DJIA Dow Jones Industrial Average- MARKET CYCLES Lesson One

Introduction to Market Cycles

Lesson One

Markets are more predictable than you and I have been led to believe. We have been told that historical data cannot be used to predict what will happen. But is that statement actually true?

Answer -- YES and NO. It is not a lie. Even with the best techniques of technical analysis and analyzing the repetitive and predictable cycles which occur, we can make a fairly accurate prediction of future movements, but it is not 100% reliable. We must always leave some room for the unexpected to occur at any moment. That is true!

But, can we learn to analyze market cycles in such a way that we can get a fairly accurate prediction of a rough prediction of future movements? My answer is YES! Not with 100% accuracy though. But honestly, even a 60% accurate prediction would be good. But I think we can do much better than 60 percent. I expect if we work at this method we can approach 80-90% accuracy But How?

I am going to take you on a journey of discovering market cycles which occur in every chart on every time frame. These cycles have been staring at you in the face, but you likely have not noticed them. They are hidden in plain sight. Perhaps some of you already see these cycles, and some of them are more obvious than others. Maybe you already know all you need about market cycles on every level, in which case, why read more?

My prediction is that not all of you will be able to understand or believe what I will tell you, maybe you will say I am crazy! If I am crazy, then let me be crazy, because this is working for me, better than other methods have. But if this is not helpful for you, then of course, I wish you well and hope you find something that is helpful.

This method of analyzing charts does take a lot of work, mental effort and concentration. There is nothing easy about it. If you are looking for a quick and easy way to trade successfully then you should try looking somewhere else. It will take hard work and time and motivation to perfect this strategy.

All this to say, if you don’t like what I am writing for any reason, you do not have to read this. You are completely free by me to stop reading now.

First – we are taking about Market cycles – what is a market cycle?

People may mean different things but I am talking about recurring cyclical patterns in any chart.

Sometimes we draw cycle diagrams in a circle – which is perfectly fine, but if we want to stretch out the cycle and measure a recurring cycle over time, then we need to use the example of a SINE WAVE. Sine waves are everywhere in nature. We have sine waves in SOUND WAVES, alternating current electricity, signal data, electromagnetic waves including radio, magnetic waves, light waves, xrays, gamma rays, etc.

We can also use the sine wave to describe natural changes in the world – if we were to measure the quantity of light in the 24 hour cycle where we live, it would look like a sine wave. If we were to measure the cycle of inspiration and expiration, it would be a sine wave. If we were to measure temperature fluctuations in a temperate zone around the year, it would roughly form a sine wave. What about waking and sleep cycles, etc? There are many other examples.

But in terms of the market, our sine wave describes two important phases – GROWTH and REST. GROWTH and REST, GROWTH and REST. Depending on the overall position of multiple cycles Rest can be a major correction, or just a flat zone, or even simply slower growth. But one thing is very important to understand – every chart and every market has MANY MANY MANY different cycles or sine waves of many different time durations, and amplitudes which are all occurring at the same time. If it were just one sine wave on a flat pattern, it would be obvious to everyone and there would be no need for me to point this out.

(Continued in update section)

Lesson One

Markets are more predictable than you and I have been led to believe. We have been told that historical data cannot be used to predict what will happen. But is that statement actually true?

Answer -- YES and NO. It is not a lie. Even with the best techniques of technical analysis and analyzing the repetitive and predictable cycles which occur, we can make a fairly accurate prediction of future movements, but it is not 100% reliable. We must always leave some room for the unexpected to occur at any moment. That is true!

But, can we learn to analyze market cycles in such a way that we can get a fairly accurate prediction of a rough prediction of future movements? My answer is YES! Not with 100% accuracy though. But honestly, even a 60% accurate prediction would be good. But I think we can do much better than 60 percent. I expect if we work at this method we can approach 80-90% accuracy But How?

