Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

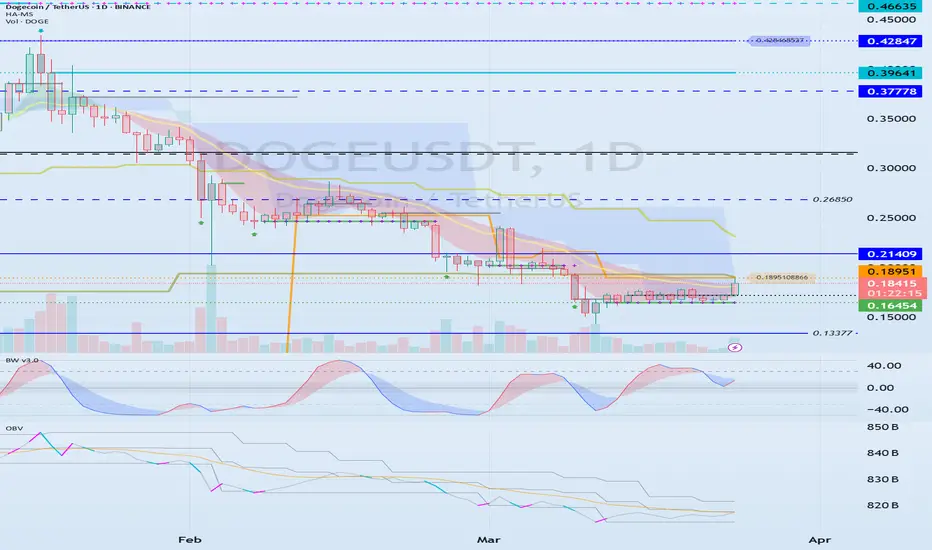

(DOGEUSDT 1D chart)

The key is whether it can maintain the price by rising above 0.18951.

If it rises after receiving support near 0.18951, we need to see whether it can rise above the M-Signal indicator on the 1W chart.

In other words, we need to see whether it can maintain the price above 0.21409.

If not, it is likely to show a downward trend like the previous trend.

-

Therefore, I think this is a great opportunity to turn into an upward trend in line with the flow of BTC.

What we need to do is to check if it is supported around 0.18951.

If it is supported, it is a time to buy.

Since the M-Signal indicator of the 1M chart is passing around 0.18951, it is highly likely that it will show a different flow than before.

Since OBV has to break through the upper line of the Price channel to surge, it is better not to rush too much and check if it is supported around 0.18951 before trading.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Big picture

I used TradingView's INDEX chart to check the entire range of BTC.

(BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(LOG chart)

Looking at the LOG chart, we can see that the increase is decreasing.

Accordingly, the 46K-48K range is expected to be a very important support and resistance range from a long-term perspective.

Therefore, we do not expect to see prices below 44K-48K in the future.

-

The Fibonacci ratio on the left is the Fibonacci ratio of the uptrend that started in 2015.

That is, the Fibonacci ratio of the first wave of the uptrend.

The Fibonacci ratio on the right is the Fibonacci ratio of the uptrend that started in 2019.

Therefore, this Fibonacci ratio is expected to be used until 2026.

-

No matter what anyone says, the chart has already been created and is already moving.

It is up to you how to view and respond to it.

Since there is no support or resistance point when the ATH is updated, the Fibonacci ratio can be appropriately utilized.

However, although the Fibonacci ratio is useful for chart analysis, it is ambiguous to use it as a support and resistance role.

The reason is that the user must directly select the important selection points required to create the Fibonacci.

Therefore, it can be useful for chart analysis because it is expressed differently depending on how the user specifies the selection point, but it can be seen as ambiguous for use in trading strategies.

1st: 44234.54

2nd: 61383.23

3rd: 89126.41

101875.70-106275.10 (when overshooting)

4th: 134018.28

151166.97-157451.83 (when overshooting)

5th: 178910.15

-----------------

Other content (coins, stocks, etc.) is frequently posted on X.

X에 다른 내용(코인, 주식 등)이 자주 게시됩니다.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

X에 다른 내용(코인, 주식 등)이 자주 게시됩니다.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Other content (coins, stocks, etc.) is frequently posted on X.

X에 다른 내용(코인, 주식 등)이 자주 게시됩니다.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

X에 다른 내용(코인, 주식 등)이 자주 게시됩니다.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.