): 94,400.0

Breakdown trigger. A move below confirms bearish continuation.

Bull/Bear S/R Flip (Macro Inflection): 91,631.5

Wider structural pivot. If tested, it validates extended downside momentum.

Risk Management Note:

Trade positions are tightly managed with low capital exposure for the purpose of stress testing system robustness under 100x leverage on lower timeframes (LTF). The focus is on validating mechanical execution and structural thesis under high-leverage conditions, ensuring precision risk control and adaptability in volatile environments.

Narrative:

BTC’s parabolic drive into supply stalls at RL, confirming exhaustion via sell-side volume. This setup fades that weakness, targeting structural inefficiency unwind while enforcing strict risk protocols.

Defined risk. Asymmetric reward. No ambiguity.

One shot. One kill.

This is a pre-loaded limit short, positioned for One Shot, One Kill, targeting asymmetric downside with strictly defined risk parameters.

Trade Details:

Entry Price: 94,750.0

Pre-set limit beneath RL zone, fading the supply spike at exhaustion.

Stop-Loss (OG SL): 95,100.0

Supply absorption invalidation.

Tick distance: 350 ticks (risk exposure: 0.70 USDT).

Take-Profit (OG TP): 91,700.0

Targeting the Structure Rebuild Zone where demand could reassert control.

Tick distance: 3,050 ticks (reward potential: 6.10 USDT).

Risk-Reward Ratio: 8.71 : 1

Engineered for extreme asymmetry, capturing downside inefficiency while minimizing capital at risk.

Position Details:

Pair: BTCUSDT Perpetuals

Direction: Short

Leverage: 100x Isolated

Position size: 0.002 BTC

Margin used: 189.50 USDT

Execution time: 2025-04-25 23:57:01

Fee structure:

Entry fee: 0.0379 USDT (≈2% of margin)

Exit fee (estimated): ~0.04 USDT

Expected Outcomes:

If stop-loss hits: ~0.74 USDT total loss (risk + fees).

If take-profit hits: ~6.02 USDT net gain (post fees).

Structural Context:

Rejection Liquidity (RL) Zone: 94,716.4–94,722.9

Supply apex. Bulls must reclaim or face breakdown.

Point of Control (POC) – Critical Pivot Point (PP): 94,400.0

Breakdown trigger. A move below confirms bearish continuation.

Bull/Bear S/R Flip (Macro Inflection): 91,631.5

Wider structural pivot. If tested, it validates extended downside momentum.

Risk Management Note:

Trade positions are tightly managed with low capital exposure for the purpose of stress testing system robustness under 100x leverage on lower timeframes (LTF). The focus is on validating mechanical execution and structural thesis under high-leverage conditions, ensuring precision risk control and adaptability in volatile environments.

Narrative:

BTC’s parabolic drive into supply stalls at RL, confirming exhaustion via sell-side volume. This setup fades that weakness, targeting structural inefficiency unwind while enforcing strict risk protocols.

Defined risk. Asymmetric reward. No ambiguity.

One shot. One kill.

Trade closed: stop reached

Trade Outcome:The trade was executed precisely at 94,750.0, but NY Open (NYO) volatility ran a liquidity sweep through the Rejection Liquidity (RL) Zone, triggering the stop-loss with slippage at 95,119.90 (+19.9 ticks deviation).

Planned total risk (including fees):

0.70 USDT core risk + 0.0379 USDT entry fee + 0.1046 USDT exit fee = 0.8425 USDT expected loss.

Actual realized loss (including fees and slippage):

0.7398 USDT core market loss + 0.0379 USDT entry fee + 0.1046 USDT exit fee = 0.8823 USDT total loss.

Deviation Impact:

Slippage contributed 0.0398 USDT (5.69% increase over planned risk).

Fees accounted for 16.1% of total realized loss.

Execution Refinement Note:

This outcome highlighted the necessity to calibrate stop-loss buffers during LO and NYO, incorporating sessional volatility premiums. Moving forward, stop placements will account for expected liquidity sweeps, reducing exposure to avoidable slippage while retaining strict invalidation logic.

Fee modeling has also been fully standardized at 0.02% maker / 0.055% taker—integrated directly into all initial risk assessments.

System Integrity:

Despite the thesis failing under NYO liquidity stress, the risk framework held firm.

Loss was contained, capital preserved, and execution protocols refined for future engagements.

System evolved. Discipline maintained.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.