I am going to take you on a journey of discovering market cycles which occur in every chart on every time frame. These cycles have been staring at you in the face, but you likely have not noticed them. They are hidden in plain sight. Perhaps some of you already see these cycles, and some of them are more obvious than others. Maybe you already know all you need about market cycles on every level, in which case, why read more?

My prediction is that not all of you will be able to understand or believe what I will tell you, maybe you will say I am crazy! If I am crazy, then let me be crazy, because this is working for me, better than other methods have. But if this is not helpful for you, then of course, I wish you well and hope you find something that is helpful.

This method of analyzing charts does take a lot of work, mental effort and concentration. There is nothing easy about it. If you are looking for a quick and easy way to trade successfully then you should try looking somewhere else. It will take hard work and time and motivation to perfect this strategy.

All this to say, if you don’t like what I am writing for any reason, you do not have to read this. You are completely free by me to stop reading now.

First – we are taking about Market cycles – what is a market cycle?

People may mean different things but I am talking about recurring cyclical patterns in any chart.

Sometimes we draw cycle diagrams in a circle – which is perfectly fine, but if we want to stretch out the cycle and measure a recurring cycle over time, then we need to use the example of a SINE WAVE. Sine waves are everywhere in nature. We have sine waves in SOUND WAVES, alternating current electricity, signal data, electromagnetic waves including radio, magnetic waves, light waves, xrays, gamma rays, etc.

We can also use the sine wave to describe natural changes in the world – if we were to measure the quantity of light in the 24 hour cycle where we live, it would look like a sine wave. If we were to measure the cycle of inspiration and expiration, it would be a sine wave. If we were to measure temperature fluctuations in a temperate zone around the year, it would roughly form a sine wave. What about waking and sleep cycles, etc? There are many other examples.

But in terms of the market, our sine wave describes two important phases – GROWTH and REST. GROWTH and REST, GROWTH and REST. Depending on the overall position of multiple cycles Rest can be a major correction, or just a flat zone, or even simply slower growth. But one thing is very important to understand – every chart and every market has MANY MANY MANY different cycles or sine waves of many different time durations, and amplitudes which are all occurring at the same time. If it were just one sine wave on a flat pattern, it would be obvious to everyone and there would be no need for me to point this out.

(Continued in update section)

Note

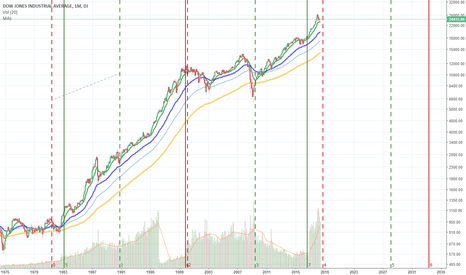

No single set of cyclical pattern in and of itself would be able to sufficiently provide you with enough information to know how to trade. To understand future movements of the market, you must find multiple patterns and calculate their combined net effect. This is not a simple task. Now, let’s start with the chart which I selected for this idea. I am now using the DOW JONES INDUSTRIAL AVERAGE as an example. I have selected this chart because we can pull up data since approx. 1915 from it. Looking at market cycles from the long-term perspective is a good way to get into market cycles, and it is already a well-accepted, non-controversial idea.

Look at the RED and GREEN lines on the DJIA chart. Each red line is approximately on the PEAK of the sine wave cycle, and each GREEN line is on approximately the trough (Low point) of the sine wave. A GREEN ZONE would start at the green line and end at the red line. A RED ZONE would start at the RED line and end at the Green line. It is during a GREEN ZONE that there is more GROWTH and during a RED ZONE that there is more REST (or correction). Easy to remember – Green = GROWTH. RED = REST.

As I said, there are many cycles occurring simultaneously, but for this first example we are only going to look at one cycle. This is a cycle in the stock market which is APPROXIMATELY 17 years for each half cycle. (not exactly 17 years) The part that is exact is it is exactly the same amount of time between each line. I have used the fib time zone tool to make every line the exact same time between each line.

