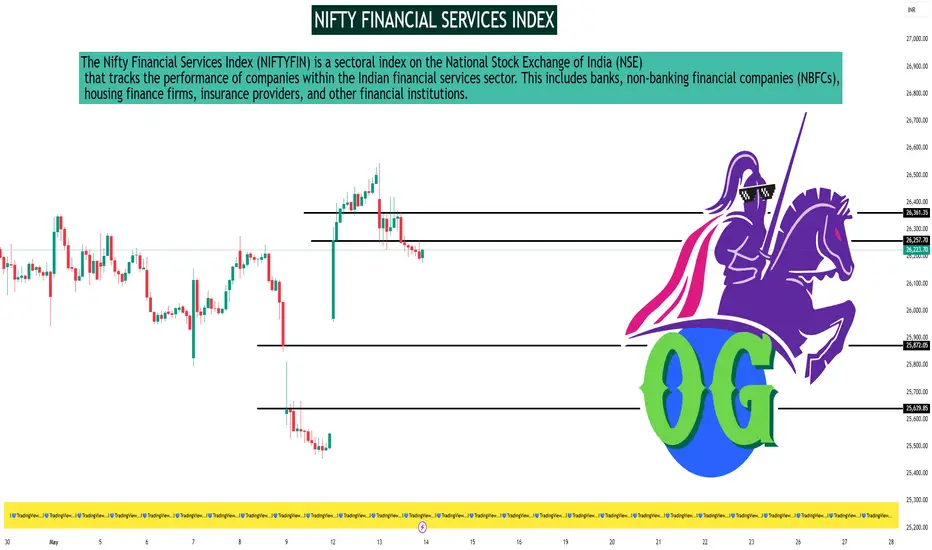

As of May 13, 2025, the Nifty Financial Services Index (NIFTYFIN) closed at 26,206.00, reflecting a decline of 1.10% for the day.

📊 30-Minute Timeframe Technical Overview

Key Support and Resistance Levels:

Support: Approximately 25,245.07

Resistance: Approximately 26,562.40

These levels are derived from recent price actions and are crucial for traders monitoring short-term movements.

Technical Indicators Summary:

Relative Strength Index (RSI 14): 52.33 – Neutral

Stochastic Oscillator (9,6): 98.35 – Overbought

Stochastic RSI (14): 2.60 – Oversold

MACD (12,26): 54.67 – Buy

Average Directional Index (ADX 14): 15.72 – Neutral

Williams %R: -1.94 – Overbought

Commodity Channel Index (CCI 14): -48.30 – Neutral

Average True Range (ATR 14): 166.29 – Indicates lower volatility

Rate of Change (ROC): 2.80 – Buy

Bull/Bear Power (13): -19.22 – Sell

Interpretation:

The technical indicators present a mixed outlook. While the MACD and ROC suggest bullish momentum, the overbought readings from the Stochastic Oscillator and Williams %R indicate potential for a short-term pullback. The neutral RSI and ADX values suggest a lack of strong directional momentum.

📈 Accessing 30-Minute Charts

For real-time 30-minute interval charts and advanced technical analysis tools, consider the following platforms:

TradingView – Nifty Financial Services Index

Investing.com – Nifty Financial Services Chart

Groww Terminal – Nifty Financial Services

These platforms offer customizable charts with various indicators to assist in your analysis.

📊 30-Minute Timeframe Technical Overview

Key Support and Resistance Levels:

Support: Approximately 25,245.07

Resistance: Approximately 26,562.40

These levels are derived from recent price actions and are crucial for traders monitoring short-term movements.

Technical Indicators Summary:

Relative Strength Index (RSI 14): 52.33 – Neutral

Stochastic Oscillator (9,6): 98.35 – Overbought

Stochastic RSI (14): 2.60 – Oversold

MACD (12,26): 54.67 – Buy

Average Directional Index (ADX 14): 15.72 – Neutral

Williams %R: -1.94 – Overbought

Commodity Channel Index (CCI 14): -48.30 – Neutral

Average True Range (ATR 14): 166.29 – Indicates lower volatility

Rate of Change (ROC): 2.80 – Buy

Bull/Bear Power (13): -19.22 – Sell

Interpretation:

The technical indicators present a mixed outlook. While the MACD and ROC suggest bullish momentum, the overbought readings from the Stochastic Oscillator and Williams %R indicate potential for a short-term pullback. The neutral RSI and ADX values suggest a lack of strong directional momentum.

📈 Accessing 30-Minute Charts

For real-time 30-minute interval charts and advanced technical analysis tools, consider the following platforms:

TradingView – Nifty Financial Services Index

Investing.com – Nifty Financial Services Chart

Groww Terminal – Nifty Financial Services

These platforms offer customizable charts with various indicators to assist in your analysis.

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.