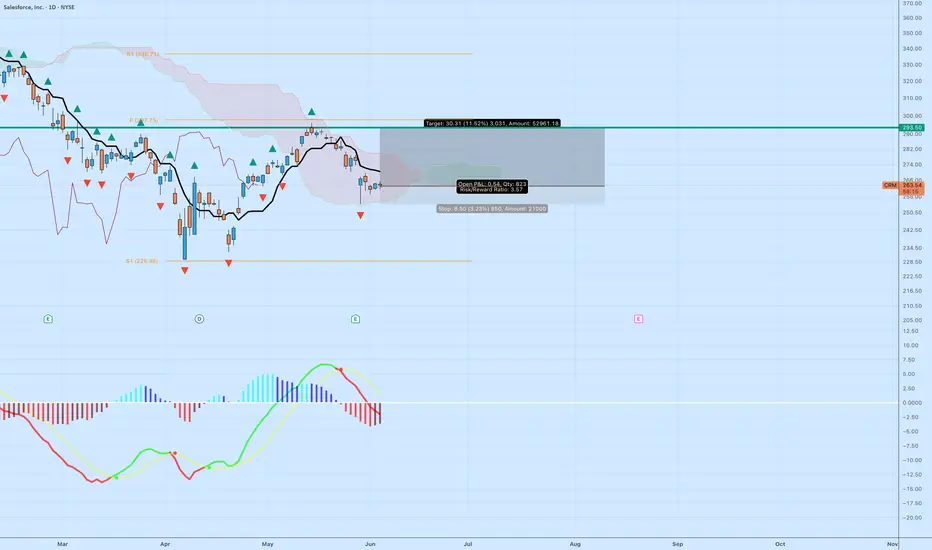

Salesforce (CRM) is setting up for a compelling long opportunity based on a combination of Ichimoku cloud structure, pivot level confluence, and a strong risk/reward ratio. After a recent pullback from the $290s, CRM has entered a consolidation range just above the Ichimoku cloud. With a defined stop and a clear breakout target, the long case offers an R/R of 3.57, which is notable in this current market environment.

🔍 Entry & Trade Details

Entry: $263.52

Stop Loss: $255.00 (approx. 3.23%)

Target: $293.50 (approx. 11.52%)

Risk/Reward Ratio: 3.57

Position Size: 100 shares (~$21,000 exposure)

This long position is targeting a return to the previous high around the $293.50 mark, which aligns closely with the key pivot resistance (R1 zone) and the upper boundary of the recent trading range. The tight stop loss just below the cloud and recent support ensures limited downside while leaving room for CRM to climb with momentum.

☁️ Ichimoku Structure Analysis

CRM is currently sitting inside the Ichimoku cloud, a zone of equilibrium where price tends to consolidate before a larger move. The key observation is that the conversion line (Tenkan-sen) is flat and the lagging span (Chikou) is attempting to cross above prior price action—both are early signals of bullish intent.

If CRM can decisively clear the upper cloud boundary, it opens the door for a move back to the psychological $290–$295 zone.

📊 MACD Momentum Shift

Below the chart, the MACD histogram has flipped negative recently, but that’s not unusual in a consolidation phase. More important is whether we see a re-acceleration in histogram bars along with a bullish MACD crossover, which would be a strong continuation signal.

With the histogram declining but price holding, we’re watching for a momentum divergence setup—bullish if confirmed by volume.

🔄 Volume & Previous Structure

CRM saw strong buying interest in mid-May, driving it above the pivot point ($277.75). Since then, price has retraced back toward support, shaking out weak hands and retesting the structure. Volume on the pullback has been controlled, suggesting this may be a healthy base before the next leg up.

📌 Trade Thesis

This is a technical long trade betting on:

A bounce off Ichimoku support

Bullish re-engagement of buyers near cloud edge

Clean target at former highs ($293.50)

Favorable risk/reward setup

The broader market conditions remain mixed, but CRM’s positioning in the enterprise software sector, combined with recent revenue growth and forward guidance, provide a solid fundamental backdrop.

📅 What to Watch

A daily close above the Ichimoku cloud

A green MACD histogram bar

Increased buy volume near $265–$270

💬 Final Thoughts

Salesforce is offering a high-probability, high-reward long setup here. Tight stop, clear target, and bullish structure make this worth watching. Be patient on confirmation—but once momentum returns, this could move fast.

🔍 Entry & Trade Details

Entry: $263.52

Stop Loss: $255.00 (approx. 3.23%)

Target: $293.50 (approx. 11.52%)

Risk/Reward Ratio: 3.57

Position Size: 100 shares (~$21,000 exposure)

This long position is targeting a return to the previous high around the $293.50 mark, which aligns closely with the key pivot resistance (R1 zone) and the upper boundary of the recent trading range. The tight stop loss just below the cloud and recent support ensures limited downside while leaving room for CRM to climb with momentum.

☁️ Ichimoku Structure Analysis

CRM is currently sitting inside the Ichimoku cloud, a zone of equilibrium where price tends to consolidate before a larger move. The key observation is that the conversion line (Tenkan-sen) is flat and the lagging span (Chikou) is attempting to cross above prior price action—both are early signals of bullish intent.

If CRM can decisively clear the upper cloud boundary, it opens the door for a move back to the psychological $290–$295 zone.

📊 MACD Momentum Shift

Below the chart, the MACD histogram has flipped negative recently, but that’s not unusual in a consolidation phase. More important is whether we see a re-acceleration in histogram bars along with a bullish MACD crossover, which would be a strong continuation signal.

With the histogram declining but price holding, we’re watching for a momentum divergence setup—bullish if confirmed by volume.

🔄 Volume & Previous Structure

CRM saw strong buying interest in mid-May, driving it above the pivot point ($277.75). Since then, price has retraced back toward support, shaking out weak hands and retesting the structure. Volume on the pullback has been controlled, suggesting this may be a healthy base before the next leg up.

📌 Trade Thesis

This is a technical long trade betting on:

A bounce off Ichimoku support

Bullish re-engagement of buyers near cloud edge

Clean target at former highs ($293.50)

Favorable risk/reward setup

The broader market conditions remain mixed, but CRM’s positioning in the enterprise software sector, combined with recent revenue growth and forward guidance, provide a solid fundamental backdrop.

📅 What to Watch

A daily close above the Ichimoku cloud

A green MACD histogram bar

Increased buy volume near $265–$270

💬 Final Thoughts

Salesforce is offering a high-probability, high-reward long setup here. Tight stop, clear target, and bullish structure make this worth watching. Be patient on confirmation—but once momentum returns, this could move fast.

Trade active

Note

Trade still active. If you found my trades helpful, please consider sending a tip in BTC to: bc1qr35mrh82hykpy9v6znpsyuew85x84ezjyrrf6m

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

If you found my trades helpful, please consider sending a tip in BTC to: bc1qr35mrh82hykpy9v6znpsyuew85x84ezjyrrf6m

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.