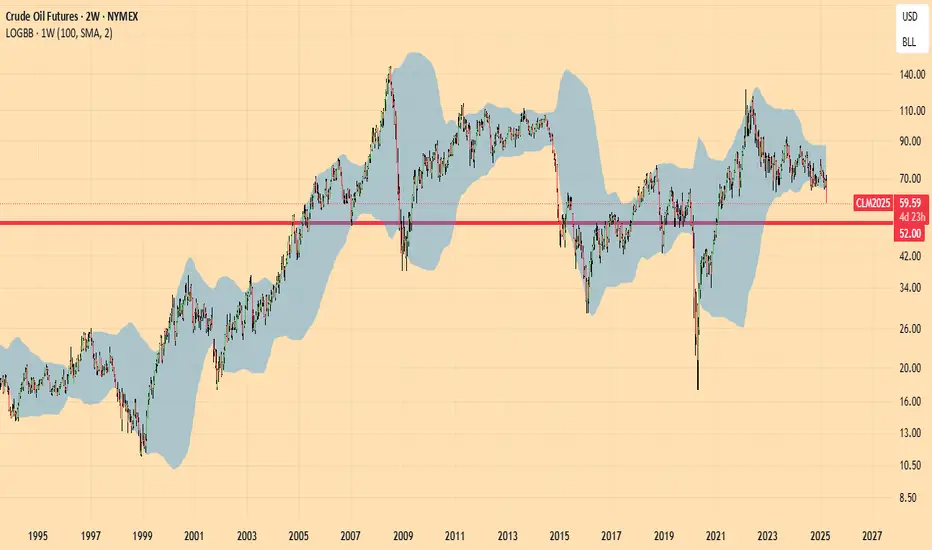

STRONG SELL until November 2025

First Target : $52

Second Target : $43

Under the screening of 100 Weeks Bollinger Bands, Oil is in the same situation as in 1986, 1993, 1998, 2014 and 2020

Since there is talk of a glut " Strong production growth expected to increase global oil glut in 2025, 2026" Bloomberg 11/02/2025, the target could be as low as $32 (High 2022 =130 * GannRatio 0.25)

However there will be a heavy test at around $52-55, a support line uniting several key points since 12/2006. Eventually, greater volatility alone would make $43 possible. (130*GannRatio 0.33).

It is noticeable that in all instances exepted 2014, a very sizable rebound was observed from 6 months after the plunge, so that we would be strongly short right now and contemplate to buy from September 2025

We cannot speculate as to whether there will be 2 plunges (2014) or 1 straight plunge (all other instances excepted 1998) or a prolonged plunge (1993). This is why the test in the $50 is crucial. The article suggests for 2025-26, more in line with 1993 and 2014. Therefore we believe that $43 will be reached.

First Target : $52

Second Target : $43

Under the screening of 100 Weeks Bollinger Bands, Oil is in the same situation as in 1986, 1993, 1998, 2014 and 2020

Since there is talk of a glut " Strong production growth expected to increase global oil glut in 2025, 2026" Bloomberg 11/02/2025, the target could be as low as $32 (High 2022 =130 * GannRatio 0.25)

However there will be a heavy test at around $52-55, a support line uniting several key points since 12/2006. Eventually, greater volatility alone would make $43 possible. (130*GannRatio 0.33).

It is noticeable that in all instances exepted 2014, a very sizable rebound was observed from 6 months after the plunge, so that we would be strongly short right now and contemplate to buy from September 2025

We cannot speculate as to whether there will be 2 plunges (2014) or 1 straight plunge (all other instances excepted 1998) or a prolonged plunge (1993). This is why the test in the $50 is crucial. The article suggests for 2025-26, more in line with 1993 and 2014. Therefore we believe that $43 will be reached.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.