Just like a sine wave for a note of music, or for a single radio frequency In our example, the amount of time between each peak of the wave of a single note or single radio frequency is the same amount of time each cycle We can’t change the amount of time between the peaks or troughs of the cycle to fit our chart.

These approximately 17 year periods are well known and documented in economic circles and they are referred to as “SECULAR BULL” or “SECULAR BEAR” markets. This is nothing really new yet, nothing that I invented, but I did put these lines on the chart with the fixed time frames. Did you know that these SECULAR BULL and SECULAR BEAR markets are exactly the same amount of time for each half-cycle?

A secular bull market does not make the market recession proof, nor does a secular bear market mean you cannot have run-ups in the stock market. As I said, there are other cycles also occurring and these 17 year periods do not explain other patterns.

If you look closely these patterns don’t appear exactly like a sine wave do they? Just periods of better growth and periods of weaker growth. Actually these 17 year periods are also part of a much bigger SINE wave which has been in a growth phase for a LONG TIME! We have had massive economic growth since the industrial age began, even despite multiple depressions in the 1800s and the great depression.

Note

Did you ever stop to be thankful that despite an economy that goes up and down, the very long term trend is UP! There is NO REASON why we should be fortunate enough to be living in a long term economic boom, other than MERCY from ON HIGH. I don’t know even exactly when this economic boom started so it is really harder to calculate when it will end. But using Elliot Wave theory starting from 1942, we can clearly see an Elliot wave pattern using the 17 year periods. We could finish a wave 5 by 2033 or before. (It would be before 2033 if we have a repeat of the Pre-depression bubble). Potentially things could really go DOWNHILL from there!Oops, looks like I am getting ahead of myself now! Now, I have to address the obvious anomaly on the chart --- the Pre depression bubble which popped 1929. This was clearly not according to what was “supposed” to happen based on the 17 year cycles. Remember I said, no single set of cycle can predict all the market moves. But in the case of the predepression bubble. – it is a bit of a mystery. Something caused an amazing force of excess positive energy peaking in 1929. This was clearly extra-than-the-normal energy compared with the normal pattern. It should normally had closed somewhat upward in 1933, but not such a drastic peak. But the excess energy came early and clearly ran out of steam. Then the positive energy subsequently INVERTED upside down and we have a nearly identical inverted pattern to the pre depression bubble. The years that followed 1933 also look to be an odd inverted but otherwise symmetrical pattern of the 1920s WHY?

Honestly, I don’t know the answer to the why. But we should all take it as a warning. Unexpected changes in amplitude to other patterns can happen, but they will in all likelihood then invert the opposite direction creating an opposite pattern. I do not have the answers why yet, but be warned in case you see this happen in other charts.

This did happen on a smaller scale in the Litecoin chart when the Lite pay deal was announced in February 2018. When the deal fell through, more or less the same pattern inverted (upside down) in March/April 2018. All the positive energy that went into it (in excess of what was warranted), then became inverted in a tiny microcosmic example of what happened in the Great Depression. Interesting.

Note

According to my theory in this chart, if the unexpected does happen, it appears the unexpected occurs normally in terms of unexpected amplitude, but even then, it is still typically following the existing frequency patterns which were already present in the chart.My lesson is getting too long now, so we will have to end lesson ONE! In the next lesson, I will show you how you can calculate the effects of TWO separate cycles occurring at once in the chart. I will post the link to the next lesson in this idea, when I have it ready.

Please click LIKE if you like the idea. If you did not like it, you do not have to keep reading more!

Note

I have a link to a related idea which will is to prepare for LESSON 2 on market cycles where we will combine the 17 year cycle and the 9 year cycle. Please see the idea below.Note

Stay TUNED! I will continue to show you more MARKET CYCLES and this will get more relevant soon! Check my profile ideas later, I will also release information on BITCOIN based on these cycles as well.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.