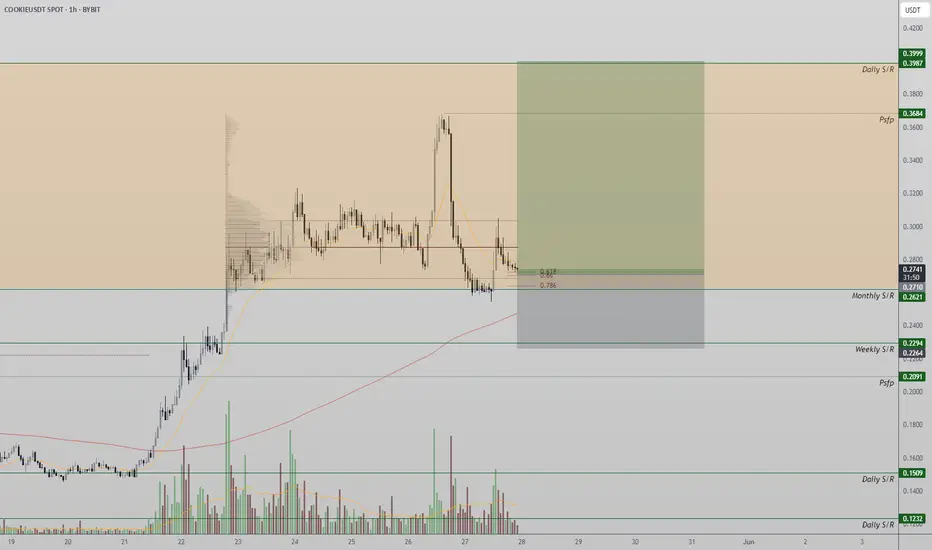

After a sharp corrective move, COOKIE is back at a key support level. With multiple layers of confluence lining up, price action remains bullish — and a bounce toward $0.38 is in play.

Key Highlights:

Support Zone: Confluence of 0.618 Fibonacci, monthly support, and major moving average

Current Structure: Healthy correction following rejection near high time frame resistance

Upside Target: $0.38 resistance remains the key level to reclaim

Full Analysis:

COOKIE has pulled back from its recent rally after failing to break through the high time frame resistance near the $0.38 level. However, this retracement has landed price action right into a technical demand zone — combining the 0.618 Fibonacci retracement, the monthly support level, and a long-term moving average. This multi-layered support structure creates a strong foundation for a potential reversal.

Despite the corrective move, the broader trend remains bullish. The rejection at $0.38 did not break any structural higher lows, and volatility in this zone is not uncommon in trending markets. As long as price holds above this confluence zone, COOKIE maintains its upside structure, and the probability of a retest of the $0.38 resistance grows stronger.

Volatility is expected in this phase of the move, but it should be viewed within the context of a bullish continuation pattern. Confirmation of support holding — such as bullish engulfing candles or volume uptick — would further validate a reversal scenario.

Key Highlights:

Support Zone: Confluence of 0.618 Fibonacci, monthly support, and major moving average

Current Structure: Healthy correction following rejection near high time frame resistance

Upside Target: $0.38 resistance remains the key level to reclaim

Full Analysis:

COOKIE has pulled back from its recent rally after failing to break through the high time frame resistance near the $0.38 level. However, this retracement has landed price action right into a technical demand zone — combining the 0.618 Fibonacci retracement, the monthly support level, and a long-term moving average. This multi-layered support structure creates a strong foundation for a potential reversal.

Despite the corrective move, the broader trend remains bullish. The rejection at $0.38 did not break any structural higher lows, and volatility in this zone is not uncommon in trending markets. As long as price holds above this confluence zone, COOKIE maintains its upside structure, and the probability of a retest of the $0.38 resistance grows stronger.

Volatility is expected in this phase of the move, but it should be viewed within the context of a bullish continuation pattern. Confirmation of support holding — such as bullish engulfing candles or volume uptick — would further validate a reversal scenario.

Join the Free Trading Group

Telegram: t.me/freetradingden 🔥

Unlock Blofin Bonuses

Trade with perks & support the community!

blofin.com/invite/alchemisttrader 🎁

Stay sharp, trade smart.

— Team The Alchemist ⚔️

Telegram: t.me/freetradingden 🔥

Unlock Blofin Bonuses

Trade with perks & support the community!

blofin.com/invite/alchemisttrader 🎁

Stay sharp, trade smart.

— Team The Alchemist ⚔️

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join the Free Trading Group

Telegram: t.me/freetradingden 🔥

Unlock Blofin Bonuses

Trade with perks & support the community!

blofin.com/invite/alchemisttrader 🎁

Stay sharp, trade smart.

— Team The Alchemist ⚔️

Telegram: t.me/freetradingden 🔥

Unlock Blofin Bonuses

Trade with perks & support the community!

blofin.com/invite/alchemisttrader 🎁

Stay sharp, trade smart.

— Team The Alchemist ⚔️

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.